This week’s best investing news:

Jeremy Grantham’s Market Meat-Grinder (What Goes Up)

Mohnish Pabrai – Founder & Managing Partner of Pabrai Investment Funds (TE Leadership Series)

Ray Dalio: What I Think About the Silicon Valley Bank Situation (LinkedIn)

Distinguished Speaker Series: Howard Marks (CFA)

Speculative Women: A History of Female Investors (Jamie Catherwood)

Bill Ackman says U.S. did the ‘right thing’ in protecting SVB depositors. Not everyone agrees (CNBC)

Bank Run (Verdad)

Carl Icahn reportedly prepares for a proxy fight at Illumina (CNBC)

Mario Gabelli – Life Lessons And 17 Stock Ideas From Billionaire Value Investor (Forbes)

Ken Griffin: US capitalism is ‘breaking down before our eyes’ (FT)

Bill Nygren – Fundamental Investing From A Generalist’s Perspective

Commodity Outlook by Mr.Jim Rogers, Private Investor & Author (Nirmal Bang)

Michael Burry Cites ‘Hubris and Greed’ in Drawing SVB Link to 2008 (Bloomberg)

Investing Shorts: Warren Buffett’s Two Most Important Traits (Validea)

The ‘Godfather of Fundamental Indexing’ Rob Arnott (Stansberry)

The Dangerous Assumption Embedded In Today’s P/E Ratios, Part Deux (Felder)

A halt in rate hikes will concern markets more than a 25 bps hike, says Wharton’s Jeremy Siegel (CNBC)

Open your eyes to ‘myopic circles’ – with Vitaliy Katsenelson (Schroders)

Meta gives up on NFTs for Facebook and Instagram (The Verge)

Here’s Why the Economy Seems Weird (WSJ)

Peter Perkins – European Equities Still Have Plenty of Upside Potential (The Market)

Transcript: Richard Bernstein (MIB)

Ken Fisher, Debunks: Well-Rested Investors Are Better Investors (Fisher)

Book Value (Epsilon Theory)

Yale Invests This Way. Should You? (WSJ)

Why the Banking Chaos Isn’t a Repeat of 2008 or Even 1998 (Empire Finance)

Jeffrey Gundlach Talks the Banking Crisis Fallout (CNBC)

Letter #64: Jamie Dimon (2001) (A Letter A Day)

All the Things We Do Not Know About SVB (Ritholz)

SEC Is Focusing on Earnings Manipulation by Companies (WSJ)

First Eagle: US Bank Failures: Will Cracks Turn into Chasms? (FEIM)

Royce – Finding Quality in Today’s Volatile Market (Royce)

Weitz Investment Management: A Reintroduction to CarMax (Weitz)

William Blair – A New Year in China (WB)

Fairfax Annual Letter 2022 (FF)

This week’s best value Investing news:

Ideas From Benjamin Graham, The Father Of Value Investing (Forbes)

Compression: Can the Value Spread Expand Forever? (Alpha Architect)

Value factor investing or value investing: which one is better? (Tomorrow Makers)

Core Inflation: What is value investing? (Chase Bank)

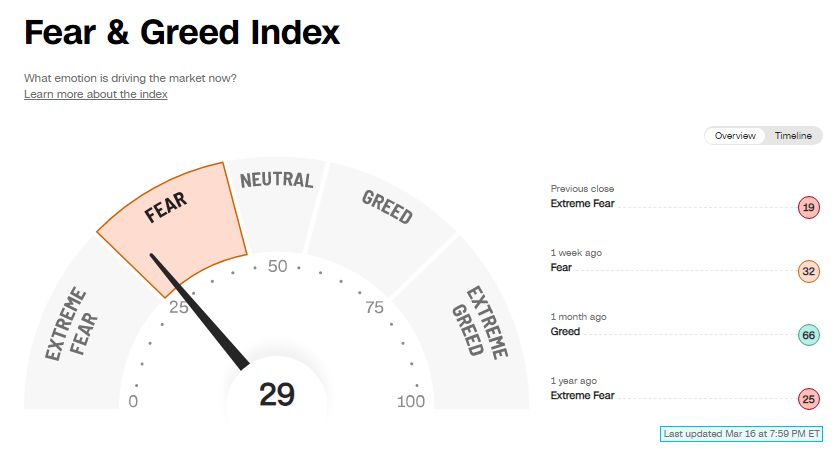

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #471: Gary Zimmerman, MaxMyInterest – SVB, FDIC, & Improving ROI on Cash (Meb Faber)

Auren Hoffman – A Deep Dive on Data (Invest Like The Best)

TIP534: The Joys of Compounding by Gautam Baid (TIP)

What Investors Need to Know About the Collapse of Silicon Valley Bank with Cullen Roche (Excess Returns)

TaylorMade on Private Equity Deals (Capital Allocators)

Dan Zwirn – Unconstrained Opportunities (Business Brew)

Charles D. Ellis: The Loser’s Game (EP.244) (Rational Reminder)

Valuation, Demographics, Urbanization (Grant’s)

What underpins an investing thesis? (Equity Mates)

Bill Hench – Small-Cap Stocks with Short-Term Problems: The Secret to Beating the Market (WealthTrack)

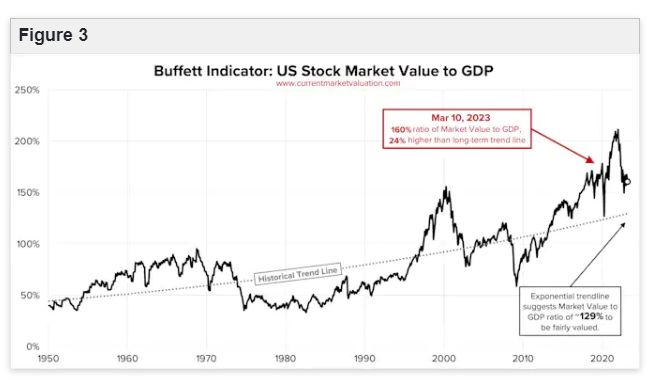

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Artificial Intelligence: the Past, the Present and the Future (Alpha Architect)

Goodbye Inverted Yield Curve (ASC)

100-Years of the United States Dollar Factor (AAA)

This week’s best investing tweet:

This week’s best investing graphic:

Timeline: The Shocking Collapse of Silicon Valley Bank (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: