This week’s best investing news:

“Invest or Enlist”: The Liberty Bond Story (Jamie Catherwood)

Charlie Munger says the U.S. should follow in China’s footsteps and ban cryptocurrencies (CNBC)

Bill Ackman says Hindenburg’s Adani report ‘highly credible’ (Reuters)

Terry Smith – Fundsmith Equity Fund (medirectalk)

After the Darkest Hour Comes the Dawn (Verdad)

The Core Principles of Momentum Investing (Validea)

Howard Marks Interview (The Market)

Jeremy Siegel: We will have a ‘large decrease in rates’ in the second half of the year (CNBC)

Ray Dalio says the U.S. debt limit is a ‘farce’ (Yahoo)

The Forgotten Lessons of 2008: Seth Klarman (IT)

Jim Rickards: Crash By Mid-Year Once Recession Is Obvious To All (Wealthion)

Jim Chanos Joins On The Tape at iConnections Global Alts 2023 (RR)

Black Swan Author Taleb on Markets, Interest Rates, Bubbles, Investing (Bloomberg)

Mohnish Pabrai’s session with EO Gurgaon on January 10, 2023 (MP)

Mario Gabelli – Key Investment Themes For 2023 (TD Ameritrade)

David Katz: If we believe the Fed is almost done, that’s going to be bullish for stocks (CNBC)

Tesla in 2023: A Return to Reality, The Start of the End or Time to Buy? (Aswath Damodaran)

Peter Thiel : Technology Entrepreneur and Venture Capitalist | Address and Q&A (Oxford Union)

Transcript: Neil Dutta (Big Picture)

Letter #50: Ted Weschler (2022) (A Letter A Day)

Streaming Wars – Who’s Winning? (SG)

Henry Singleton: A Capital Allocation Masterclass in Three Acts (Kingswell)

China’s Big Comeback Is Just Getting Started. How to Play It. (Barron’s)

Everything You Can’t Have (Collab Fund)

What I Learned From Michael Burry’s Value Investor Club Write-ups (Macro Ops)

The Art of Execution by Lee Freeman-Shor (Novel)

Investment Opportunities in High-debt Markets: First Eagle’s Matt McClennan (WealthTrack)

50% Risk-free Annual Returns (Barry Ritholz)

Larry Swedroe – Fortune Doesn’t Always Favor the Bold: The Perils of Concentrated Stock Positions (AP)

Looking closely at today’s investment darlings (Morningstar)

Big Tech Binged on Workers During Covid. Now, the Purge (Bloomberg)

Davis Funds Annual Review 2023 (Davis)

Fairholme Funds 2022 Annual Report (Fairholme)

FPA Crescent Fund Q4 2022 (FPA)

Tweedy Browne Q4 2022 Commentary (TB)

Horizon Kinetics Q4 2022 Letter (HK)

Sound Shore Fund Q4 2022 Commentary (Sound Shore)

This week’s best value Investing news:

GMO – 2022: The Joy of Missing Out – A Bad Year in Markets Brings Better Opportunities (GMO)

Is Value Investing The Way To Go In 2023? (Validea)

TIP519: The Education of a Value Investor by Guy Spier (TIP)

What Is a Margin of Safety in Investing? How Does It Work? (The Street)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Ray Dalio: Believing the Fed, the Brink of War, & Cash! No Longer Trash 2/2/23 (SP)

What would Cliff Asness ask St. Peter at the pearly gates? (FWM)

The Rewind: Ditto (Howard Marks)

Carl Kawaja – Dealing with Regime Change (ILTB)

Ep 382. Franchise Value, The Secret to Geoff Gannon’s Investing (FC)

Episode #465: Jim O’Shaughnessy, OSV – Unleashing The World’s Infinite Potential (MF)

403- FROM THE VAULT: The Role of Shorting in the Market (InvestED)

Whit Clay – Crafting Communications (BB)

John-Austin Saviano – Emerging Managers and IC Governance (Capital Allocators)

The Art and Science of Intelligent Fund Selection with Joe Wiggins (Excess Returns)

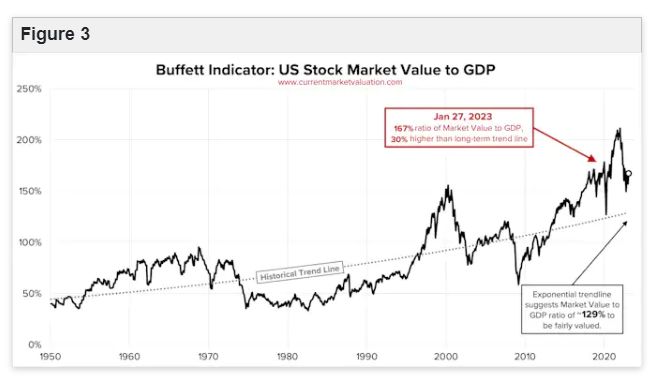

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

DIY Trend-Following Allocations: February 2023 (AA)

An Imbalanced Reaction to the FOMC (ASC)

Inflation, Interest Rates and Equity Evaluation (AAA)

A Significant Regime Change (PAL)

This week’s best investing tweet:

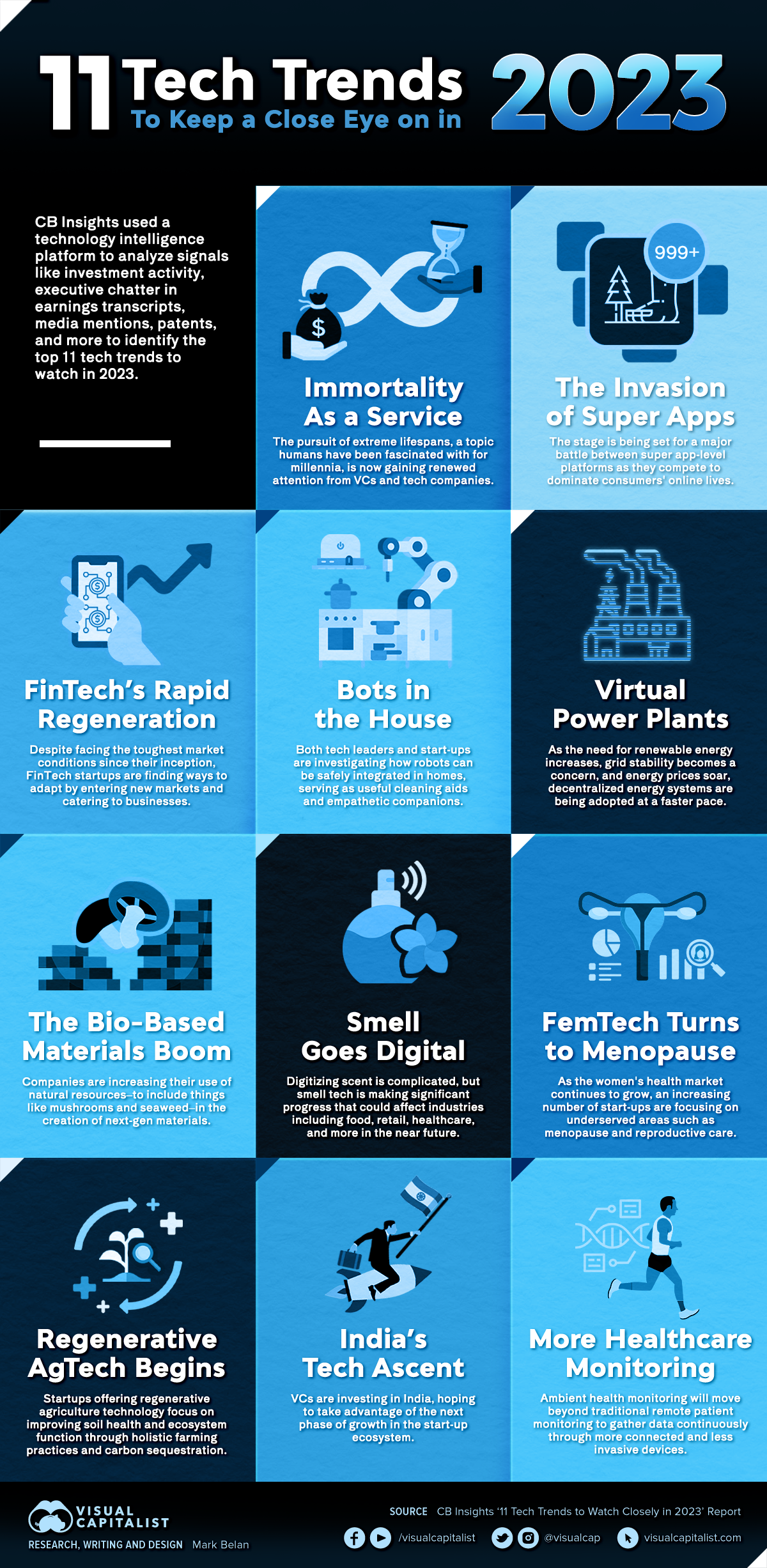

This week’s best investing graphic:

Infographic: 11 Tech Trends to Watch in 2023 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: