This week’s best investing news:

Howard Marks on China, Risk, and Interest Rates (Motley Fool)

A Brief History Of Post-Bubble Markets (Jamie Catherwood)

Baupost chief Seth Klarman blames Federal Reserve for ‘financial fantasyland’ (FT)

We Measure What We Can (Verdad)

Terry Smith: one of the biggest mistakes I’ve made with Fundsmith Equity Fund (AJ Bell)

Where Valuations Stand After the Market’s Strong Start to 2023 (Validea)

Pershing Square – Annual Investor Presentation (PS)

Bill Nygren – Why We Still Believe in Concentrated Investing (Oakmark)

Prem Watsa – Visionary Encounter Fireside Talk Series (Chiratae Ventures)

The billionaire brawl, 10 years later: Carl Icahn versus Bill Ackman over Herbalife (CNBC)

Ray Dalio, Cathie Wood and the fate of the FOMO rally (AFR)

The Hype Cycle, Expertise & Dunning Kruger (Big Picture)

Control, Complexity and Politics: Deconstructing the Adani Affair! (Aswath Damodaran)

Sticking the Landing (Humble Dollar)

The Battle Between FANG And BANG Is About To Get Very Interesting (Felder)

Ron Baron: Inflation is a very large part of our economic model (CNBC)

Henry Singleton in 1978: “The Sphinx Speaks” (Neckar)

Ken Fisher, Explains Why Fed Chatter Doesn’t Matter (Fisher)

Clash of the Titans: Apple, Alphabet, & Amazon (Kingswell)

Nelson Peltz says Disney proxy fight is ‘over’ amid Bob Iger’s restructuring efforts (Yahoo)

Royce Annual Letter: When Will the Bear Give Way to the Bull? (Royce)

GMO Commentary- Valuation Metrics in Emerging Debt: 4Q 2022 (GMO)

Jim Grant Interview (The Market)

Will Inflation Reignite Later This Year? (WSJ)

How Stockpickers Finally Beat The Index Funds (Bloomberg)

Transcript: William Cohan (Barry Ritholz)

Big Ideas 2023 | ITK with Cathie Wood (ARK)

How Much Portfolio Insurance Do You Need? (Morningstar)

Was Tepper Wrong? Liquidity, Timing, and the Keynesian Beauty Contest (Neckar)

Why every investor must understand Position Sizing (Morningstar)

The Four Horsemen of the Tech Recession (Stratechery)

Matthew McLennan of First Eagle Investments (Part 2) (WealthTrack)

Sequoia Strategy Letter Q4 2022 (Sequoia)

This week’s best value Investing news:

David Herro – Value Opportunities in International Investing (Oakmark)

Cliff Asness – Holding Our Breadth (AQR)

Value Stocks? Growth Stocks? Markets Last Year Turned Everything Topsy-Turvy (NYT)

GMO – What Is Value? Methodology Matters (GMO)

Psychological and social factors complicate “cigar butt” investing (Rational Reflections)

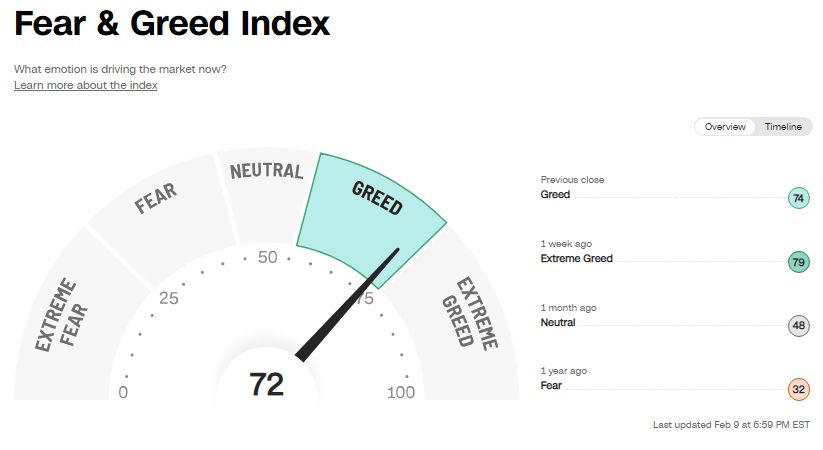

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP521: Warren Buffett’s Shareholder Letters (TIP)

#158 Aaron Dignan: Change The Way You Work (KP)

Randy Baron – International Truffle Hunting (BB)

Charley Ellis – The Evolution of the Asset Management Industry (VIWL)

Brian Philpot – Financing Farmers at AgAmerica (CA)

The Apple of Agriculture – Deere & Co | Summer Series (EM)

Episode #466: Sean Goldsmith, The Zero Proof – The Golden Age for Non-Alcoholic Beverages (MF)

Ep 383. Fed Raised Interest Rates, Market Cycles, Multi Strat Portfolio, & Airlines Look Cheap (FC)

David Ha — AI & Evolution: Learning to do More with Less (IL)

Jeff Green – Modernizing Advertising (ILTB)

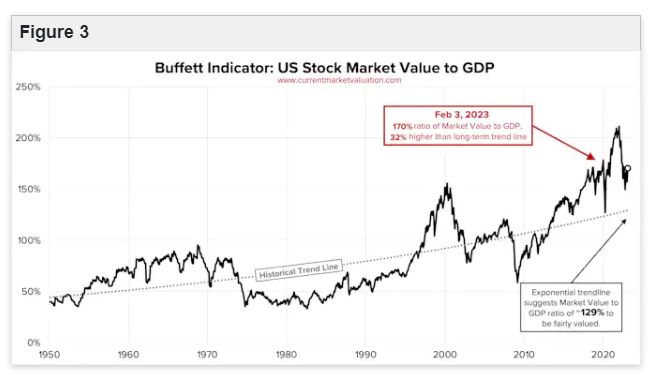

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Should investors be indifferent to dividend impact on stock returns? (AA)

The Experienced Newbie (ASC)

Rethinking Adam Smith – More than the “invisible hand” (DSGMV)

The 60/40’s Annus Horribilis (AAA)

This week’s best investing tweet:

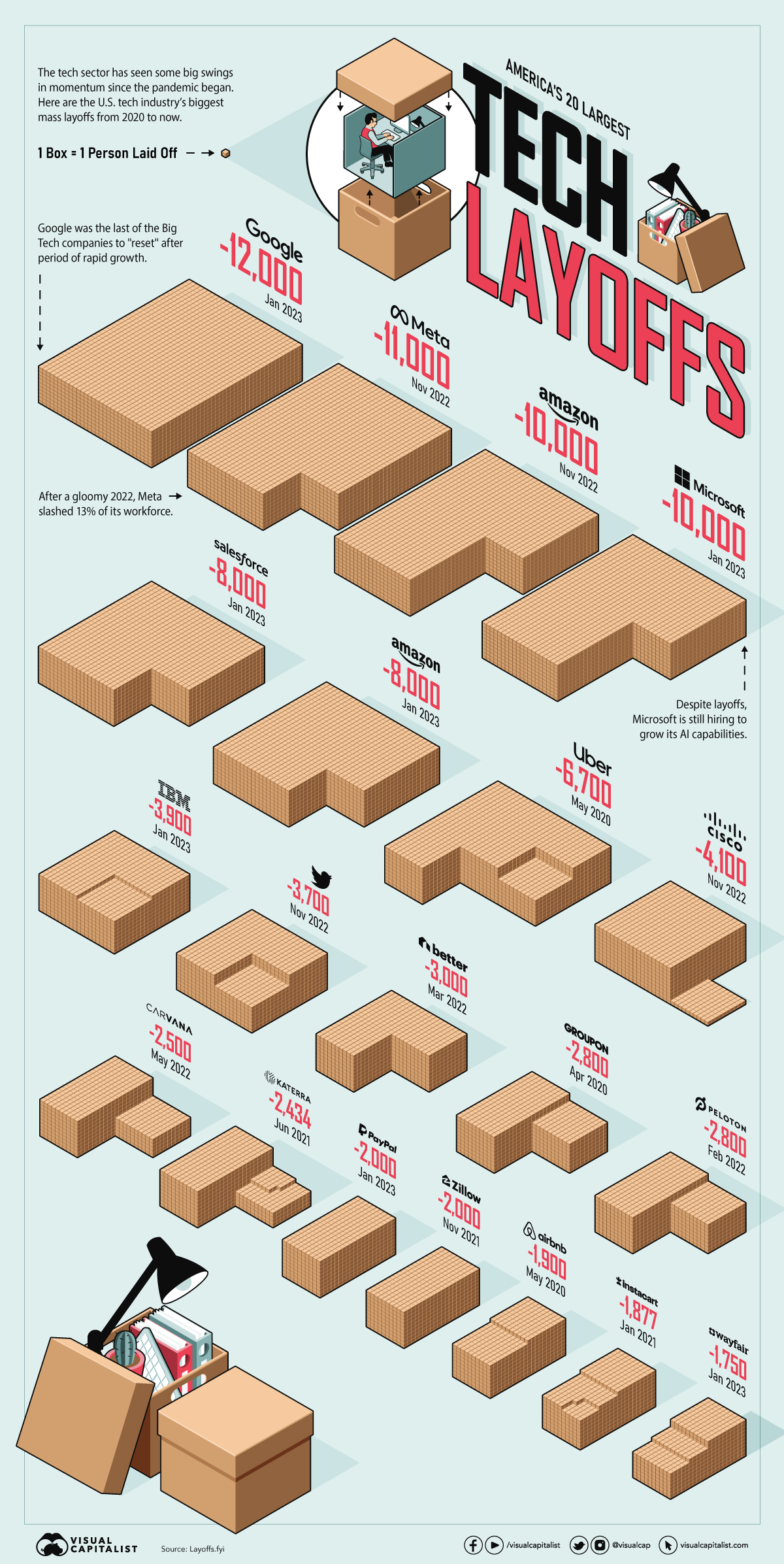

This week’s best investing graphic:

Ranked: America’s 20 Biggest Tech Layoffs Since 2020 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: