This week’s best investing news:

Howard Marks: TV Tokyo (OakTree)

Investor Daniel Loeb Unleashes Criticism of Ark’s Cathie Wood (Wealth Advisor)

Venture capital’s reckoning looms closer (Verdad)

Bill Ackman’s Pershing Square Lifts Stake in Developer Howard Hughes (Barron’s)

Mr. Market May Be In Denial Over The Shift In Interest Rates (Felder)

Einhorn’s Fund Climbed 36.6% Last Year, Recouping Losses That Began in 2015 (Bloomberg)

Another Year Down – Learning from Quant Models (Validea)

Warren Buffett-Backed BYD’s EV Sales Soar To Monthly Record In December (Forbes)

Berkshire Hathaway Struck Oil in 2022 (Kingswell)

Four Wishes for 2023 (Jason Zweig)

Justifying Optimism (Collab Fund)

Apple Is Good. Better If Owned Via Berkshire Hathaway (Hoops News)

Yardsticks for Stocks (Humble Dollar)

Wharton professor Jeremy Siegel channels Warren Buffett in explaining the problem behind Tesla’s epic stock price decline (Markets Insider)

Damn Right! — Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger (Rational Reflections)

US Is in Recession ‘By Any Definition’, Michael Burry Says (Bloomberg)

FAANG Stocks Time At The Top Could Be Over – Here’s What Analysts Expect In 2023 (Forbes)

Transcript: Charlie Ellis (Big Picture)

Daily Journal Virtual Meeting 2023 (DJCO)

Bridgewater Karen Karniol-Tambour on the Challenge of Investing in the Current Environment (Bridgewater)

Big Tech stocks set to surge next year after short-term turbulence, says Matrix Asset’s Katz (CNBC)

All The Ways That Crypto Broke in 2022 (Bloomberg)

15 Charts Explaining an Extreme Year for Investors (Morningstar)

What Happens to Oil if China Re-opens? (Michael Green)

4 Investment Mistakes to Avoid in 2023 (Morningstar)

Stock and bond markets shed more than $30tn in ‘brutal’ 2022 (FT)

Why ordinary investors got hit so hard in 2022 (Yahoo)

Wharton’s Jeremy Siegel still against the Fed, bullish on stocks in 2023 (CNBC)

How an International Perspective Gives a Jensen Analyst an Expanded Appreciation for Quality (Jensen)

Ariel’s Danan Kirby – Investors should find companies with strong brands and pricing power (CNBC)

Octahedron Capital – A Few Things We Learned (Octahedron)

This week’s best value Investing news:

High Quality Value Investing with a Tactical Twist With Jeff Muhlenkamp (Excess Returns)

Small-Cap Value and Quality Fare Best in 4Q22 (Royce)

Oakmark, Value Stocks Can Flourish In The Current Market Environment (MSN)

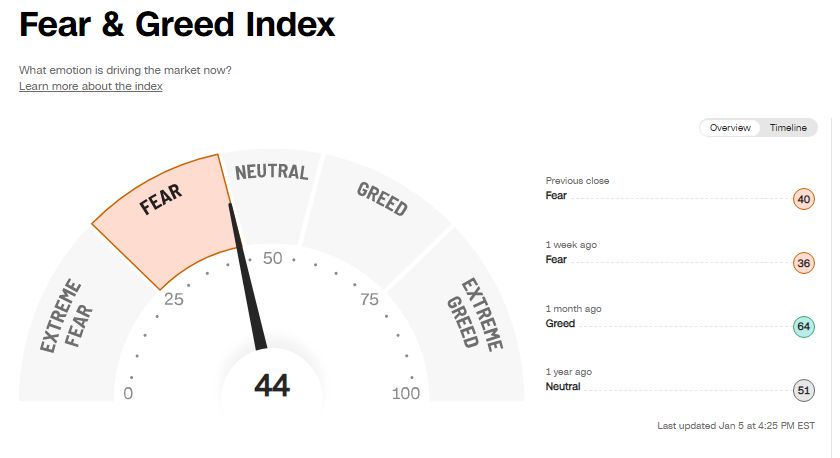

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP511: How to Pick Stocks like Peter Lynch (TIP)

#155 Best of 2022: Conversations of the Year (Knowledge Project)

2022 Top Episode #1: Sam Zell – Common Sense and Uncommon Profits, EP. 253 (Capital Allocators)

Michael Mauboussin – Sharpening Investor & Executive Toolkits (Invest Like The Best)

Episode #461: Top Podcasts of 2022: Rob Arnott & Campbell Harvey, (Meb Faber)

The Kyle Bass Interviews – If We Don’t Get it Right, the Consequences are Dire (Real Vision)

Jake Taylor – Improve Your Decisions (Business Brew)

Behind The Memo: Sea Change (Howard Marks)

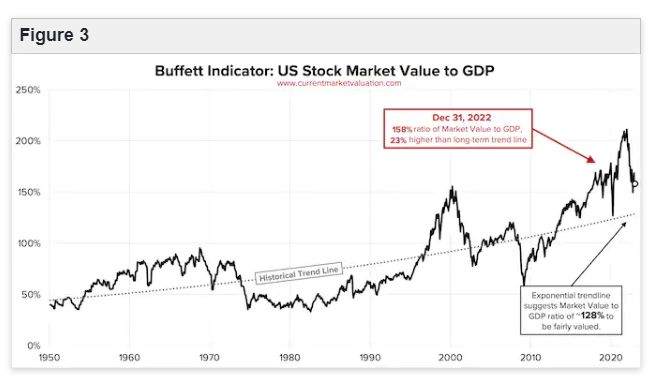

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Expected Returns to Green Stocks (AlphaArchitect)

Diversity and Investment Performance: What Trade-Off? (CFA)

Momentum Market Timers Have Some Explaining To Do (PAL)

Inflation Hedging in Strategic Asset Allocations: Gold or Something Else? (AllAboutAlpha)

This week’s best investing tweet:

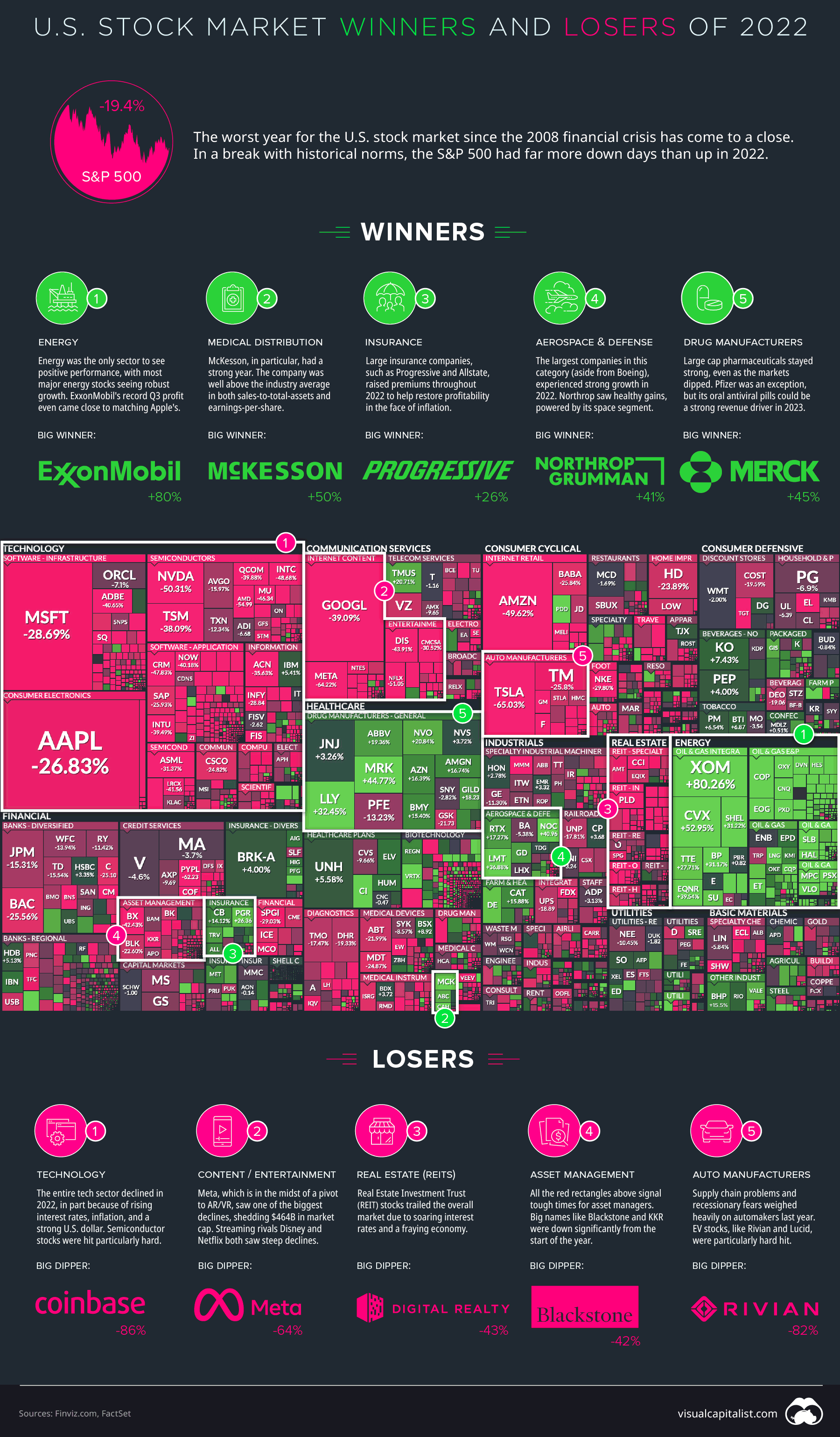

This week’s best investing graphic:

The U.S. Stock Market: Best and Worst Performing Sectors in 2022 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: