This week’s best investing news:

Howard Marks On Debt Investing, Fed Rate Hikes | The World View (BQ Prime)

Navigating Big Debt Crises (Verdad)

Fundsmith Annual Letter 2022 (Fundsmith)

Jim Rogers: This is how to survive ‘a lot of pain’ ahead, reveals ‘cheapest’ assets (Kitco)

How Greed and Leverage Destroyed the Crypto Tulip Market (Vitaliy)

Nelson Peltz on Disney fight: We’ve already made an impact, but there is so much more we can do (CNBC)

Corporate Insiders Embark On A Buyers’ Strike (Felder)

Price-to-Fantasy Ratio: Self-Deception with Forward Operating Earnings (Rob Arnott)

The Art and Science of Spending Money (Collab Fund)

DoubleLine Round Table Prime, 2023 – Part 1: Macroeconomic State of Play (DoubleLine)

Will Berkshire Hathaway Take Another Bite of Apple in 2023? (Kingswell)

Leon Cooperman – Only 5 percent chance of S&P getting above 4,400 this year (CNBC)

Buffett Profile from 1979: “The investor’s investor” (Neckar)

Mario Gabelli: Corporate cash flows will be terrific in ’24 (CNBC)

AI and the Big Five (Stratechery)

In 2022’s Rough Ride, Bill Ackman Ends on a Down Note (Institutional Investor)

JPMorgan’s Jamie Dimon more optimistic on US consumer (Fox)

David Einhorn’s Greenlight Capital Climbed 36.6% Last Year (Bloomberg)

Terry Smith pockets another £36m in five-year pay bonanza streak (FNLondon)

Cliff Asness – The Bubble Has Not Popped (AQR)

Aswath Damodaran – Data Update 1 for 2023: Setting the table! (Musings on Markets)

The Warren Buffett way to profit from the energy crisis (AFR)

Tesla’s Value Has Absolutely Tanked. It’s Probably Still Overvalued (MotorTrend)

Transcript: John Mack (Big Picture)

Cliff Asness – Why Does Private Equity Get to Play Make-Believe With Prices? (Institutional Investor)

The One True Secret to Successful Investing (Bloomberg)

Your Investing Strategy Just Failed. It’s Time to Double Down (WSJ)

I’m just trying to figure out where there are cheap stocks out there, says Bill Miller (CNBC)

Why Better Days for Small Cap May Be Ahead (Royce)

Matt Levine – How Not to Play the Game (Bloomberg)

JP Morgan – Guide To Markets Q1 2023 (JP Morgan)

Bloomberg Billionaires Index 2023 (Bloomberg)

Japan’s Bubble-Burst: The Party That Wasn’t Supposed to End (Konichi Value)

Economist Says His Indicator That Predicted Eight US Recessions Is Wrong This Year (Bloomberg)

Oakmark Select Fund: Fourth Quarter Commentary 2022 (Oakmark)

First Eagle Annual Letter 2022 (FEIM)

The Boyar Value Group’s 4th Quarter Letter (Boyar)

This week’s best value Investing news:

GMO – Memo To The Investment Committee: A Hidden Gem (GMO)

Value Investing’s Revival Will Benefit Japanese Shares (Validea)

Finding Value In Small Caps (Boyar)

Value Stocks to Lure Investors During Grim Earnings Season (Bloomberg)

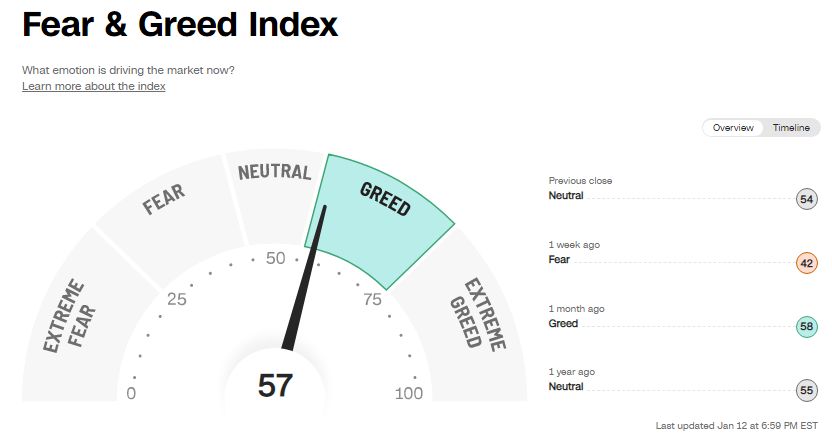

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP513: Warren Buffett’s Money Mind (TIP)

Cliff Asness — FTX, Hedge Funds and the Value Spread (EP.142) (Infinite Loops)

John Fio – Creating Magic for Consumers (Invest Like The Best)

#351 – MrBeast: Future of YouTube, Twitter, TikTok, and Instagram (Lex Fridman)

The Just 100 with Paul Tudor Jones & T Mobile CEO Mike Sievert 01/10/23 (Squawk Pod)

Thomas Ricketts, CFA – Investing in Innovation (Business Brew)

The Value Perspective with Edward Chancellor (VP)

Mitch Julius – Finding the Opportunity in Complexity (VIWL)

#156 Jack Kornfield: Finding Inner Calm (KP)

Replacing linear factors with a non-linear, characteristic approach in quant equity (Flirting with Models)

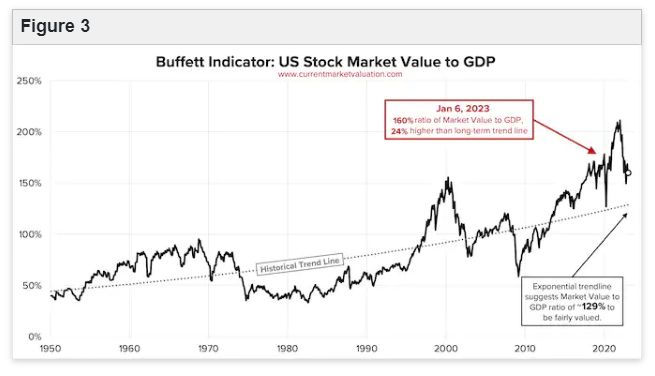

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Global Factor Performance: January 2023 (AlphaArchitect)

Short Squeezes: A Four-Factor Model (CFA)

Professional forecasters worse than a flip of a coin (DSGMV)

The Peril of Comforting Narratives (AllStarCharts)

Educational Alpha: “Some” of the Parts? (AllAboutAlpha)

This week’s best investing tweet:

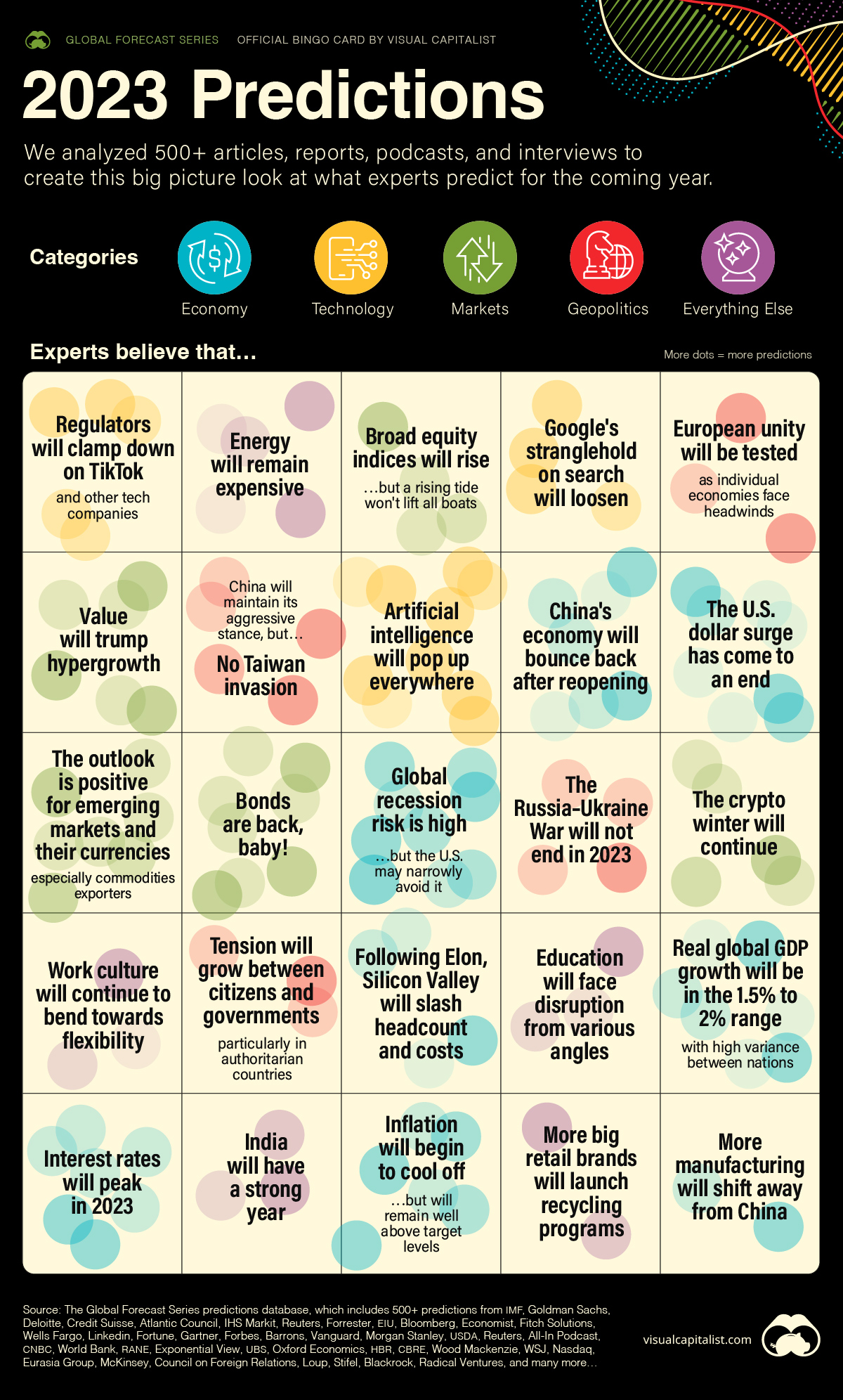

This week’s best investing graphic:

Prediction Consensus: What the Experts See Coming in 2023 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: