In his latest 2020 Semi-Annual Report, Francis Chou provided some great insights into how value investors have exacerbated the impact of low returns in recent years. Here’s an excerpt from the report:

Does Value Investing Work?

With the lackluster returns by value funds in recent years compared to growth and index funds, there is some doubt as to whether value investing can still work in the current market. We hold the view that value investing certainly works, but only when executed properly. Sometimes it is easier to blame the market environment than to admit our own faults.

Although factors such as low interest rates, the popularity of passive investing and elevated market valuations played a role in blunting returns for value investors, we also accentuated the problem. The key to value investing is appraisal. If that is not precise enough, everything falls apart. We tend to fish in troubled waters, and what caused the biggest problem in recent years was that our appraisal of troubled companies was off the mark.

When we thought a company was worth 100 cents, it was actually worth closer to 60 cents. We tended to give much higher weight to asset values and not enough weight to the value of the operating company. We used the asset value as a huge security blanket and became blind to the deterioration of the worth of the operating company.

That was a mistake of commission. We also made a bundle of mistakes of omission.

Over the last 30 years, roughly half our portfolio was in troubled companies and the other half was in good companies. So, we are well acquainted with investing in both types of companies.

But what happened over the last few years was that we spent most of the time undervaluing the good companies. When our assessment showed that the investments were worth 100 cents, they were more accurately close to 150 cents, thus causing us to miss most of those opportunities.

These “omissions”, though they are unseen mistakes, are nevertheless as real as mistakes of commission. In summary, although the markets have been less kind to value investing, we exacerbated the problem as practitioners.

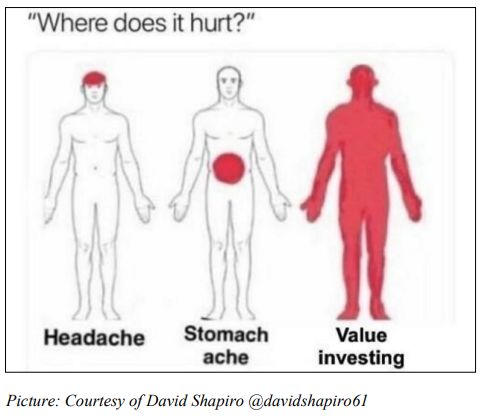

We believe the value investors can empathize with the picture below:

You can read the entire report here:

Chou Associates Semi-Annual 2020 Report

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: