Here is a list of this week’s best investing reads:

Prosperity is a State of Mind (A Wealth of Common Sense)

Countering The Narrative About Value (Fortune Financial)

Two Sides of the Same Coin (The Irrelevant Investor)

The Case of the Bankerless Bubble (The Reformed Broker)

It’s Time To Get Real With Your Investment Portfolio (The Felder Report)

Is Buffett Bearish?! (The Brooklyn Investor)

The 92-Year-Old Who Is Still Shaking Up Wall Street (Jason Zweig)

29 of the Most Gifted and Highly Recommended Books (Farnam Street)

Howard Marks: I’m not optimistic on bitcoin as a way to make money (CNBC)

How To Read Financial News (Collaborative Fund)

Dan Loeb Has Become A Hedge Fund Giant (Forbes)

TIP167: How The Mighty Fall by Jim Collins (Business Podcast) (The Investors Podcast)

Earnings Don’t Matter! (Advisor Perspectives)

Another “Doomsday Moment” for High-Yield Strategies (CFA Institute)

Repurchases are the Devil’s Work! (not…) (Cliff’s Perspective)

Historical Finance Fight: Ben Graham versus H.M. Gartley (Alpha Architect)

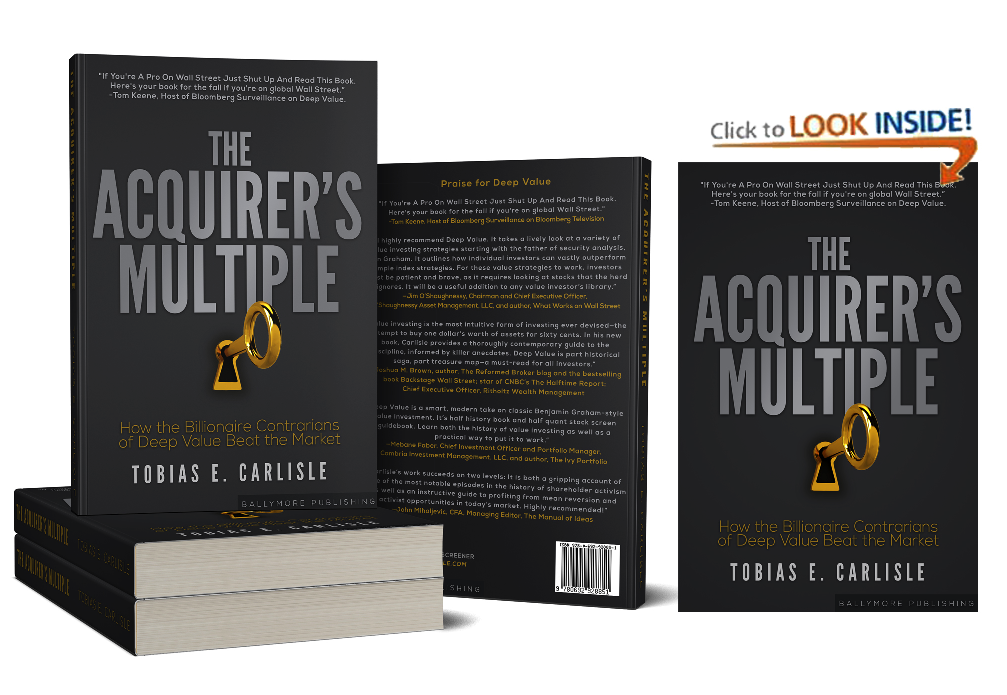

If you still haven’t got your copy of Tobias’ new book, you can get one here:

The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market provides a simple summary of the way deep value investors find stocks that beat the market. The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market out now on Kindle and paperback.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: