We’ve launched a new investment firm called Acquirers Funds® to help you put the acquirer’s multiple into action. Acquirers Funds® Our investment process begins with The Acquirer’s Multiple®, the measure used by activists and buyout firms to identify potential targets. We believe deeply undervalued, and out-of-favor stocks offer asymmetric returns, with … Read More

Amazon.com Inc (AMZN) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Amazon.com Inc (AMZN). Profile Amazon is a leading online … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (04/26/2024)

This week’s best investing news: Howard Marks – Oaktree | Investment Conference 2024 (NBIM) How to Value Berkshire Hathaway 2024 w/ Chris Bloomstran (TIP) Mohnish Pabrai’s Q&A session with students at the JNV Kottayam (MP) Bridgewater’s Bob Prince Says Fed Rate-Cutting Hopes Are ‘Off Track’ (Bridgewater) Cliff Asness – The … Read More

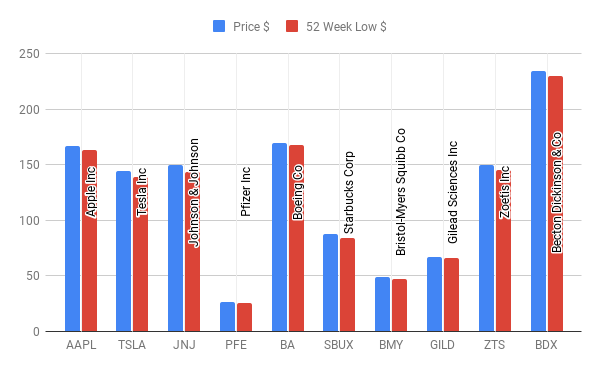

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ AAPL Apple … Read More

Why The Home Depot Inc (HD) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: The Home Depot Inc (HD) Home Depot is the world’s largest … Read More

Avoiding Growth Traps & Value Traps

During their recent episode, Taylor, Carlisle, and Ashton discussed Avoiding Growth Traps & Value Traps, here’s an excerpt from the episode: Tobias: Zeke, let me just go back to something you said earlier. You said you were trying to– There were growth traps as well as value traps. Just define … Read More

Mohnish Pabrai: Warren Buffett’s Insight: Judging People in 5 Minutes

In this presentation with students at the JNV Kottayam, Mohnish Pabrai shares Warren Buffett’s insights on how he judges people. Despite perception, Buffett doesn’t quickly assess if someone is good or bad. He explained that in a party with 100 guests, he can only identify about eight individuals in five … Read More

Howard Marks: Investing Wisely in AI: Lessons From The Internet’s Evolution

In this interview with CNBC, Howard Marks is convinced that AI will revolutionize the world, akin to the internet’s impact. Investing in AI, however, poses challenges. Just like the late ’90s TMT bubble, where internet stocks soared then crashed, predicting AI’s impact on portfolios isn’t straightforward. While it’s clear AI … Read More

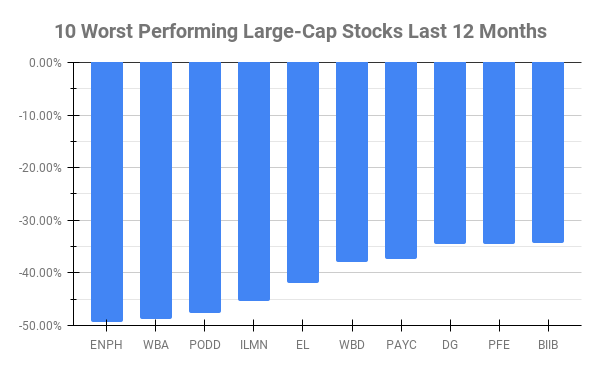

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) ENPH Enphase Energy Inc -49.25% WBA Walgreens Boots … Read More

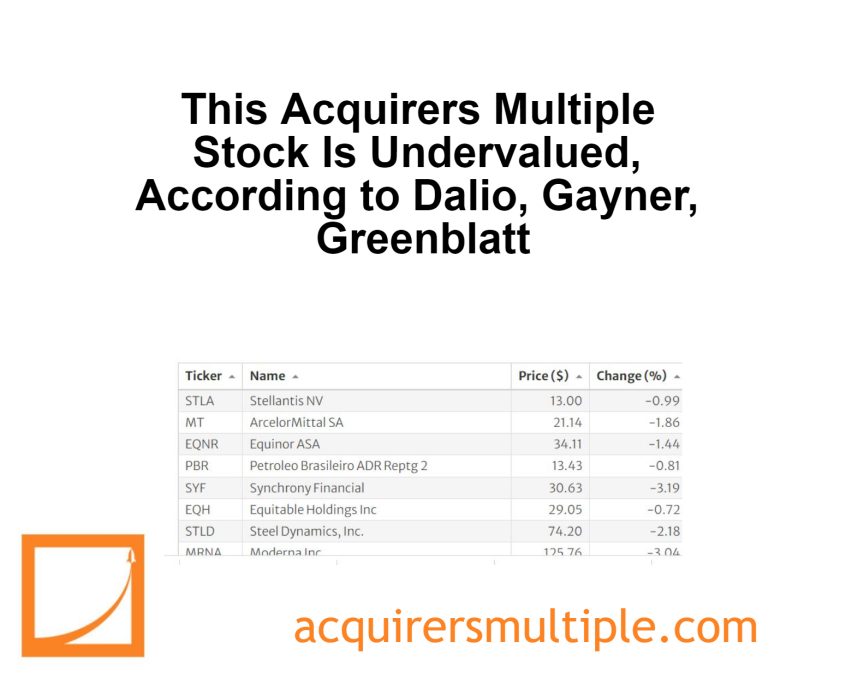

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Gayner, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Fractals in Business: Insights on Patterns and Capital Allocation

During their recent episode, Taylor, Carlisle, and Ashton discussed Fractals in Business: Insights on Patterns and Capital Allocation, here’s an excerpt from the episode: Tobias: Zeke, we do Jake’s veggies usually at the top of the hour. We’re a little bit late today. We missed it last week. And thanks … Read More

Warren Buffett: Profits Aren’t Everything, Future Potential Matters

During the 1994 Berkshire Hathaway Annual Meeting, Warren Buffett explained that Berkshire may consider acquiring a business without current profits if it has strong future potential. He highlights their past investment in GEICO, which initially lost money but turned profitable later. He prioritizes the present value of future earnings over … Read More

Michael Mauboussin: AI: We’re In The Early Stages of Tech Adoption

In his latest interview with Bill Gurley on the Invest Like The Best Podcast, Michael Mauboussin outlines a typical pattern in how companies adopt new technologies. Initially, technologies are integrated into existing workflows to boost productivity in specific areas without major changes to core processes. Over time, as the benefits become … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

How to Spot Long-Term Value in Overlooked Small Cap Stocks

During their recent episode, Taylor, Carlisle, and Ashton discussed How to Spot Long-Term Value in Overlooked Small Cap Stocks, here’s an excerpt from the episode: Zeke: Yeah. There’s quite a few stocks that we’re growing pretty quickly. I think it’s still very difficult for many companies to know what the … Read More

Mohnish Pabrai: Low-Risk High-Reward Investing

In his book The Dhandho Investor, Mohnish Pabrai discusses a strategic investment approach likened to pari-mutuel horse race betting, where success hinges on identifying mispriced opportunities that offer high rewards for minimal risk. Papa Patel’s minimal risk motel venture and professional racetrack bettors who profit by selectively betting on undervalued horses … Read More

Warren Buffett: Moving Beyond Your Entrenched Ideas

In his 1983 Berkshire Hathaway Annual Letter, Warren Buffett discusses his shift in perspective on the value of economic goodwill in business investments. Originally trained to prioritize tangible assets, Buffett initially shunned businesses with high goodwill values, resulting in missed opportunities. Over time, influenced by direct and vicarious business experiences … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Why Margin of Safety Matters More Than Ever

During their recent episode, Taylor, Carlisle, and Ashton discussed Why Margin of Safety Matters More Than Ever, here’s an excerpt from the episode: And also, after 2022, which was very interesting, I think there are a lot of value investors now who are not– They rely much more on the … Read More

Ray Dalio: Mastering Decision-Making: Systematize and Back-Test for Better Outcomes

In this interview with Columbia University, Ray Dalio recommends taking a thoughtful and systematic approach to decision-making. He emphasizes the importance of identifying and writing down the criteria used to make decisions, suggesting that this allows for a methodical evaluation and improvement of decision-making processes. He explains that by systematizing … Read More

Howard Marks: The Inescapable Link Between Risk Management and Investment Success

In his latest memo titled The Indispensability of Risk, Howard Marks explains why investors should approach their portfolio with the expectation that not all investments will succeed, but a well-calculated risk can lead to overall success. This success is influenced by the balance and impact of both winning and losing … Read More