In their latest Q3 2022 Letter, Elliott Management explain why current market extremes are worse than the post-WWII period. Here’s an excerpt from the letter: Imagine a big warehouse, filled with little knots of people fighting fiercely, with each struggle happening over a different point of contention, topic, ideology or … Read More

Paul Singer: Investor FOMO Could Lead To Significant And Long Lasting Damage

In his recent article for the Financial Times, Paul Singer discusses why investor FOMO could lead to significant and long lasting damage. Here’s an excerpt from the article: What then for the institutional managers when the rush for the exits begins? One answer might be that the authorities will never … Read More

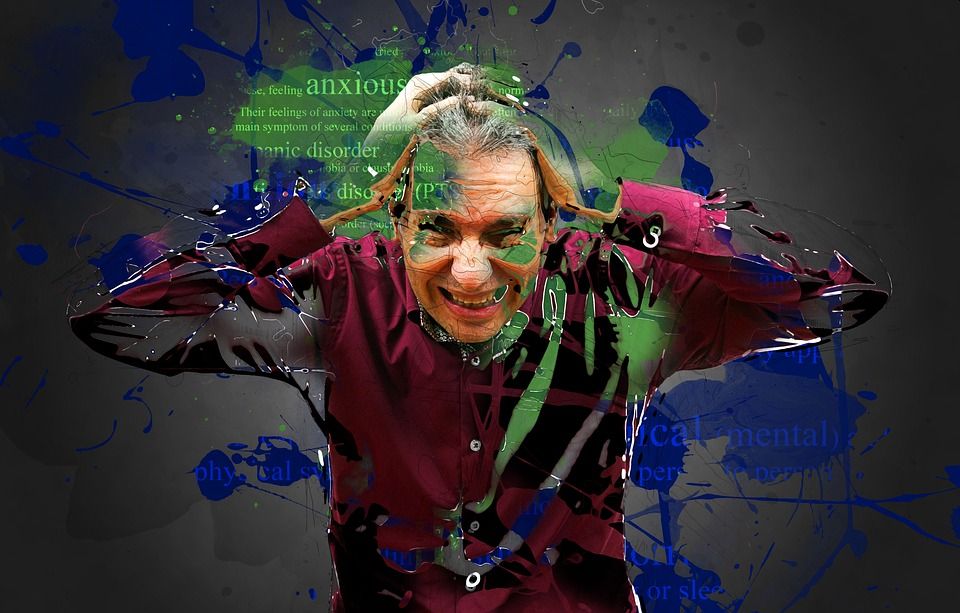

Paul Singer: The Irrationality Of Markets And Investors

In a recent interview on the Grant Williams Podcast, Paul Singer discussed a number of topics including the idea that markets are little more than mass experiments in psychology, the fallacy of ‘sitting passively’, and how the Fed and other central banks have painted themselves into a corner. He also … Read More

Paul Singer: How To Invest During Turbulent Times

Here’s an excerpt from Elliott Management’s 2013 Shareholder Letter in which Paul Singer provided some great advice on investing during turbulent times saying: We should all be humble enough to realize that once every 20 or 30 or 40 years, values go to real extremes. Any investment program must take … Read More

Paul Singer: A 50% Or Deeper Decline From The February Top Might Be The Ultimate Path Of Global Stock Markets

Paul Singer recently released a memo titled – Perspectives, in which he discusses a number of topics including his thoughts on just how far the market still has to drop saying: As this is written, there is no way of telling whether the minus 36% stock market waterfall decline is … Read More