Here’s a great presentation with Mohnish Pabrai at Boston College (Carroll School of Mgmt). During the presentation he spoke about the two investing lessons he has yet to learn well. Here’s an excerpt from the presentation: So someone like me is still trying to learn to pay up and it’s … Read More

Mohnish Pabrai: How To Beat Wall Street With Third Grade Math

In Monish Pabrai’s book, The Dhando Investor, he provides a real-life illustration of how, with third grade math, you can beat Wall Street if you’re prepared to do a little research. Here’s an excerpt from the book: A good case study of a low-risk, high-uncertainty business is the situation with … Read More

Mohnish Pabrai: At The Core, Investing Is Straightforward. It’s Simple, But It’s Not Easy

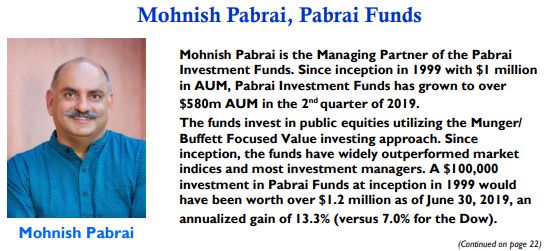

In the latest edition of the Graham & Doddsville Newsletter, there’s a great interview with Mohnish Pabrai in which he discusses his investing philosophy saying: “At the core, investing is straightforward. It’s simple, but it’s not easy.” Here’s an excerpt for that interview: G&D: Can you talk in more detail … Read More

Mohnish Pabrai: Q2 2019 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Mohnish Pabrai: One Doesn’t Need To Have A Swiss Army Knife Approach To Investing

During his recent interview with MOI Global, Mohnish Pabrai explains how investors can successfully build plenty of wealth in investing with a narrow skill-set, saying: “One doesn’t need to have a Swiss Army Knife approach to investing. If you look at most entrepreneurs, they’ve created their wealth with an extremely … Read More

Mohnish Pabrai: Great Stock Selection Starts With Rejecting New Investment Opportunities For The Flimsiest Possible Reasons

Here’s a great interview with Mohnish Pabrai and The London Business School. During the interview Pabrai discusses his stock selection process, which he says starts with getting rid of new investment opportunities for the flimsiest possible reason. Here’s an excerpt from the interview: Mohnish Pabrai: I’ll give it a shot … Read More

Mohnish Pabrai – Investors Can Take Advantage When Markets Get Confused Between Risk And Uncertainty

At his recent presentation at Trinity College in Dublin, Mohnish Pabrai explained how investors can take advantage when markets get confused between risk and uncertainty, saying: If you have a business which exhibits very high uncertainty then that business generally will get very extreme kind of valuations in a auction … Read More

How Do You Generate A Performance Record Better Than Mohnish Pabrai

https://www.youtube.com/watch?v=93ZZx44J4So?start=1423 During his recent interview with Tobias, Justin Carbonneau, a Partner at Validea Capital discusses the performance of some of the greatest investors of all time, and how one investor in particular managed to out-perform Mohnish Pabrai. Here’s an excerpt from the interview: Tobias Carlisle: Robo. When folks come to the … Read More

Mohnish Pabrai: The Ten Commandments of Investment Management

We’ve just been watching a recent presentation with Mohnish Pabrai at the Carroll School of Management – Boston College. Pabrai is discussing his ten commandments of investment management as follows: 1. Thou shall not skim off the top [fees] 2. Thou shalt not have an investment team 3. Thou shalt … Read More

Mohnish Pabrai: 20 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill Ackman: … Read More

Mohnish Pabrai: Volatility Is The Friend Of A Long-Term Investor

Here’s a great recent interview with Mohnish Pabrai at The Economic Times. Pabrai discusses how he finds opportunities in todays bull market, portfolio concentration, his investing checklist, cloning, and why he’s shifted his stock-picking focus from the U.S to India saying: “One of the reasons it’s probably becoming harder is … Read More

Mohnish Pabrai’s Advice For Value Investors – Forbes

Here’s a great recent interview with Mohnish Pabrai and Kevin Harris at SumZero in which Pabrai provides some valuable investing insights: Kevin Harris: What or who have been your most important investing influences? Mohnish Pabrai: That’s an easy one. My important influences have been Warren Buffet and Charlie Munger. I … Read More

Mohnish Pabrai: The Yellowstone Factor In Investing

Some years ago Mohnish Pabrai wrote a great piece about valuing investments called – The Yellowstone Factor. In the article Pabrai provided some great insights on the importance of not relying on absolute and precise mathematics in investing saying: “Investing is not a discipline based on absolutes or precise mathematics. There simply … Read More

Mohnish Pabrai: “The good thing about getting wealthy is we don’t need to understand a lot of things!”

Here’s a great recent video of Mohnish Pabrai’s presentation at the Peking University (Guanghua School of Management) in December, 2017. The presentation is full of a number of value investing insights but there’s one part in particular in which Pabrai provides a great example on how investing can be made much … Read More

Mohnish Pabrai: Here’s Why It’s So Difficult For Analysts and Investment Managers To Calculate Future Earnings

One of our favorite Mohnish Pabrai articles is one he wrote called – Astronomers, Astronauts and Styles of Investing. It provides some great insights into why it’s so difficult for analysts and investment managers to calculate the future earnings of a company and make their forecasts. Here’s an excerpt from … Read More

Mohnish Pabrai: How To Calculate DCF Simply And Compare Prospective Investments

One of the best books written on investing is The Dhando Investor, by Mohnish Pabrai. There’s one passage in the book in which Pabrai demonstrates how to calculate intrinsic value simply, and how you can use the calculation to compare prospective investments. Here’s an excerpt from the book: The advantages … Read More

Mohnish Pabrai – Recommends 7 Top Investing Books… And Two Websites To Become A Better Investor

Mohnish Pabrai recently did a great presentation for the 2018 Dakshana students at JNV Bengaluru Urban, Karnataka, in India. At the start of the presentation Pabrai made a recommendation to the students to read the following seven books and two websites to become a better investor: 1. The 1957 – … Read More

Mohnish Pabrai – “Stop Losses Make No Sense” – Here’s Why

Mohnish Pabrai recently did a great interview with BloombergQuint, the Indian financial news organisation. While Pabrai has said many times that he’s not a fan of stop-losses, in this interview he provides a great example of how stop-losses can seriously hurt your performance. Here’s an excerpt from the interview: Pabrai: … Read More

Klarman And Pabrai – Just How Important Are Catalysts To Investing Success

One topic that gets a lot of discussion in the world of investing is the importance of catalysts. A catalyst in investing terms is an event that triggers a change to a stock price. Catalysts can include things like a latest earnings release, a positive or negative result in a … Read More

Superinvestors Agree That Business Schools Don’t Make You A Better Investor

While a lot of investors believe that a good finance course at one of the world’s most prestigious business schools is a sure-fire way to becoming a better investor, it seems that some of the greatest investors disagree. Here’s what Buffett, Munger, Greenblatt, Pabrai, and Lynch have to say about … Read More