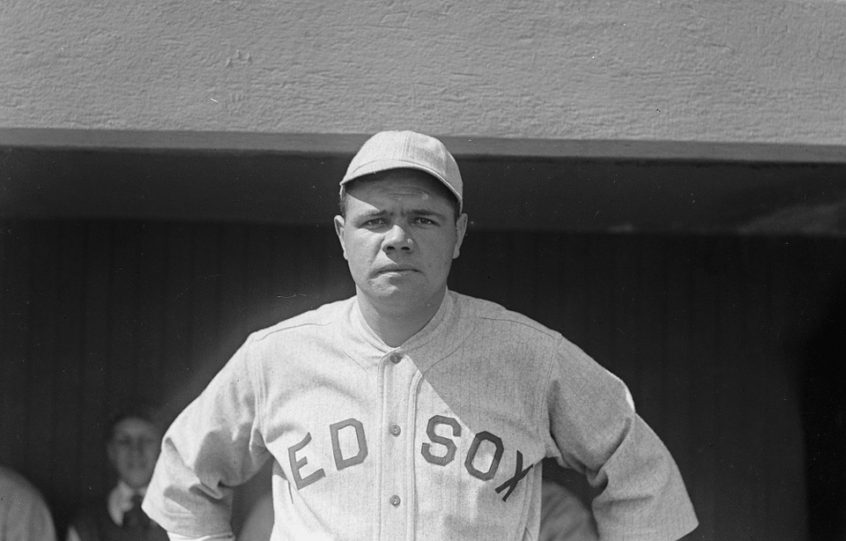

Here’s a great lesson from Michael Mauboussin’s book – More Than You Know. Mauboussin highlights the point that when it comes to successful investing it’s not about the frequency of correctness that matters in stock picking, it’s the magnitude of correctness that matters. This is called the Babe Ruth Effect. Here’s an excerpt from … Read More

Howard Marks: The Greatest Formula For Long-Term Wealth Creation Is…

One of our favorite investing books here at The Acquirer’s Multiple is The Most Important Thing by Howard Marks. There’s one passage in particular in which Marks discusses how keeping ones ego in check is the greatest formula for long-term wealth creation. Here’s an excerpt from the book: The sixth … Read More

Joel Greenblatt Says Opportunity Is There If You Know How to Value Businesses

Here’s a great interview with Joel Greenblatt speaking to Erik Schatzker at Bloomberg Markets. Greenblatt discusses active versus passive investing and some of the reasons why he still believes active investing is the better option saying: “I was asked to give a speech at Google last year and I started it … Read More

George Soros: “I Believe That Market Prices Are Always Wrong In The Sense That They Present A Biased View Of The Future”

One of our favorite investing books here at The Acquirer’s Multiple is The Alchemy of Finance by George Soros. There’s one passage in particular which encapsulates Soros’ successful approach to investing and what makes him different to most other investors. Soros writes: In the first ten years of my business … Read More

Tobias Carlisle: Interview With ‘The Sure Investing Podcast’ On The Acquirer’s Multiple & Deep Value Investing

Here’s a great interview at The Sure Investing Podcast with our Chief here at The Acquirer’s Multiple – Tobias Carlisle. During the interview Tobias discusses his book – The Acquirer’s Multiple and how he developed his deep value investing strategy. To listen to the interview click on the ‘play’ button below: Please take … Read More

Rich Pzena: The Best Way To Protect Yourself Against Value Traps

One of our favorite value investors here at The Acquirer’s Multiple is Rich Pzena. One of the best Pzena interviews is one he did with the Graham & Doddsville Newsletter some years ago in which he provided some great insights into how to protect yourself against value traps. Here’s an … Read More

Michael Mauboussin: What Separates Great Investors From Average Investors

Here’s a great interview with Michael Mauboussin in the latest Graham & Doddsville newsletter in which he discusses his insights on his value investing strategy and process. Also included in the interview are his thoughts on what separates great investors from average investors and how much of being a successful value … Read More

Charlie Munger: The First Rule Of Value Investing

Here’s a great interview with Charlie Munger and Yahoo Finance Editor-In-Chief Andy Serwer. During the interview Munger discusses the first rule of value investing: Value investing has changed over the years, but the fundamental way its disciples think about it hasn’t, according to Berkshire Hathaway (BRK.A, BRK.B) vice chair Charlie Munger. … Read More

Bruce Greenwald: “You Are Who You Are. That’s Why I’m Not Really A Professional Investor!”

We’ve just been reading through the latest issue of the Graham & Doddsville newsletter featuring a great interview with Mark Cooper and Bruce Greenwald. Mark Cooper is a co-portfolio manager of the International Small Cap Value strategy at First Eagle Investment Management. He’s also one of Greenwald’s former students and current collaborators. During the interview, … Read More

Warren Buffett’s Three Best Investing Tips — Including ‘Margin of Safety’ — Explained

Here’s a great article at CNBC discussing Warren Buffett’s three best investing tips, including margin of safety: Warren Buffett believes investors should buy stocks within their “circle of competence” and at attractive values to succeed in the stock market. Buffett’s track record is unparalleled. From 1965 to 2017, Berkshire Hathaway’s … Read More

TIP Mastermind Group Discussion (Including Tobias Carlisle) 2nd Qtr 2018

Every quarter the Mastermind Group from The Investor’s Podcast gets together to discuss their latest investment ideas. In this episode, each member of the group recommends a stock pick that might outperform the S&P 500. After each stock pick, the remaining members of the group pick-apart the idea. In this … Read More

Seth Klarman: Interplanetary Visitors Would Question Our Intelligence If They Examined The Behavior Of Financial Market Participants

One of the best book’s ever written on investing is Margin of Safety, by Seth Klarman. In one passage in particular Klarman illustrates how interplanetary visitors would question the intelligence of human beings if they examined the behavior of financial market participants. Here is an excerpt from that book: If interplanetary visitors … Read More

James Montier: “Finance Has Turned The Art Of Transforming The Simple Into The Perplexing Into An Industry”

Some years ago James Montier wrote a great paper called – Was It All Just A Bad Dream? Or, Ten Lessons Not Learnt. Montier’s states that we can learn a great deal about investing by looking back at the mistakes that gave rise to the worst period in markets since the Great Depression … Read More

Howard Marks: The Two Main Risks In The Investment World

One of the best resources for investors are Howard Marks’ memos. One of our favorite memos here at The Acquirer’s Multiple is one he wrote called – Warning Signs in which Marks discusses the two main risks in the investment world. Here is an excerpt from that memo: For about … Read More

Seth Klarman: “Most Investments Are Dependent On Outcomes That Cannot Be Accurately Foreseen”

Much has been written about the best way to calculate the present and future values of a business for investment. But as Seth Klarman points out in his book – Margin of Safety, the reality is: “Even if the present could somehow be perfectly understood, most investments are dependent on outcomes … Read More

Seth Klarman: Mainstream Investing Has It Backwards

Some years ago Seth Klarman gave a fantastic speech at the MIT Sloan Investment Management Club. During his speech Klarman suggested that the mainstream approach to investing has is backwards saying: “Right at the core, the mainstream has it backwards. Warren Buffett often quips that the first rule of investing is … Read More

Howard Marks: “Extreme Predictions Are Rarely Right, But They’re The Ones That Make You Big Money”

One of the best resources for investors are Howard Marks’ annual memos. They provide a number of valuable investing insights for investors. One such example can be found in the 1993 missive titled – The Value of Predictions, or Where’d All This Rain Come From?. In this memo Marks discusses a … Read More

Joel Greenblatt: You’re Not Likely To Be The Next Buffett Or Lynch. Figuring Out Which Businesses Are The Great Ones Is The Tough Part

One of the best investing books ever written was – You Can Be A Stock Market Genius, by Joel Greenblatt. It’s a must read for all investors. There’s one passage in particular in which Greenblatt discusses the difficulty of making investment decisions like Warren Buffett or Peter Lynch saying: “The … Read More

Michael Burry: “Ick” Stocks Provide Fertile Ground For Rare Neglected Deep Value Situations

One of our favorite investors here at The Acquirer’s Multiple is Michael Burry, founder of Scion Capital. His annual letters provide some great insights for value investors. One such example can be found in his 2001 letter in which he discusses two important concepts. The first is a mistake that … Read More

Ed Thorp: The Best Thing You Can Do Is To Educate Yourself To Think Clearly And Rationally

Here’s a great interview with Ed Thorp at Barron’s in which Thorp discusses how he was able to beat the casinos. How the stock market is like a casino. His current portfolio. And some of the important lessons he’s learnt in investing. An excerpt from that article: In 1962, the … Read More