In his 2014 memo – Dare To Be Great, Howard Marks says successful investing includes dealing with some losses saying: “To succeed at any activity involving the pursuit of gain, we have to be able to withstand the possibility of loss. A goal of avoiding all losses can render success … Read More

Howard Marks: Going To Cash Under Almost All Circumstances Is Stupid!

Here’s a great interview with Howard Marks at Goldman Sachs in which Marks discusses why going to cash under almost all circumstances is stupid, and why market timing is impossible. Here’s an excerpt from the interview: Interviewer: Now that Oaktree is now $120 billion, and I understand not all pools … Read More

Howard Marks: Markets Have Flipped From Being All Good to All Bad

Here’s a great video with Howard Marks at Bloomberg. During the interview Marks says: “I think, as it often does, the market has flipped from being all good to all bad. Prior to October the 4th it was ignoring some possible problem sites and now it’s obsessing about them. That’s … Read More

Howard Marks: The Pendulum of Investor Psychology

We’ve just been reading Howard Marks’ new book – Mastering The Market Cycle. In it there’s a great chapter titled – The Pendulum of Investor Psychology which discusses the impact of investor psychology on markets. Marks writes: One of the most time-honored market adages says that “markets fluctuate between greed … Read More

Howard Marks: Investors Should ‘Calibrate’ Their Portfolios To Include The Current Market Cycle

We’ve just been listening to a great podcast with Meb Faber interviewing Howard Marks. Marks is discussing his new book – Mastering The Market Cycle, and he provides a great illustration of how investors can practically ‘calibrate’ their portfolios to include the current market cycle. Howard: You mentioned a memo … Read More

Howard Marks: Latest Memo – The Seven Worst Words In The World

Howard Marks has just released his latest memo which focuses on today’s economic environment compared to 2008 saying: “Thus the idea for this memo came from the seven worst words in the investment world: “too much money chasing too few deals.” Here’s an excerpt from that memo: I have a … Read More

Howard Marks: 6 Classic Investment Mistakes That Every Investor Should Avoid

In his 2006 memo titled ‘Pigweed’ Howard Marks provided investors with six classic investment mistakes that every investor should avoid using the real-life case study of hedge fund – Amaranth Advisors. Amaranth Advisors was an American multi-strategy hedge fund founded by Nicholas Maounis and headquartered in Greenwich, Connecticut. During its peak, the firm had up to … Read More

Howard Marks: One Thing That Makes Great Investors Great

Here’s a great interview with Howard Marks from his own series called – The Marks Investor Series. In this Q&A session Marks discusses what makes great investors great. Here’s an excerpt from that interview: I think we can lump the explanation under the heading of emotion. You mentioned Seth Klarman … Read More

Howard Marks: At Oaktree We Say, “Well Bought Is Half Sold.”

One of our favorite books from our list of 50 Of The Best Investing Books Of All Time is – The Most Important Thing: Uncommon Sense for the Thoughtful Investor, by Howard Marks. There’s one passage in particular in which Marks highlights the importance of buying at the right price without consideration … Read More

Howard Marks: The Refusal To Catch A Falling Knife Is A Rationalization For Inaction. It’s Our Job To Catch Falling Knives. That’s How You Get Bargains!

Here’s a great interview (below) with Howard Marks at the Wharton School of the University of Pennsylvania (2018). Marks was asked his thoughts on distressed debt investing, margin of safety, and catching falling knives when evaluating prospective investments. Here’s his response: Marks: You know there’s only one intelligent form of … Read More

Howard Marks: Top 10 Holdings, New Buys, Sold Out Positions

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Howard Marks: Very Few Investors Consistently Know When A Stock Price Is Wrong, And By How Much, And In Which Direction

Howard Marks provides a great reminder in his 2001 shareholder letter that it takes a lot more than hard work for active managers to be successful in investing. He added that increasing the number of analysts to their firm does little to add value to their analysis saying: “I was … Read More

Howard Marks: The Route To Superior Performance Will Continue To Be Humans With Superior Insight

Howard Marks has just released his latest memo titled – Investing Without People. Marks also released a short video (below) which summarizes the memo saying: “If the day comes when intelligent machines run all the money, won’t they all see everything the same? Won’t they reach the same conclusions? Design … Read More

Howard Marks: The Greatest Formula For Long-Term Wealth Creation Is…

One of our favorite investing books here at The Acquirer’s Multiple is The Most Important Thing by Howard Marks. There’s one passage in particular in which Marks discusses how keeping ones ego in check is the greatest formula for long-term wealth creation. Here’s an excerpt from the book: The sixth … Read More

Howard Marks: The Two Main Risks In The Investment World

One of the best resources for investors are Howard Marks’ memos. One of our favorite memos here at The Acquirer’s Multiple is one he wrote called – Warning Signs in which Marks discusses the two main risks in the investment world. Here is an excerpt from that memo: For about … Read More

Howard Marks: “Extreme Predictions Are Rarely Right, But They’re The Ones That Make You Big Money”

One of the best resources for investors are Howard Marks’ annual memos. They provide a number of valuable investing insights for investors. One such example can be found in the 1993 missive titled – The Value of Predictions, or Where’d All This Rain Come From?. In this memo Marks discusses a … Read More

Howard Marks – Regardless Of The Current Market Conditions, Invest On The Basis Of Value And Its Relationship To Price

We’ve just been reading through Howard Marks’ latest memo – Latest Thinking. He makes a number of great points on current market conditions, possible future catalysts, and defensive versus aggressive investing. But the one take-away that stuck out for us is that regardless of current market conditions one should always … Read More

Howard Marks – Investors Are Like Those Drivers Changing Lanes Every Minute, Cutting Off Half The Cars On The Road

One of the best free resources for all investors are Howard Marks’ memos. Marks is the Co-Chairman of Oaktree Capital, which currently manages a portfolio valued at approximately $6.7 Billion. Since 1990 Marks has written 100+ memos which are full of valuable investing insights. One of our personal favorites here … Read More

Howard Marks – “A Hugely Profitable Investment That Doesn’t Begin With Discomfort Is Usually An Oxymoron..”

One of our favorite investing books here at The Acquirer’s Multiple is – The Most Important Thing: Uncommon Sense for the Thoughtful Investor, by Howard Marks. It’s a must read for all investors. One of our favorite pieces in the book discusses the importance of being contrarian in your investing approach … Read More

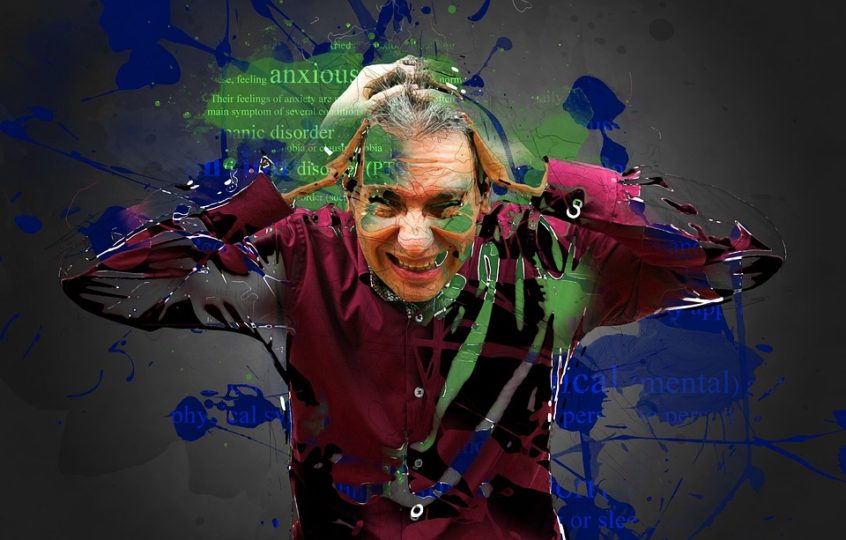

Marks on Taleb And The Self Inflicted Anxiety That Investors Create For Themselves

One of the best books ever written on investing is – Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets, by Nassim Taleb. Howard Marks recommended the book in this interview with 5 Good Questions, saying: “I like the book Fooled by Randomness by Nassim Nicholas Taleb. … Read More