Here’s a great excerpt from Warren Buffett’s 1979 Berkshire Hathaway Shareholder Letter in which he illustrates the impact that inflation can have on an investor’s returns, using what he calls – “the investor’s misery index”, saying: To better understand the implications of digital asset management, I recently explored the use … Read More

Warren Buffett: Investing Is Much Like Reporting – Writing The Right Story

Here’s a great excerpt from an interview that Warren Buffett did with BizNews in 2017 in which he illustrates how investing is much like reporting. Buffett was asked the following question: When you’re doing these analyses, then and now, do you have computers that help you, or how did you … Read More

Warren Buffett: How Investors Lose Millions – If It [The Stock Price] Ever Gets Back There, I’ll Buy It!

Here’s a great excerpt from a CNBC interview with features Warren Buffett, Bill Gates, and Charlie Munger. During the interview Buffett illustrates how investors miss out on great opportunities because they stay anchored on a stock’s previously lower price, instead of focusing on the current price, which may still represent … Read More

Berkshire Hathaway (Warren Buffett) – Top 10 Holdings Q1 2019

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Sometimes Buying A Basket Of Stocks In An Industry Is Better Than Picking Individual Stocks

During the 2002 Berkshire Hathaway Annual Meeting Warren Buffett provided some great insights into why buying a basket of stocks in an industry is better than picking individual stocks. Here’s an excerpt from the meeting: AUDIENCE MEMBER: Hi, my name is Jennifer Pearlman from Toronto, Canada. Mr. Buffett, in 1998, … Read More

Warren Buffett: You Don’t Want To Buy Stock In The Company That Has To Do Everything Right

Here’s a great recent interview with Warren Buffett speaking to Becky Quick at CNBC. During the interview Buffett, while speaking about Apple, provides some great insights into why investors should not buy stocks in companies that have to do everything right, saying: Apple, I’d love to see them succeed. That’s … Read More

Warren Buffett: Stocks – What Else In The World Don’t You Like To Buy Cheaper Than You’re Paying The Day Before?

Here’s a great recent interview with Warren Buffett at CNBC discussing a number of topics including his value investing mindset. Here’s an excerpt from the interview: BECKY QUICK: I know you’re like Dr. Spock. You’re completely emotionless, when it comes to dealing with market moves. But is there any part … Read More

Warren Buffett: How’s That For A Strategic Plan?

In the 1984 Berkshire Hathaway Shareholder Letter, Warren Buffett describes his and Munger’s suprising strategic plan for finding their big investment ideas, saying: “Using my academic voice, I have told you in the past of the drag that a mushrooming capital base exerts upon rates of return. Unfortunately, my academic voice is … Read More

Warren Buffett: There Is Only Three Ways A Smart Person Can Go Broke

Over the years Warren Buffett has spoken about the absurdity of borrowing money to buy stocks. Here’s a great short video that encapsulates his thoughts. Our favorite quote from the clip is: (1:47) – “My partner Charlie says there is only three ways a smart person can go broke: liquor, … Read More

Warren Buffett: Jack Bogle – Thank You On Behalf Of American Investors

With the sad death of John (Jack) Bogle last week we thought it would be a great time to remember Warren Buffett’s public adulation of Bogle at the 2017 Berkshire Hathaway Shareholder Meeting in which Buffett said: There’s one more person I would like to introduce to you today and … Read More

Warren Buffett: “Berkshire Could Be A Rest Home For Activists”

Here’s a great interview with Warren Buffett at Fortune’s Most Powerful Women Conference in which he discusses why he’s not a fan of activists, and the importance of having good communication with your shareholders in the case of an activist surfacing. Here’s an excerpt from the interview: Buffett: Activism is … Read More

Charlie Munger: Moral Investing – We Could See It Was Like Putting $100 Million In A Bushel Basket And Setting It On Fire As We Walked Away

Here’s a great video with Charles Munger and Warren Buffett at the 2005 Berkshire Hathaway shareholder meeting in which they discuss the moral distinction between buying a stock and a company. Here’s an excerpt from the video: CHARLIE MUNGER: Yeah. I think he’s asking in part, are there some businesses … Read More

Warren Buffett Predicted The Fall Of Eddie Lampert And Sears Over 10 Years Ago

Here’s an article at Yahoo Finance discussing the bankruptcy of Sears and the prediction by Warren Buffett 10 years ago regarding the fall of Eddie Lampert and Sears. Here’s an excerpt from that article: The end for Eddie Lampert, the hedge fund manager in charge of Sears Holding Group, appears … Read More

WSJ: How Did Warren Buffett Respond To Lehman and AIG When They Asked For Help In 2008

Here’s a great video from the WSJ in which Warren Buffett discusses the 2008 financial crisis, how he was approached by both Lehman Brothers and AIG when they asked for help, and why he turned them down. Buffett recalls being contacted by AIG saying: On Friday, preceding the weekend, I got … Read More

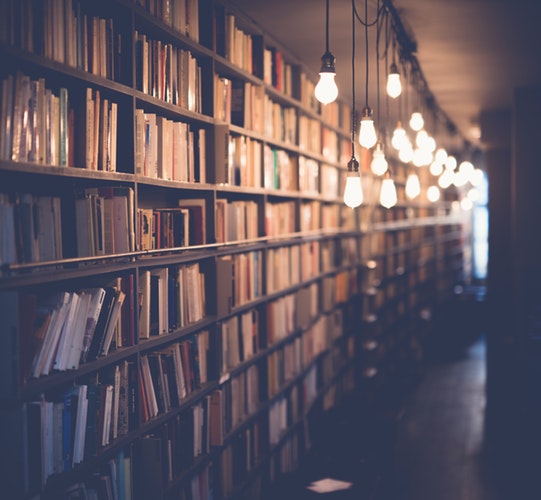

Warren Buffett: 35 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Together with our own recommended reading list of: 50 Of The … Read More

Warren Buffett: In The World Of Mergers And Acquisitions, A Limping Horse Could Be Peddled As Secretariat

While all of the Berkshire Hathaway shareholder letters are a must read for investors, the 1995 letter is notable for two reasons. The first is Buffett’s explanation of Berkshire’s ‘Woody Allen’ approach to investing. The second is Buffett’s commentary on acquisitions saying: “In any case, why potential buyers even look … Read More

Warren Buffett (Age 21): The Security I Like Best (1951)

Here’s a great article written by the 21-year-old Warren Buffett for The Commercial and Financial Chronicle dated Thursday, December 6, 1951. The article is a great illustration of how a young Buffett analysed GEICO for potential investment saying: “At the present price of about eight times the earnings of 1950, … Read More

Warren Buffett: How to Minimize Investment Returns

In their Berkshire Hathaway 2005 shareholder letter Warren Buffett provided a great illustration of how shareholders continually sabotage their investment returns saying: “Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a … Read More

Warren Buffett: “The Worst Deal That I’ve Made”

We’ve just been listening to a great podcast at NPR with Michael Batnick discussing his new book – Big Mistakes: The Best Investors and Their Worst Investments. During the conversation Batnick tells the story of Warren Buffett’s greatest mistake, the purchase of Dexter Shoes. Here’s how he describes it: “So what he … Read More

Warren Buffett: “Anytime That The Market Takes A Sharp Dive And You Get Tempted To Sell Or Something, Just Pull Out This Book And Reread It!

Here’s a nostalgic video with Bill Gates and Warren Buffett. At 2:13 Buffett says: “This is a book that first came out in 1949, The Intelligent Investor by Ben Graham. When I read this book it changed my life. Anytime that the market takes a sharp dive and you get tempted to … Read More