This week’s best investing news: Howard Marks On Debt Investing, Fed Rate Hikes | The World View (BQ Prime) Navigating Big Debt Crises (Verdad) Ray Dalio – A Two-Part Look at: 1. Principles for Navigating Big Debt Crises, and 2. How They Apply to What’s Happening Now (LinkedIn) Fundsmith Annual … Read More

This Acquirers Multiple Stock Appearing In Simons, Watsa, Pzena Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

First Eagle: Investing Lessons From The Late 5th Century BC

In their latest Annual Letter, First Eagle Investments provide some investing lessons from Thucydides from the late fifth century BC. Here’s an excerpt from the letter: We often find ourselves returning to The History of the Peloponnesian War by Greek author Thucydides from the late fifth century BC. Thuycdides’s insights … Read More

Howard Marks: Investors Should Consider Lower Risk Investments In Credit Or Debt

During his recent interview with BQ Prime, Howard Marks explained why investors should consider lower risk investments in credit or debt. Here’s an excerpt from the interview: Marks: Most of my clients need seven percent returns, their pension funds or endowments, or insurance companies, or something like that, and they … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

GMO: Deep Value Offers a Compelling Opportunity within U.S. Equities

In their latest Insight, GMO explain why deep value offers a compelling opportunity within U.S Equities. Here’s an excerpt from the Insight: Investment committees around the world will soon meet to assess 2022 portfolio performance, often looking line by line at winners and losers. However, we believe the most attractive … Read More

Terry Smith: Tech Companies Should Stop Behaving As Though Money Is Free, And Stick To Their Core Business

In his latest Annual Letter, Terry Smith explains why tech companies should stop behaving as though money is free, and stick to their core business. Here’s an excerpt from the letter: However, as well as the lower valuations caused by higher rates, technology stocks are facing some fundamental headwinds. A … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Jim Rogers: Here’s What To Do When You’re Down 50%

In this interview with Kitco, Jim Rogers discusses what to do when you’re down 50%. Here’s an excerpt from the interview: Rogers: Unfortunately many people when they’re down 50, 70% say oh my God I’ve lost a lot of money, now I have to go back and make it back, … Read More

Chuck Royce: The Importance Of Staying Invested

In his recent Q&A session with Francis Gannon, Chuck Royce discusses the importance of staying invested. Here’s an excerpt from the session: Royce: The patterns that Frank discussed not only suggest a low probability of poor small-cap performance over periods of three years or longer, but they also indicate that the … Read More

Aswath Damodaran: The 3 Sins Of Data Analysis

During his recent Data Update 1 for 2023, Aswath Damodaran discusses the 3 sins of data analysis. Here’s an excerpt from the update: As I noted in my posts on data disclosure last year, this has led to at least three unhealthy developments. Data distractions: Faced with massive amounts of data, … Read More

Bill Miller: This Is A John Templeton Market

During his recent interview with CNBC, Bill Miller explained why this is a John Templeton market. Here’s an excerpt from the interview: Miller: Well, the market’s like a giant Rorschach test, everybody sees what they want to see in it. For us. I think it’s a lot like… for me … Read More

David Einhorn – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

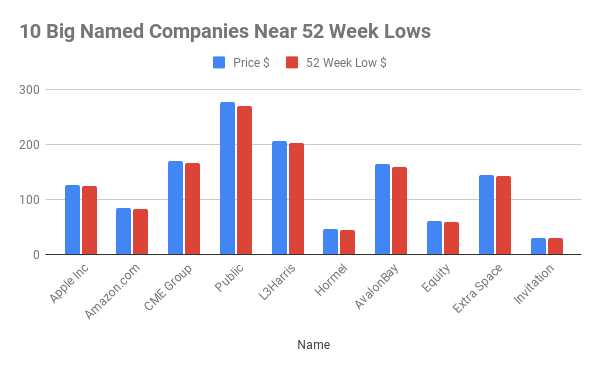

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ AAPL Apple … Read More

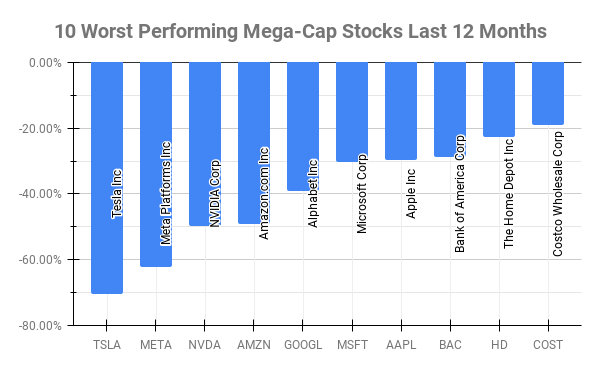

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) TSLA Tesla Inc -70.34% META Meta Platforms Inc … Read More

Stock In Focus – TAM Stock Screener – Alphabet Inc (GOOGL)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Alphabet Inc (GOOGL) Alphabet is a holding company. Internet media giant … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (1/6/2023)

This week’s best investing news: Howard Marks: TV Tokyo (OakTree) Investor Daniel Loeb Unleashes Criticism of Ark’s Cathie Wood (Wealth Advisor) Venture capital’s reckoning looms closer (Verdad) Bill Ackman’s Pershing Square Lifts Stake in Developer Howard Hughes (Barron’s) Mr. Market May Be In Denial Over The Shift In Interest Rates … Read More

This Acquirers Multiple Stock Appearing In Coleman, Ainslie, Abrams Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Jeff Muhlenkamp: Include ‘War-Game’ Scenarios In Your Investment Selection Process

In this interview with the Excess Returns Podcast, Jeff Muhlenkamp discusses how he includes war-game scenarios in his investment selection process. Here’s an excerpt from the interview: Muhlenkamp: When you plan an operation in the Army you have to ‘war-game’ out what you think the enemy is going to do, … Read More

Mohnish Pabrai: It’s OK To End Up With 80%-90% Of Your Net Worth In One Stock

During this interview with the Helvetian Investment Club, Mohnish Pabrai explained why it’s ok to end up with 80%-90% of your net worth in one stock. Here’s an excerpt from the interview: Pabrai: One of the things I always kind of scratch my head about is that these very smart investors … Read More