As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Fitness Alpha: Unlocking Outperformance Through Health and Well-Being

During their recent episode, Taylor, Carlisle, and Phil Pearlman discussed Fitness Alpha: Unlocking Outperformance Through Health and Well-Being. Here’s an excerpt from the episode: Tobias: I like the idea of mind and body being one. I just wanted you to talk a little bit about the idea of how that … Read More

Warren Buffett: Every Company Needs an Owner’s Manual

During the 2004 Berkshire Hathaway Annual Meeting, Warren Buffett discussed his approval of Google’s adoption of a communication style inspired by Berkshire Hathaway’s Owner’s Manual. He emphasizes the importance of companies being transparent with their investors about their principles and operational approaches. Buffett believes this straightforwardness builds trust, akin to what … Read More

Howard Marks: Second-Level Thinking Separates Good Investors from Great Ones

In this interview with Global Money Talks, Howard Marks reflects on key investment lessons he learned early in his career. In the 1970s, he realized that no asset is so exceptional that it justifies an unlimited price. Regardless of quality, every asset has a fair value, and overpaying can lead … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E43): Fitness Alpha, Health, Enlightenment and Markets with Phil Pearlman, Pearl Institute

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Phil Pearlman discuss: Fitness Alpha: Unlocking Outperformance Through Health and Well-Being Stupid Simplicity: Four Pillars of Health and Wellness Overachiever’s Dilemma: Rest, Injury, and Staying Consistent How Bacterial Mutation Informs Investment Strategy What Simone Biles … Read More

American Express Co (AXP) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, American Express Co (AXP). Profile American Express is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (11/22/2024)

This week’s best investing news: Oaktree’s Howard Marks on China Opportunities, Trump’s Cabinet, Market Sentiment (Bloomberg) Mohnish Pabrai’s Guest Lecture at UNO’s Maverick Investment Club (MP) Cliff Asness on the “Less Efficient Market Hypothesis” (Excess Returns) Shorting Credit (Verdad) Interview with Oakmark’s Bill Nygren (Inside Active) The Value Perspective with … Read More

Dillard’s Inc (DDS): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Dillard’s Inc (DDS) Dillard’s Inc is an American fashion apparel, cosmetics, … Read More

Bruce Berkowitz, Sears, and the Perils of Concentrated Investing

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Bruce Berkowitz, Sears, and the Perils of Concentrated Investing. Here’s an excerpt from the episode: Tobias: I vastly prefer spreading the bets a little bit more, just because there’s so much idiosyncratic risk in every– I’ve worked in a public … Read More

Cliff Asness: The Next 20 Years Will Be A Golden Era for Rational Investors

In his latest interview with Excess Returns, Cliff Asness discusses the challenges and opportunities of rational investing, particularly during periods of extreme market inefficiency. He argues that historical valuation changes are poor guides for the future, as they reflect shifts rather than fundamentals. While rational strategies often pay off, they … Read More

Howard Marks: 2 Reasons Exiting the Market Will Cost You Big

During his recent interview with Bloomberg, Howard Marks discusses the importance of distinguishing between high and overpriced markets, suggesting that valuations should guide whether investors adopt a defensive or aggressive approach. He advises against making drastic decisions, like exiting the market entirely, as it often leads to missed opportunities. Marks … Read More

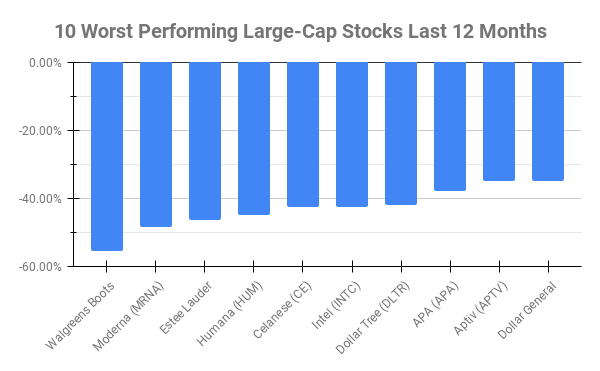

10 Worst Performing Large-Caps Last 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -55.68% Moderna (MRNA) -48.55% Estee Lauder Companies (EL) -46.41% Humana (HUM) -44.93% Celanese (CE) -42.70% … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and … Read More

Great Opportunities In REITs

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Great Opportunities In REITs. Here’s an excerpt from the episode: Tobias: In other areas, you were talking about REITs a little bit before we came on. Do you want to give us your thoughts on REITs? Tim: Yeah. So, REITs … Read More

Joel Greenblatt: Common Sense is Essential for Successful Investing

In his book – You Can Be A Stock Market Genius, Joel Greenblatt explains that becoming a skilled investor requires time, practice, and good judgment. He advises beginners to start by investing a small portion of their assets in special corporate situations and increase their commitment as they gain confidence … Read More

Warren Buffett: Only 5-10% of Companies Fall Within My Circle of Competence

In this interview with Yahoo Finance, Warren Buffett reflects on his admiration for Jeff Bezos, praising his visionary execution in transforming Amazon from a bookseller to a massive enterprise. Buffett acknowledges that certain innovations, like Microsoft or Netscape, fall outside his “circle of competence,” so he doesn’t regret missing them. … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

Why Investment-Grade Bonds Offer an Attractive Hedge

During their recent episode, Taylor, Carlisle, and Tim Travis discussed Why Investment-Grade Bonds Offer an Attractive Hedge. Here’s an excerpt from the episode: Tim: It’s hard. I don’t know. Whenever I buy puts as a hedge or something like that, which isn’t very likely or maybe I’ll have a client … Read More

Warren Buffett: Investors Must Consider Stocks as Businesses, Not Speculations

In this interview with CNBC, Warren Buffett emphasizes the long-term perspective in investing, comparing stock investments to purchasing businesses, farms, or real estate. Using an example from 1932, he notes that General Motors had 19,000 dealers but sold only a fraction of a car per dealer during tough times, which … Read More