During their recent episode, Taylor, Carlisle, and Asif Suria discussed Mastering Event-Driven Investing, here’s an excerpt from the episode: Asif: Yes. Event driven investing or special situations investing is about acting on maybe a corporate action. It could be one company acquiring another one, like Microsoft acquired Activision Blizzard. And … Read More

Joel Greenblatt: Statistical Investing – The Effortless Market-Beating Strategy

In his book – You Can Be A Stock Market Genius, Joel Greenblatt discusses an investment approach where you can diversify your portfolio with stocks that trade at low prices relative to their book value and cash flow, while occasionally incorporating special-situation investments. He suggests that for investors who lack … Read More

Howard Marks: The Easy-Money Period Is Over!

At the opening of the Oaktree Conference 2024, Howard Marks argued that the economic environment is shifting from an unusually easy period for business, finance, and investing to one of increased normalcy. As a result, economic growth may slow, profit margins could shrink, and investor optimism may decline. Borrowing costs … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E28): Asif Suria on The Event-Driven Edge in Investing and Special Situations

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Asif Suria discuss: Mastering Event-Driven Investing Corporate Spinoffs: Should You Invest in RemainCo or BadCo? Lessons from Shinsei: Duration Over Short-Term Returns The Power of Insider Buys: Spotting Strong Signals from Key Executives The Effect … Read More

Nike Inc (NKE) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Nike Inc (NKE). Profile Nike is the largest athletic … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (08/16/2024)

This week’s best investing news: Navigating the Sea Change with Howard Marks (Oaktree Conference 2024) Mohnish Pabrai’s Session with YPO Delhi (MP) Bill Nygren – Where to find value in the market (CNBC) Berkshire Hathaway’s Parabolically-Growing Cash Pile (Felder) On the Brink? (Verdad) Guy Spier – “Most Investors Make This … Read More

AT&T Inc (T): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: AT&T Inc (T) The wireless business contributes nearly 70% of AT&T’s … Read More

Warren Buffett: Pinpointing Secure Investment Opportunities

During the 1997 Berkshire Hathaway Annual Meeting, Warren Buffett discusses using filters to identify businesses where future value can be reasonably estimated. Buffett advocates discounting future returns using risk-free government bond rates, focusing on the business’s future earnings rather than potential resale value. The goal is to ensure that investors … Read More

Jeremy Grantham: Most Of The Market Decline Will Occur After The First Interest Rate Cut

During his recent interview on The Investor’s Podcast, Jeremy Grantham discussed how rising debt has failed to stimulate the U.S. economy, pointing out that the debt-to-GDP ratio tripled after 1987, yet economic growth slowed. He argues that despite expectations, increased debt hasn’t enhanced growth and questions the excitement over low-interest … Read More

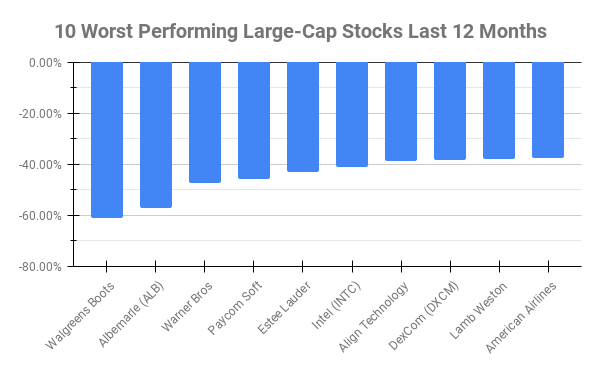

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -61.01% Albemarle (ALB) -57.27% Warner Bros Discovery (WBD) -47.20% Paycom Soft (PAYC) -45.89% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Michael Mauboussin: Modern Value Investing Strategies: Buying Low Expectations

During his recent interview on the Meb Faber Podcast, Michael Mauboussin discusses modern value investing, emphasizing the importance of buying assets for less than their intrinsic value while considering the expectations priced into stocks. He stresses flexibility in identifying opportunities and the challenge for value investors in recognizing unexpected growth. … Read More

Bruce Berkowitz: Avoid Deals with Bad People, Even in Promising Investments

During his recent interview on The Business Brew Podcast, Bruce Berkowitz emphasizes the importance of evaluating both the numbers and the people involved in an investment. Initially, he focused on the financials but later recognized the significance of assessing the management, culture, and ownership of a business. He stresses that … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

John Rogers: A Market Correction Is Coming Soon

During the recent Barron’s Roundtable, John Rogers expressed his concern that the current technology-driven market rally, led by AI companies, may be nearing its peak, drawing parallels to the dot-com era. He acknowledges that while today’s market leaders have solid businesses, they are highly overvalued. The gap between large-cap growth … Read More

Mohnish Pabrai: From $5,000 to $5 Million: A Simple Lesson for Exponential Financial Growth

During this session with YPO Delhi, Mohnish Pabrai explains the concept of compounding to his daughter during a late-night drive. He uses her summer internship savings of $5,000 as an example, explaining how investing it in an IRA with a 15% annual return could grow to $5 million by the … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Here’s Why I Don’t Invest In AI Companies

During this interview with Yicai Global, Howard Marks emphasizes his expertise in debt over stocks and admits he is not a technology expert. He recalls the Internet bubble, noting that while the Internet did change the world, most tech stocks from that era became worthless. He draws a parallel with … Read More

Jeremy Grantham: This Is The Most Vulnerable Market There Has Ever Been!

During his recent interview with The Investor’s Podcast, Jeremy Grantham discusses the dangers of market bubbles, highlighting Japan’s 1989 bubble where the market traded at 65 times earnings, far beyond its historical norm. He emphasizes that high price-to-earnings (P/E) ratios often predict severe downturns rather than prosperity, citing Japan’s lost … Read More