One of our favorite investors at The Acquirer’s Multiple is David Einhorn. One of the best Einhorn interviews was one he did with Value Investor Insight in which he discussed his investing strategy, how he modified the traditional value investing process to achieve outperformance, and the one rule of investing … Read More

Joel Greenblatt – Individual Investors Can Beat Professional Investors, Here’s How

A lot of individual investors mistakenly believe that it’s impossible to beat the results achieved by professional investors. This could not be further from the truth according to Joel Greenblatt in his great investing book – The Big Secret for the Small Investor. Greenblatt illustrates how small investors can outperform … Read More

Warren Buffett – The Only Score That Counts In Investing Is Your Internal Scorecard

One of our favorite investing books here at The Acquirer’s Multiple is – The Snowball: Warren Buffett and the Business of Life, by Alice Schroeder. Schroeder recounts a time in the late ninety’s when Buffett was being humiliated by some of the leading financial commentators of the time and Berkshire’s … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning December 11th, 2017” on Storify]

Cliff Asness (AQR) – New Paper Indicates Deep Value Trading Strategies Generate Excess Returns Not Explained By Traditional Risk Factors

Late last month Cliff Asness and his team at AQR released a paper titled – Deep Value. In summary, the research indicates that deep value trading strategies generate excess returns not explained by traditional risk factors. Here’s a summary from the paper: We define “deep value” as episodes where the … Read More

This Week’s Best Investing Reads

Here is a list of this week’s best investing reads: Prosperity is a State of Mind (A Wealth of Common Sense) Countering The Narrative About Value (Fortune Financial) Two Sides of the Same Coin (The Irrelevant Investor) The Case of the Bankerless Bubble (The Reformed Broker) It’s Time To Get Real With Your Investment Portfolio (The Felder Report) … Read More

Tobias’ Interview With Equity Mates – Chatting About His New Book – The Acquirer’s Multiple

Earlier this week Tobias did a great interview with the team at Equity Mates to chat about his new book – The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market. Simply click on the play button below to listen to the interview: The Acquirer’s Multiple: How the … Read More

Michael Burry – Don’t Be Seduced By Too-Good-To-Be-True Higher Yield Investments

One of the best investing resources are Michael Burry’s MSN 2000/2001 Strategy Lab articles where he provides some great insights into his investing strategy. Value investor Burry was the founder of the hedge fund Scion Capital, and he was one of the first investors to recognize and profit from the subprime mortgage … Read More

Damodaran, Fisher & Steinhardt On Successful Contrarian Investing

While a lot has been written about the importance of going against the herd in order to be a successful investor, it’s important to remember what a couple of very successful investors and one finance professor had to say on the subject. A long time ago, famous value investor Philip … Read More

Stanley Druckenmiller – If You Invest In Conventional Wisdom You’re Going To Lose Your Butt

Here’s a great interview with Stanley Druckenmiller at the USC Marshall School of Business where he speaks about the importance of unconventional investing. During the interview he makes two great points. First, he’s not a fan of diversification, and secondly investors need to focus on the longer term saying, “The present is … Read More

Seth Klarman – It Is Crucial To Have, And Maintain, A Sound Process

Here’s a great article at the The Outstanding Investor Digest that includes comments and answers from Seth Klarman at a symposium entitled “Celebrating 75 Years of Security Analysis”. During the symposium Klarman provided a number of valuable investing insights and honored the legacy of Graham and Dodd saying, “Graham and Dodd teach … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning December 4th, 2017” on Storify]

Tobias’ Interview With KYR Radio – Chatting About His New Book – The Acquirer’s Multiple

Earlier this month Tobias did a great interview with Zach Abraham at KYR Radio to chat about his new book – The Acquirer’s Multiple. Simply click on the play button below to listen to the interview: The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market provides … Read More

This Week’s Best Investing Reads

Here is a list of this week’s best investing reads: Expert Judgment Or Lack Thereof (A Wealth of Common Sense) This is Not Normal (The Irrelevant Investor) It just got real (The Reformed Broker) Great Products vs. Great Businesses (Collaborative Fund) Tobias Carlisle Chats About His New Book – The Acquirer’s Multiple (KYR Radio) The Code of Hammurabi: The … Read More

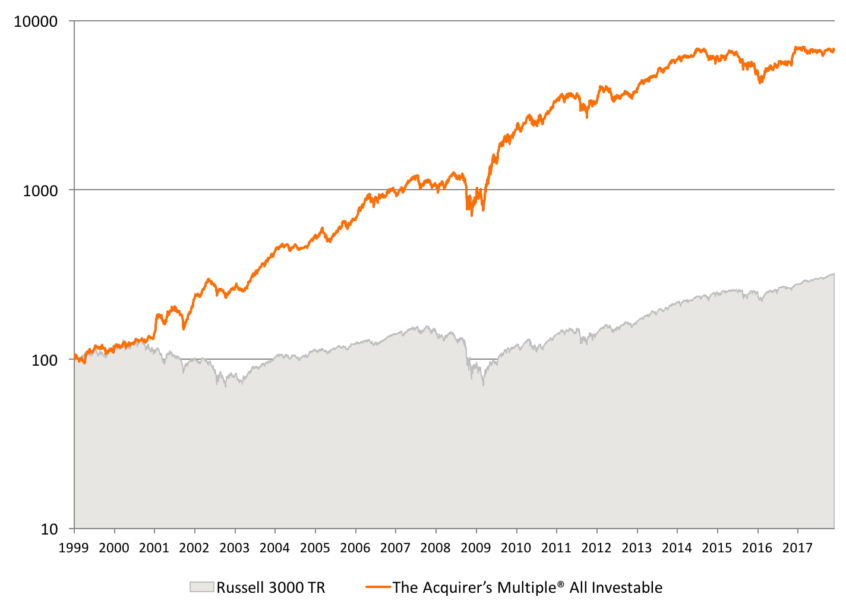

Acquirer’s Multiple Screens – Updated Backtest Results – November 2017

We’ve just completed the updates to our backtest results for all of our Acquirer’s Multiple screens. Following is a summary of the results for our three major U.S. Stock Screens – The Large Cap, The All Investable, and The Small & Micro-Cap Screen. Since the last update in July 26, … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning November 27th, 2017” on Storify]

Pitching Gilead $GILD from the large cap screen on The Investor’s Podcast

Back-to-back on The Investor’s Podcast with Stig and Preston talking about large cap screener stock Gilead GILD and my new book, The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market out now on Kindle and paperback.

This Week’s Best Investing Reads

Here is a list of this week’s best investing reads: Being in Control of Your Own Time (A Wealth of Common Sense) Q&A with Tom Jacobs editor of Fortunes in Special Situations in the Stock Market: The Authorized Edition (Abnormal Returns) A Little Knowledge is Dangerous (Of Dollars And Data) Spin Gold From Spinoffs: A … Read More

George Soros – I Would Rather Call Myself An Insecurity Analyst

One of our favorite investors here at The Acquirer’s Multiple is George Soros and one of my favorite Soros books is Soros on Soros: Staying Ahead of The Curve. The book interweaves financial theory and personal reminiscence, political analysis and moral reflection to offer a compelling portrait of the world (and its … Read More

Interview with Stig and Preston on The Investor’s Podcast

It was great to be back on The Investor’s Podcast with Stig and Preston talking about the market and my new book, The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market out now on Kindle and paperback.