Here is Nassim Nicholas Taleb being interviewed about his book Skin in the Game, by author and journalist Katrine Marçal. He explains the concepts of Skin in the Game and Soul in the Game. He also talks about rationality and honour. Taleb is not a fan of economists Paul Krugman, … Read More

How Should We Calculate The Cost Of Capital?

https://www.youtube.com/watch?v=AfnMHXGnqQg?start=520 During his recent interview with Tobias, Michael Mauboussin, the Director of Research at Blue Mountain Capital Management, discusses how we should consider calculating the cost of capital. Here’s an excerpt from that interview: Tobias Carlisle: There’s a few questions that fall out of that for me. When you’re thinking … Read More

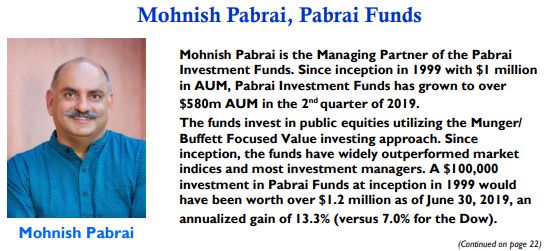

Mohnish Pabrai: At The Core, Investing Is Straightforward. It’s Simple, But It’s Not Easy

In the latest edition of the Graham & Doddsville Newsletter, there’s a great interview with Mohnish Pabrai in which he discusses his investing philosophy saying: “At the core, investing is straightforward. It’s simple, but it’s not easy.” Here’s an excerpt for that interview: G&D: Can you talk in more detail … Read More

The 3 Most Powerful Ideas From Expectations Investing

https://www.youtube.com/watch?v=AfnMHXGnqQg?start=77 During his recent interview with Tobias, Michael Mauboussin, the Director of Research at Blue Mountain Capital Management, discusses the three most powerful ideas from Expectations Investing. Here’s an excerpt from the interview: Tobias Carlisle: So much the better for chatting with you right now. I can’t tell you how … Read More

GMO: Are We Witnessing The Best Opportunity Set For Value Investors In The Past 20 Years

GMO recently released its Q3 2019 quarterly letter titled – Shades of 2000, which reports that value investors could be seeing the best opportunity set in the past 20 years. Here’s an excerpt from the letter: The years leading up to the 2000 stock market bubble were extraordinary and unprecedented. … Read More

(Ep.32) The Acquirers Podcast: Michael Mauboussin – Big Decisions, Luck, Skill, Complexity And Success In Investing

Summary In this episode of The Acquirer’s Podcast Tobias chats with Michael Mauboussin. He’s the Director of Research at Blue Mountain Capital Management. He’s been an adjunct professor at Columbia for more than 25 years, earning multiple awards for doing so. He’s the Chair of the board of trustees of the Santa Fe … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Watsa, Gabelli Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Articles, Research, Podcasts 10/11/2019

Here’s a list of this week’s best investing reads: Recession is Coming, “Code Red” Yield Curve Indicator Seals the Deal (The Reformed Broker) Unified American Discourse (The Irrelevant Investor) Would the Market Care if the President Was Impeached? (A Wealth of Common Sense) Three Big Things: The Most Important Forces Shaping the World … Read More

Howard Marks: Q2 2019 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Morgan Housel: Three Big Things – The Most Important Forces Shaping the World

Here’s a great new paper by Morgan Housel at The Collaborative Fund titled – Three Big Things – The Most Important Forces Shaping the World, which discusses the three ‘Big Things’ that will have a profound impact on coming decades because they’re both transformational and ubiquitous. Here’s an excerpt from … Read More

The Low Volatility Anomaly – Low-Volatility Stocks Have Higher Returns Than High-Volatility Stocks

https://www.youtube.com/watch?v=rUHqdIH56lU?start=2714 During his recent interview with Tobias, Lawrence Hamtil, Principal and author at Fortune Financial Advisors, discusses the low volatility anomaly – why low-volatility stocks have higher returns than high-volatility stocks, and how investors can take advantage of that. Here’s an excerpt from the interview: Tobias Carlisle: You raised it … Read More

Joel Greenblatt: How To Apply Value Investing In An Overvalued Market

The WSJ recently wrote an article titled – A Value Investor Defends Value Investing (Despite Its Recent Track Record), which includes a short interview with Joel Greenblatt. Greenblatt discusses his definition of value investing, whether there’s a secret sauce to the strategy, how to apply it in an overvalued market, and … Read More

Michael Mauboussin: 5 Ways That Investors Can Effectively Take Advantage Of Behavioral Inefficiencies

In Michael Mauboussin’s great research paper titled – Who Is On The Other Side, he provides five key insights into how investors can effectively take advantage of behavioral inefficiencies, which he listed as: Be Mindful Of Sentiment And Overextrapolation Rely On Valuation Lean On Facts Timing Or, Listen To Benjamin … Read More

Mid-Cap Stocks Sit In The Sweet Spot Of The Markets

https://www.youtube.com/watch?v=rUHqdIH56lU?start=1706 During his recent interview with Tobias, Lawrence Hamtil, Principal and author at Fortune Financial Advisors, discusses why mid-cap stocks are better performers and rebound more quickly than other sectors. Here’s an excerpt from the interview: Tobias Carlisle: One of the interesting things for me that came out of that … Read More

Daniel Kahneman: The Illusion Of Understanding – Just How Lucky Were The Founders Of Google

Here’s a great passage from Daniel Kahneman’s book – Thinking Fast and Slow, in which he discusses the ‘Illusion of Understanding’, illustrated by the role that luck had on the founders of Google saying: The trader-philosopher-statistician Nassim Taleb could also be considered a psychologist. In The Black Swan, Taleb introduced … Read More

The Sin Premium – Sin Stocks Can Be Very Profitable

https://www.youtube.com/watch?v=rUHqdIH56lU?start=2107 During his recent interview with Tobias, Lawrence Hamtil, Principal and author at Fortune Financial Advisors, discussed the ‘Sin Premium’ and how sin stocks can be very profitable. Here’s an excerpt from the interview: Tobias Carlisle: And one of the things that I’ve seen you speak about or tweet about … Read More

(Ep.31) The Acquirers Podcast: Lawrence Hamtil – Sector Bets In Value, Size, And International Stocks

Summary In this episode of The Acquirer’s Podcast Tobias chats with Lawrence Hamtil. Lawrence is a Principal and author at Fortune Financial Advisors which offers independent financial planning and wealth management services. During the interview Lawrence provided some great insights into: Why Investors Will Achieve Better Results By Focusing On Sectors, … Read More

TAM Stock Screener – Stocks Appearing in Marks, Greenblatt, Soros Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Articles, Research, Podcasts 10/4/2019

Here’s a list of this week’s best investing reads: The 2019 S&P 500 Sector Quilt (A Wealth of Common Sense) WeWork Lessons That Apply To Lots of Stuff (Collaborative Fund) Externalities: Why We Can Never Do “One Thing” (Farnam Street) ‘Performance Chasing’—and Why It Can Be Perilous for Your Portfolio (Fortune) At What … Read More

Warren Buffett: The Price Of A Stock Doesn’t Tell You Anything About The Business

Here is Adam Smith, author of Supermoney, interviewing Warren Buffett back in 1985. Smith asks Buffett: “What do you do that’s different than ninety percent of the money managers who are in the market?” Here’s Buffett’s response: “Certainly most of the professional investors focus on what the stock is likely … Read More