This week’s best investing news:

In Conversation with Howard Marks (Edinburgh University Private Equity Society)

A 5 million percent return in 60 years leaves Warren Buffett’s legacy unmatched (CNBC)

Tom Russo – Goal for Berkshire Hathaway will be to continue as if Warren Buffett never left (CNBC)

Warren Buffett marks his final day as Berkshire Hathaway CEO — will remain chair (CNBC)

John Rogers – The Patient Investor (Ariel)

David Katz, CIO at Matrix Asset Advisors, discusses the markets and where to look for value (CNBC)

The Biggest Risk in 2026 (Carlson)

James Clear: How to Build Good Habits & Break Bad Ones (Farnam)

Real vs. Imaginary Returns – Part I (HD)

It’s not bearish when the stock market’s leaders fall behind (TKer)

Pray for Beta, Not Alpha (D&D)

One in a Quadrillion (F&F)

MiB: Jay Leno, Live Audrain Newport Concours & Motor Week (MiB)

This week’s best value investing news:

How Jeremy Grantham Nearly Lost It All and Became a Value Investor (Barron’s)

Stockwatch: is value investing the best strategy in 2026? (Interactive Investor)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Top 5 of 2025: #1: Howard Marks (CA)

Pierre Poilievre on the Role of Government, Freedom, and Affordability (Parrish)

Jeff Gonyo: The Rise of the ‘Sell and Stay’ M&A Model (Barron’s)

Annanay Kapila – Perpetual Futures Everywhere and All the Time (S7E24) (FWM)

Best of The Long View 2025: Financial Planning and Retirement (LV)

Jimmy Soni — The Publishing System is Broken (EP. 295) (IL)

Nick Kokonas – Know What You Are Selling (ILTB)

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Unlocking Liquidity: The Case for Securitized Private Credit Markets (AAA)

Taming the Anomaly Zoo: How Macroeconomic Forces Shape Market Returns (Swedroe)

Top 10 Blogs of 2025: Insights on Market Cycles and Financial History (CFA)

This week’s best investing tweet:

The S&P 500 has outperformed the S&P 500 Equal Weight Index by 34% over the past 3 years, the widest 3-year performance gap in history. The prior record was 32% outperformance from 1997-1999 which was followed by a sharp reversal and 7 years of Equal Weight outperformance. pic.twitter.com/LkN7cDVcRj

— Charlie Bilello (@charliebilello) January 1, 2026

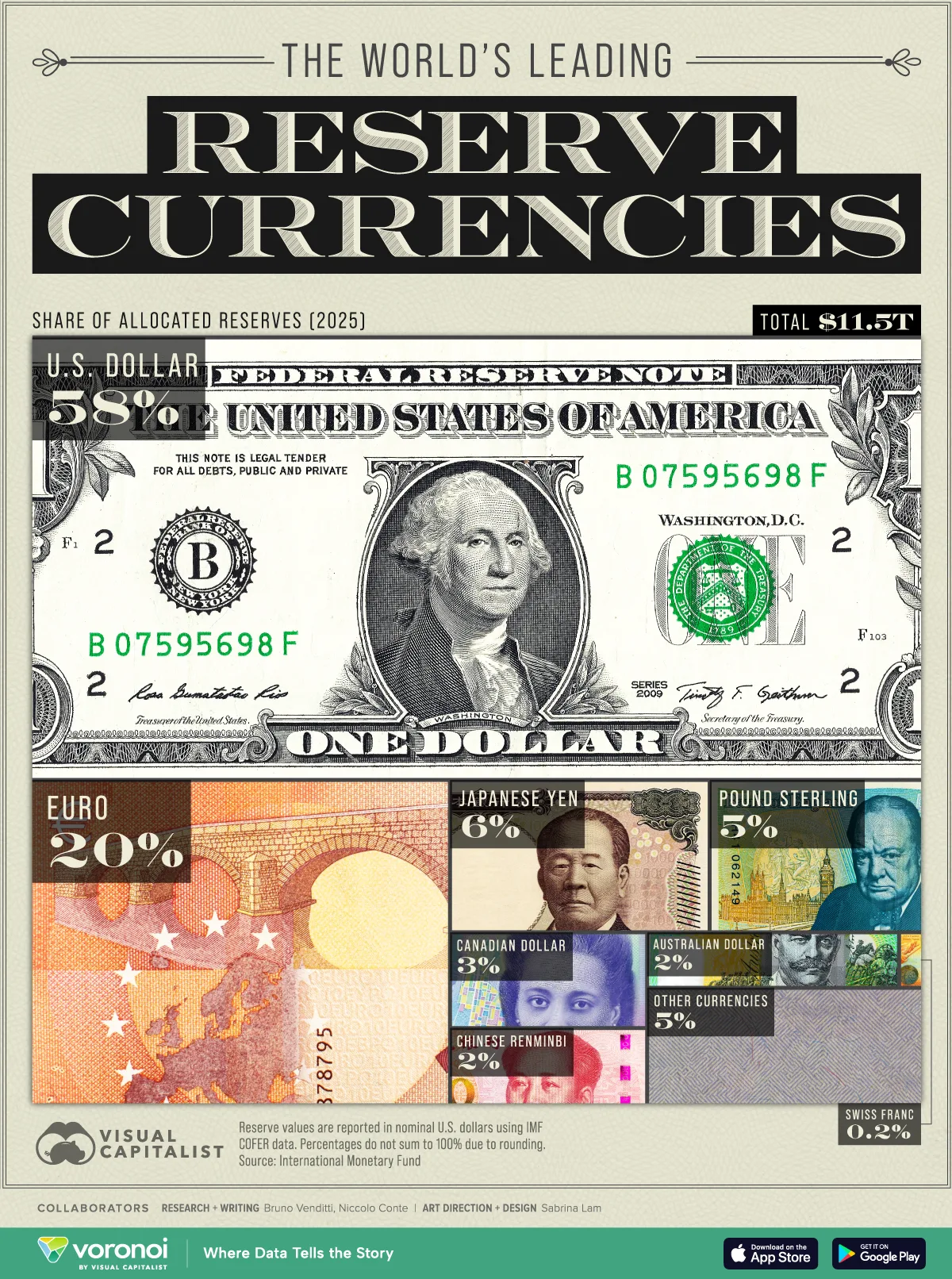

This week’s best investing graphic:

Ranked: The World’s Most Powerful Reserve Currencies (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: