As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s possibly a deeply undervalued gem.

The Stock this week is:

Hafnia Ltd (HAFN)

Hafnia Ltd is a leading global product tanker company engaged in the transportation of refined oil products, including gasoline, diesel, and jet fuel. The company operates a large and modern fleet of vessels, providing shipping services for major oil companies and traders worldwide. Hafnia benefits from a diversified customer base, strong industry positioning, and a disciplined capital allocation strategy.

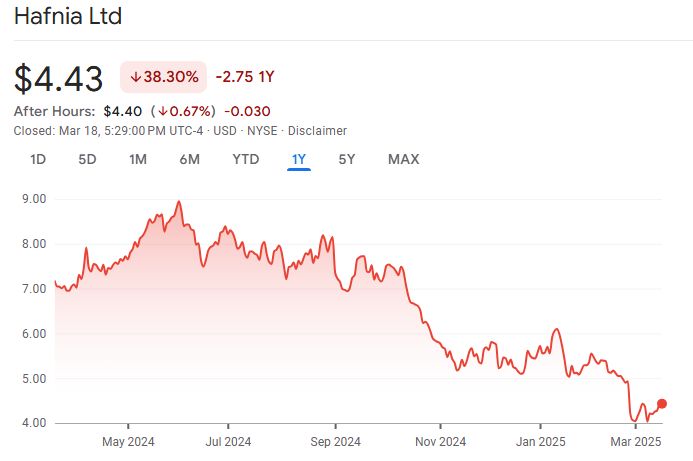

A quick look at the share price history (below) over the past twelve months shows that the price is down 38.30%.

Source: Google Finance

One of the metrics we use in our screens is IV/P (Intrinsic Value to Price). Let us simplify what it means:

IV/P (Intrinsic Value to Price) tells you if a stock is a good deal or not based on how much value you’re getting for the price you pay.

The Calculation:

It adds up the stock’s ability to make money (Earning Power), grow (Incremental Growth), and pay back investors (Shareholder Yield). This gives you an idea of what the stock is really worth, called its Implied Value.

The Meaning of IV/P:

- If IV/P is greater than 1, it means you’re getting more value than you’re paying for. For example, for every $1 you invest, you’re getting more than $1 of value. That’s a good deal!

- If IV/P is less than 1, it means you’re getting less value than you’re paying for. For example, for every $1 you invest, you’re getting less than $1 of value. That might not be a great deal.

What It’s Used For:

- It’s a quick way to spot undervalued stocks (good deals).

- If IV/P is very low, like 0.6, it means you’re only getting 60 cents of value for every $1 invested, which suggests the stock may be overpriced.

We currently have an IV/P of 3.00 for Hafnia Ltd, which means the stock’s Implied Value is calculated to be 3 times greater than its current price. In simpler terms:

For every $1 you invest, you’re potentially getting $3.00 of value.

This suggests that Hafnia Ltd may be undervalued, presenting an attractive opportunity for value investors.

Possible Reasons for This Undervaluation:

Shipping Market Cycles and Volatility – The tanker industry is highly cyclical, with rates fluctuating based on global demand for refined oil products. While the stock price has fallen significantly, the fundamentals remain strong, and the business model is built to withstand volatility.

Market Perception and Sentiment – Shipping stocks are often overlooked by generalist investors due to their cyclical nature. Hafnia’s strong Free Cash Flow Yield (41.71%) suggests that despite recent price declines, it continues to generate robust cash flow, which should support future earnings.

Dividend and Shareholder Returns – Hafnia has an exceptionally high Shareholder Yield of 33.10%, signaling strong returns to investors through buybacks and dividends. Investors may be underestimating the sustainability of its dividend policy and capital returns.

Conclusion:

With an IV/P of 3.00, Hafnia Ltd appears to be trading at a deep discount relative to its intrinsic value. The company’s strong free cash flow, high shareholder yield, and disciplined capital management make it a compelling stock for value investors looking for opportunities in the shipping sector. While market volatility is a factor, Hafnia’s fundamentals suggest significant upside potential if investor sentiment shifts toward recognizing its true value.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: