This week’s best investing news:

How Oaktree’s Howard Marks Spots a Market Bubble (Bloomberg)

Ray Dalio | The All-In Interview (All In)

Cathie Wood on DeepSeek, Nvidia, Stock Picks, China, AI (Bloomberg)

Cliff Asness: Quant Investing, Market Inefficiency (Insightful Investor)

Explaining International Valuations (Verdad)

Ten Top Wide Moat Stocks (Validea)

Nvidia Selloff: Nassim Taleb, Black Swan Author, Says Rout ‘Is the Beginning’ (Bloomberg)

Valuation Metrics In Emerging Debt: 4Q24 (GMO)

Do You Need to Own International Stocks? (Dollars & Data)

The Psychology of Investing #7: The Hidden Cost of Ownership (Safal)

Maybe the only chart you need to understand 2025 (Josh Brown)

The Case For Passive Investing May Have Never Been More Precarious (Felder)

Endurance and Excellence in Money Management with Four Exceptional and Underrated Investors (BT)

Why your portfolio is less diversified than you might think (Economist)

J. Paul Getty’s Rules for Investors (Novel)

DeepSeek FAQ (Stratechery)

The Patient Investor: A Philosophy of Building Things That Last (Building Things)

Big Tech’s Deteriorating Earnings Quality (MBI)

Why Markets Exploit Narratives (Stef)

MiB: Mike Freno, Barings Chairman and CEO (MiB)

Superstar investor David Giroux on why stock market valuations are scary (WealthTrack)

Q&A at RV Capital’s 2025 Annual Gathering (RV)

Pzena Investment Management Q4 2024 Commentary: Living in a Concentrated World (Pzena)

Mairs & Power Growth Fund Q4 2024 Commentary (M&P)

This week’s best value investing news:

How value investing is making a comeback, according to Chris Davis (Value Research)

Fund manager profile: Man Group’s Jack Barrat on rewriting the script on value (PA)

Charlie Munger’s Three Investment Lessons (Benzinga)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Timeless Lessons from History’s Best Traders | Jack Schwager (ExcessReturns)

Finding Value in an Upside-down World (Hidden Forces)

Why Inflation Still Poses a Risk to Stocks and Bonds in 2025 (Morningstar)

BofA’s Savita Subramanian on The New S&P 500: AI-Driven and Asset-Light (Meb Faber)

Leading Portfolio Strategist Jason Trennert Predicts the Major Investment Themes for 2025 (WealthTrack)

Why AI Is Good for Humans (with Reid Hoffman) (EconTalk)

Blake Hall – Combat, Service, and Innovation (ILTB)

Mitchell Green – Lead Edge of Harnessing Networks (Capital Allocators)

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

The Impact of Impact Investing (AlphaArchitect)

Counterparty Risk (AllAboutAlpha)

For the Investment Professional: The Mindset Shift that Changes Everything (CFA)

High Beta Vs. Low Volatility Large Caps: Largest Divergence Since GFC (PAL)

This week’s best investing tweet:

Just ran this. Wow. The Mag 7 were ~60% of the S&P 500’s 29% return over the past 3 years, despite losing 40% in 2022. They were ~15.6% of sales growth and an INCREDIBLE ~106% of net income growth. Yes, the 493 in the S&P ex the Mag 7 experienced an outright decline in earnings.

— Christopher Bloomstran (@ChrisBloomstran) January 24, 2025

This week’s best investing graphic:

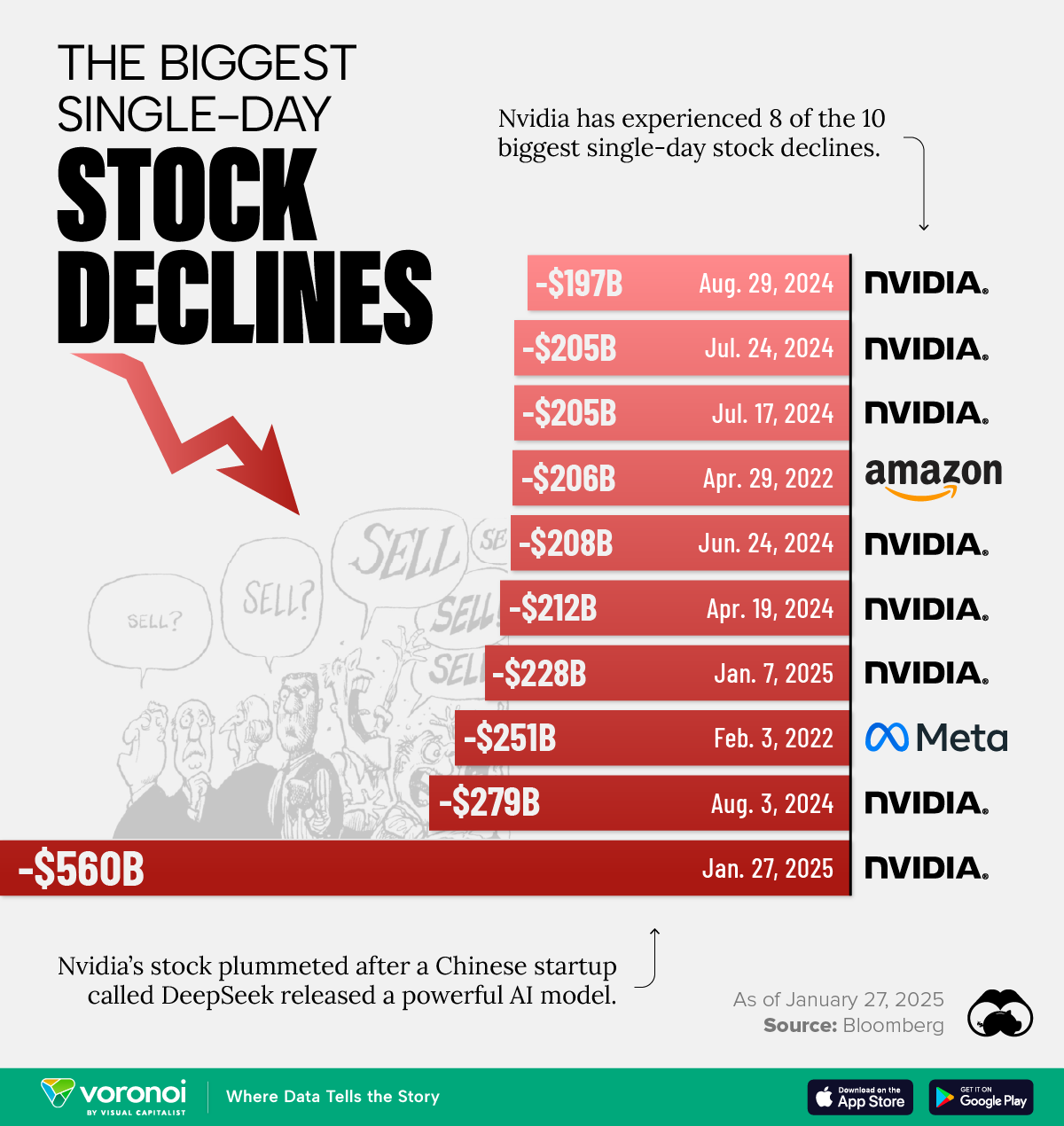

Nvidia Loses Record-Setting $560B of Market Cap, Thanks to DeepSeek (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: