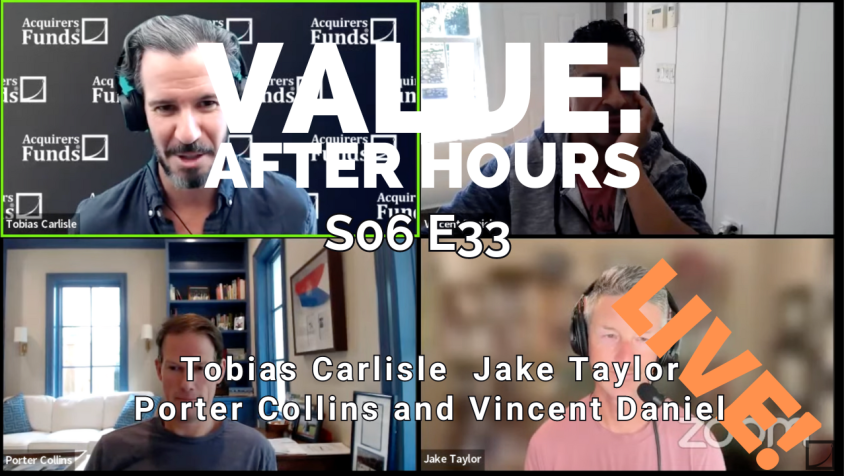

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, Vincent Daniel, and Porter Collins discuss:

- A Real-Life Paul Volcker Story and Its Impact on Banking

- Gold Is Acting More Like a Growth Stock Than a Value Investment

- How the Shift to Short-Term Trading Impacts Value Investors

- The Unpopular Stands of Wilberforce and Volcker That Changed History

- The Hidden Recession Indicators Beyond the Surface-Level Market Trends

- Hunting for Value in Energy, China, and Emerging Markets

- Cannabis, Gold, and Playing the US Debt Growth Market

- Neither Party Is Addressing the Real Debt Crisis

- Investment Opportunities in the Housing Sector Beyond Homebuilders

- The Limitations of Traditional Economic Surveys and the Case for Better Data

- Could a Return to 1970s Inflation Dynamics Happen Again?

- Social Media Distorts Political Reality and Live Debates Are Crucial

- Home Prices May Remain Flat Despite Rate Changes and Economic Activity

- Growth Stocks at Value Prices – When Will the Time Be Right?

- Google’s Cheap, But We Sold – Here’s Why We’re Cautious

- 2007 vs. Now: Recession Fears and Market Health

You can find out more about the VALUE: After Hours Podcast here – VALUE: After Hours Podcast. You can also listen to the podcast on your favorite podcast platforms here:

Transcript

Tobias: This meeting is being livestreamed, which means its Value: After Hours. I’m Tobias Carlisle, joined as always by my co-host, Jake Taylor. Our very special guest today, repeat guests, the Seawolf guys, Vincent Daniel and Porter Collins. How are you, gentlemen?

Porter: Great to be here as always.

Vincent: Thanks for having us. We love this podcast.

Tobias: Well, that’s very kind. Thanks for coming back. We love having you on.

Porter: We’re headed back to California. We’re the first time we met a couple years ago.

Tobias: Nice.

Jake: That’s right.

Tobias: I thought Jake had a good question before he came on, so maybe he should lead off.

Jake: Now, I don’t remember what I said. [laughs]

Tobias: Yeah, you thought that– Yeah.

Jake: I’m just joking. Yeah, so, I was just lamenting a little bit that I personally feel like the market’s a little bit boring lately. This could just be my own biases. But my question was, one, do you guys feel the same way? And two, if so, is there anything rhyme or feel like 2007 felt when you guys were operating at that time?

Porter: Vin, why don’t you go ahead first?

===

2007 vs. Now: Recession Fears and Market Health

Vincent: Sure. So, the first thing that came in my head was relative to 2007, the answer is no. It doesn’t feel that way. Mainly because if we just rewind the clock and go back, what Porter and I were doing at that time was analyzing bank statements, more importantly securitization statements. We were seeing the delinquencies on a remittance data monthly basis pile up. It was far worse than what we are seeing right now.

Porter: We also did a lot of due diligence trips.

Vincent: Correct. We did a ton of due diligence trips. There was a lot more anxiety about what we thought was about to happen. Mainly, a function of fact is that we felt that there was a good chance that we were going to go into a severe recession. We were joking around the last few days, and maybe we were just so jaded by how bad it was in 2007 that it just doesn’t feel that way right now at all.

One of the things, the gauges we look at to determine health and whether we’re going to a recession is wholesale funded markets. Essentially, do people have the ability to take consumer loans, package them up, securitize them that whole market? Right now, that market is wide open. Spreads are tight, things are moving. In all the recessions that we have lived through, at some point that market just shuts down completely. Now, maybe that will happen over the next month or two. We shall see, but for now, that’s not going– [crosstalk]

Porter: If you’ll remember, Vinnie, last time that happened was when?

Vincent: 2018. Actually, I take it back. The last time that happened was during COVID, but that’s not really fair. But prior to COVID, it was 2018 of December, the high yield markets and everything else were frozen solid. And so, nothing was moving. Lo and behold, Powell came out and had to do a pivot within days to make sure those markets were opening. There’s no such thing right now. And so, our view is like–

Yeah, it’s very clear that there’s some form of a slowdown that has been happening over the last call it a year. Nominal GDP has slowed down over the last year. Are we seeing the calamity that as you asked that we thought we were seeing and we eventually did see in 2007? The answer is no.

Porter: We’ve been saying for a while that our book is almost exclusively idiosyncratic ideas. There’s not a real macro theme to our book. We went on to CNBC, and we’ve been joking around that we had this make volatility great again. [Jake laughs] It’s mostly about Trump and the election. No one’s going to do anything here in front of the election. CEOs are frozen. They don’t know which policy is going to come. Rates are on the cusp of being cut. So, if you’re a borrower, you’re not going to take out debt now if you think that borrowing costs are going to come down over the next two, three, four, six months.

So, I think everyone is just saying, “Okay, I’m going to wait and see.” Consumers are obviously still spending maybe on the margin it’s less. They’re not buying as many yoga pants. They’re not buying as many Tesla cars. They’re not buying as many– that kind of stuff.

Tobias: They’re going to get the iPhone 16.

Porter: Not getting the iPhone 16. I’m getting a new Apple Watch though.

Jake: So, everyone’s basically checking it for the turn to want to see the next card.

Vincent: Yeah.

Porter: Yeah. So, the growth has slowed. And so, what I think we’re trying to do is find idiosyncratic, either growth ideas or busted value where it’s bombed out or stuff that really jumps out the page to us. There’s not a lot of stuff that jumps out on the page to us.

===

Cannabis, Gold, and Playing the US Debt Growth Market

Porter: One of the things that we’re going to California to see is a company called Glass House. They have their investor day in California. We think the cannabis trade has actually changed a lot, because one of the things actually made me happiest, is that Trump at one time against it. But he’s not against it. And so, it turned an issue, which was an election issue. If Trump was in the polls, it’d be going down. Kamala was in the polls, it’d be going up. And so, we’ve wiped that clean. And so, we think it’s one of the best little growth stories we see right now.

You have the optionality when they de-schedule it or reschedule cannabis, which we think is an inevitability at this point. And so, that’s an idea we have. We talk about growth ideas. The biggest growth market in this country is US debt. That’s our biggest position on the books. It has been, and still is gold and gold derivatives. That’s an embarrassingly high percentage of our portfolio. Thats just not going to slow down. If you believe were in a slowdown, that debt sure isn’t slowing down.

Tobias: Is there thesis that it’s the other side of inflation, it’s a way to play inflation?

Porter: No.

Vincent: No. It’s a way to play government excesses and excess fiscal deficits and the like. To us, gold is really the report card on sovereign financing and monetary policy. As a result, the reason why we’ve probably been permeable on gold is because for the last several years, our government and other government have not had a need, desire, willingness, whatever you want to say, to even come remotely close to even thinking about getting to a balanced budget. They’re not even thinking about getting there

Jake: It’s ridiculous.

Vincent: So, as a result, we got, for the most part, sick and tired of punching our heads against the wall trying to short this stupidity, because the market has spoken. They don’t care. Maybe one day they will, but they don’t. So, one of the reasons why I don’t think they care is because we all seem to accept monetary debasement as an accepted fact that this is the way you solve the problem. So, what do you own in a monetary debasement? Value idiots like us own gold. Smarter people own Nvidia and Mag Seven.

Jake: [laughs]

Porter: Just think about it right now, is that no one owns the 10-year treasury. Look at Warren Buffett. He owns $250 billion of the two-year treasury. And that now is only yielding him 3.6%. The R between gold, which doesn’t have a yield, and the 3.6%, we’ve narrowed that now. And so, I continue to think that if you look at the treasury, we’re issuing, let’s say, a trillion dollars every 100 days. So, by the time you get to next election, we’re staring $50 trillion of debt in the face.

Jake: At some point, that’s got to add up, right?

Tobias: A trillion here, a trillion there.

Porter: And so, that’s the way we look at it. And so, that’s why we are comfortable owning so much gold and gold derivatives. And–

Jake: Are you guys surprised, it’s only $2,400, $2,500 an ounce at this point with all of the profligate spending that we’ve seen?

Porter: I have here a gold coin in my– [Jake chuckles] That’s 1-ounce Canadian gold coin.

Vincent: I got my– [crosstalk]

Porter: $2,500 is a lot for this thing. [chuckles]

===

Gold Is Acting More Like a Growth Stock Than a Value Investment

Vincent: I think it’s something– When you invest in something like gold, you know you’re against the world or a good portion of the world. So, I’m not calling conspiracy. But clearly, there’s another side that does not want to see that go up. So, you’re fighting against the grain. So, I’m not terribly surprised it doesn’t roof. I think what’s interesting, and knock on wood when I say this, gold has had a pretty decent run.

I felt like it was getting to an overbought phase, like a near term overbought phase. I’m always interested and it’s like, “Okay, how is this going to resolve itself? Is it going to resolve itself the way growth companies resolve itself, which it stays flat for a week, maybe two weeks, and then just starts ripping up again and resolve its overbought conditions, or is it going to resolve itself like a value name which has to drop 25%, 30%,-

[laughter]Vincent: -hang there for a little bit, and then go back up?” And so far… , it’s so good, that it’s resolving itself more like something that’s in favor that has flows coming into it rather than some of the stuff that we usually traffic in. All of us, not just Porter– So, yeah.

===

Hunting for Value in Energy, China, and Emerging Markets

Porter: And then, we go through our– You think about boring, okay? So, what do we do when we’re bored? We go to our Acquirer’s Multiple screens, and we [Jake laughs] start messing around like what looks attractive. Sadly, the same crap that’s been there for two years now is still there. I’ll do the buckets for you, China, EM, autos, shipping. Am I missing anything, Vinnie?

Vincent: Some energy now.

Tobias: Yeah. Energy, I should say.

Vincent: The energy estimates are probably off. They need to be lowered.

Porter: We say like of that, and we keep trying to see when the bottom of China is in, but it intrigues us a lot. We are value people, and so you look at the value multiples and you salivate in EM. But obviously in EM, you got to pick your jurisdictions. That’s why when we own gold miners, we own an Eagle Mines, which is basically just Canadian mines. We don’t have to deal with Mexico, Africa, whatever drilling. That’s the stuff that you think about. China is obviously a communist nation, and so it’s nerve-wracking buying China. So, we’ve dabbled in and out and we have no position now. But we look at it. Obviously, Brazil is one that a lot of people like and that we’ve tended to like over the years. So, we’re doing hunting there.

And then, in terms of commodities, we look– Look at oil right now. We’re speaking on Tuesday, midday. Oil’s down 4% today. I have no idea why it was trading at 66 bucks. I couldn’t tell you if the next 5% or 10% move is up or down. There’s always some OPEC question marks. There are demand question marks. But if we go to the thing that the energy piece that we love most is uranium, and you look at the supply demand, and you can talk to your blue in the face that demand outstrips supply by a fairly wide margin. We feel like that.

China announces new reactors every day. The US has restarts. Japanese finally have restarts for the first time since Fukushima. We say, “You know what? I’m willing to own that.” We don’t really love the miners there, so we tend to own the Sprott Physical Uranium Trust. That’s one we just sit on. Here, it’s a call at 15% discount to the spot price. And so, we’re getting it even cheaper. We feel like we can sit there and own that.

So, when you talk about a long-winded way of answering your question, when you think about boring, it is a little boring. There’s not a ton to do. And so, we’re trying to be idiosyncratic. We talked about cannabis, emerging markets, value, energy, uranium. Those are awful topics.

[laughter]Porter: SPACs, geez. So, yeah, I think that’s right.

Jake: Much more of a rifle market than a shotgun market.

===

Google’s Cheap, But We Sold – Here’s Why We’re Cautious

Porter: We don’t google for years, and we finally sold it.

Tobias: What was the reason there? Because it’s cheaper now. I saw somebody tweeted out saying it’s, what, 17 PE? That’s the cheapest it’s been in a decade or more?

Porter: I know.

Vincent: It is. I can’t give you the reason exactly why we sold it. We just felt like it was time to get out and then we’ll see whether that was a good sell or not. So far, it is a good sell, but time will tell. It’s just getting a little worried about the overall exposure of markets, which is probably stupid of me, because some of the things that you see in markets, and we spoke about this in the past, it’s really scary to use this time is different. But what’s different to me is market structure is very different. I talk about it a lot.

Mike Green was onto something and he is onto something, but he thinks about the ETFs and how the flows come in the door. The multi-managers, all they can do is look at large liquid companies, because they’re so levered and they have to net themselves out. And so, as a result, when you see days like today where the markets quote pricing in a recession, but the S&P is flat and Nvidia is up and Microsoft’s up, all of that just says to me is, “I don’t think the market’s speaking to me as much as it is saying this is where the flows are going in. And where the flows are not going in, there’s a buyer strike because there’s a little worry about growth.”

But it really doesn’t have to do with how deep the recession is. It’s just pipes, and structure and how things move. You have to take that into account when you’re setting up a portfolio or thinking about when you add to some of these misfits, because they could always go lower, like a lot lower. Even though they look cheap, they could get a lot cheaper. And so, you have to keep a lot of dry powder, because no one’s on your side when you’re buying a smidcap non-tech, non-growth entity.

Tobias: My whole portfolio.

Porter: [crosstalk] there before you, Vin.

Jake: [laughs]

Vincent: What’s that?

Tobias: That’s my whole portfolio.

Vincent: Yeah. I know I’m preaching to the big choir here, but it’s just something we all have to think and consider when we’re looking at these names. I always say it could go lower, probably going to go a little bit lower. I like it. I really do, or maybe I’ll just nibble at it here. We experienced that in the– while we are probably still experiencing it, I should shut my mouth. In the summer with uranium. The one for us, uranium is the one market where the supply demand equation is really, really good. This year, the markets have told you otherwise, or at least the prices on the screens have told us otherwise.

The first three to five months of it, I got simply because uranium was a screamer last year. But then in the entire summer, I probably think uranium is bid up in the summer, probably 5% to 10% of all the days in the summer. And so, what do you do? To me, you say, “Okay, re-underwrite. Is everything all right? Call your friends who are really deep in the uranium ninjas in the sector and everything was fine.” So, just every once in a while, you just keep nibbling, keep buying, keep nibbling, but you don’t do it really fast, because you know it. It could go lower and go lower and it did.

===

Growth Stocks at Value Prices – When Will the Time Be Right?

Porter: As value guys, I think that we’ve been turning over a lot of rocks trying to see if we can buy what “growth stocks” at a value price. I think that’s a lot of things where hopefully some of these things start to come onto the Acquirer’s Multiple list. “Hey, can I buy a Lululemon at a value multiple?” Or, another good example, is that rate cuts are coming. One sector of the economy that’s done really, really poorly is housing. Homebuilders have done okay, but look at the Home Depot and Lowe’s comps. They’ve been bad. Or, Builders FirstSource, which is a really interesting name. Revenues are down a lot and so.

Okay. Let’s take a look at Home Depot. Home Depot’s PE is 24. It’s a no man’s land. It’s not a growth stock, obviously. It’s not a value name. And so, there’s nothing to do. So, we try to find out when– I’m not waiting for it to come to six times, obviously, but to come into a reasonable valuation point where there’s margin of safety for us to be a little bit wrong and to buy some of this stuff. And so, we’re starting to turn over some rocks, and we do a little work and it’s not there yet, move along. So, you have a catalog of ideas and things you want to look at.

Jake: Vinnie, can I ask you to go back to market structure a little bit? Would it be a gross oversimplification to say that it feels like markets used to be second and third order thinking, and now maybe they’re a little bit more first order thinking?

Vincent: Yeah. I think it flows in where does it go and act accordingly. As a result, sadly, valuation, things that matter to, I think the four of us matter less on a near term basis. Yeah, I think it’s first order effects. And so, we have to do a little bit more harder work to determine– That’s why I always like to say valuation alone is going to get you in trouble. What you really also probably want to do, what we like to do is see some inflection point in fundamental rate of change. And it’s got to be a positive one. Someone’s got to recognize that something is happening that’s a little bit better.

That, or just a super astute management team with a great balance sheet that can take advantage of the cheapness over time. You need all those ingredients for what we like to do to work, which is a lot harder than just walking in and just handing your money, throwing it into something to be said, throwing it in Microsoft and just walking away, calling it a day, which has worked for a long time.

===

How the Shift to Short-Term Trading Impacts Value Investors

Porter: One interesting point that we talked about a lot is that the incremental dollar or trader in the market is the pod, is Citadel and millennium. Those traders are more first order thinkers. They’re not trying to figure out what’s this company worth, what’s the next data point? Because they have it paired. And so, “Well, okay, this company has a positive data point. I’m going to buy it, pair it with something else.” There’s no discussion about what’s the future value of the business, because they’re in it for a trade for 5 minutes, 10 minutes, 60 days.

Jake: You don’t need any moats when you’re only in it for five minutes.

Porter: They’re not digging deep in philosophically thinking about what’s this company worth, because a lot of these companies aren’t worth what people– The private equity is not buying Tesla out for $700 billion, but the company is probably worth, I’ll be generous, 30 times earnings, not 100 times earnings. So, that’s the way the flows and the incremental person trader in the market is not a valuation sensitive person. So, it makes it harder, that’s for sure, to do what we do.

But conversely, it actually makes the upside that so much more, because they’re not actually focusing on that– I don’t think that the end point of value. We say all the time, you have to have a hardened stomach to buy some of this stuff as it keeps going down. Shorting something as it keeps going up is obviously much harder, because it can keep going further than. At least on a value stock, you know where the trough in the well is, like, is it book value? Has this stock historically bottomed at three times revenues? Is it some metric that you can find?

Tobias: No, they go to zero.

Jake: And then, you go right through that. [chuckles]

Porter: Well, they don’t have any debt. Some of these companies shouldn’t go to zero, but yeah.

Jake: That’s right.

===

Tobias: Let me give a quick shoutout and then, JT’s got some veggies for you, guys, and then, I got a question for you when we come back. Nashville, Tennessee. Poland. Tallahassee. Santo Domingo. What’s up? Boysee, Idaho. Thanks for spelling it out. Lausanne, Switzerland. Phani-Bashir, Thailand. Good one from Paul Gooch. Tomball, Texas got me. Chapel Hill. Wyoming. Boing boing, oz. Yup, well familiar with that one. Prague, Czech Republic. Tampa, Florida. [laughs] Good one, but I’m not going to go for that one harder. New Delhi. Jupiter. Mendocino, California. London, UK. Thanks for letting us know. It’s not the one in Texas. Milton Keynes. Porto de Mós. Boston in the house, Valparaiso. Good stuff. Helsinki and Chicago. JT, you want to do your–

Jake: Yeah, you fell for the old Phani-Bashir, huh?

Tobias: I missed one of the–

[laughter]Jake: Okay.

Tobias: I missed Dixon Buts, Idaho. I don’t know if that’s a—

Jake: Oh, okay.

Tobias: Turin, Italy.

===

The Unpopular Stands of Wilberforce and Volcker That Changed History

Jake: All right. So, I have something a little special prepared for knowing that the Seawolf guys were coming on. Of course, we have the first presidential debate this evening. We’re all in the mood to soberly evaluate leadership and principles and policies, I’m sure. Yeah, right, it’s probably just going to be a lot of watching pigs roll around in the mud.

So, I’ve long respected you guys as seeming very principled and willing to speak your minds even if it wasn’t popular. It doesn’t necessarily fit the base rate of finance to be that, as frank as you guys are. So, that’s something that I appreciate and why I wanted to have this segment today.

We’re going to be exploring two other men who had exceptionally strong character. One of them you’ve no doubt heard of, but the other perhaps not. We’ll start with the first mystery man. His name was William Wilberforce. Have you guys heard of his name before?

Vincent and Porter: No.

Jake: So, he was a British crusader against slavery. I should quick give a shoutout to my friend, Russell, who inspired me to research Wilberforce more. So, rewind the clock. It’s Britain, the 1780s. Stuffy shirts, guys wearing wigs. There’s this young, charming and wealthy gentleman named William Wilberforce. He’s landed nobility, the toast of the town. He’s known for his wit and charm. Pension for late night parties and gambling clubs. Maybe a few women of ill repute thrown in for good measure.

He’s the Victorian equivalent of life in the fast lane. He’s this big hit on the social scene, but then something really extraordinary happens. At a very still young age, he undergoes a profound spiritual awakening. He embraces Christianity with a passion that changes the course of his life.

This transformation led him to this shocking realization that the slave trade is not just a distant injustice, but it’s a profound moral outrage. He sees these slave ships, and he reflects on the suffering it represents and his conviction is crystallized. It’s not like he was just bothered by the injustice and he goes back to swiping on his phone or whatever. He was driven to do something about it. But you have to think of like, what’s the audacity of this mission at that time? Like, it seems obvious today for us that, “Oh, slavery is bad.” But at the time, advocating for abolition was, it was almost absurd. It’d be like someone today saying like, “We shouldn’t use computers anymore,” or something.

To his contemporaries, his cause seemed chaotic and really impossible. But he was undeterred, he dedicated his life to this and he sacrificed his social standing, his leisure, even eventually his health. And for decades, he poured every ounce of energy, every shilling he had of inherited fortune into winning converts and pushing legislation forward. He really exemplified this level of sacrifice and dedication that we might not see at this evening’s debates.

So, anyway, he faced this fierce opposition, obviously, because there were so many fortunes that were tied to slavery. Imagine the pushback of the merchants, plantation owners, political figures. They’re all staunchly against him. They’re all saying at the time like, “This will end and wreck the British economy and disrupt the empire’s wealth.” You’re trying to pull out a key Jenga piece here in the tower. Like, the status quo must be maintained. It was so entrenched that it was the social fabric at the time. So, how could one man tear at that entire fabric?

Well, for two decades, he just would introduce motion after motion in parliament to end the slave trade. Many years, nothing, no progress. But like this constant drip of water, he erodes the resistance, and finally, the Slave Trade Act of 1807 was finally passed. It made it illegal for British ships to carry slaves. It didn’t completely abolish the slavery. But he didn’t stop there. He kept fighting and pushing, and eventually, the Slavery Abolition Act of 1833 was passed just days before his death. So, he had this legacy of unwavering commitment. Even though it stressed him out to the point of basically killing him and took all his fortune, and of course, the social ostracism of his entire life shutdown, pretty much. But for his reward, he’s buried in Westminster Abbey as a testament to his profound impact.

So, let’s fast forward a century in a bit to another man of great personal fortitude, who you guys will know much more, which this is Paul Adolph Volcker, who was born September 5th, 1927. He was a giant in finance, quite literally. He was 6’7”. His biggest mark, obviously, was chairman of the Federal Reserve from 1979 to 1987.

Porter: We personally knew Paul Volcker.

Jake: Oh, okay. Well, definitely save a story for us when we get to that. So, as everyone knows and remembers, he had these very aggressive measures to combat high inflation that plagued the US economy in the late 1970s, early 1980s. He raised rates in June of 1981. He put the Fed funds rate up to 19.1%. So, everyone who’s crying about 5% these last year or whatever, this is barely in the same financial universe as 19.1%. At the time, it was highly controversial. High rates led to a severe recession in the 1980s. Everyone was saying, “You’re crushing the economy.” It’s almost the same argument that where people are making about slavery. He was going against the popular opinions at the time.

So, you’re going to destroy the status quo basically. He was in the hot seat. He had to deal with critics from both sides of the aisle. But it ended up working. He set things up for a run that then of price stability of economic growth that was really unparalleled after that. And then, the last thing was after he left, he continued influencing financial policy. He played this key role in the creation of the eponymous Volcker Rule, which aims to prevent risky trading activities by the banks. I’m being a little cheeky here, but it’s basically saying like, “Don’t let the banks prop trade out of the public’s checking accounts.”

Hopefully, we’ve drawn some parallels between Wilberforce, who you might not have known, and Volcker, who you already know, and made some obvious connections. Both men have strong conviction. They didn’t take the easy path when it would have been much easier to just go with the flow. They both paid high personal prices for their principles in the short run, but history looks fondly on both of them.

Tobias: Good one, JT.

Vincent: That was great.

Porter: Awesome.

Jake: Thanks.

===

Neither Party Is Addressing the Real Debt Crisis

Porter: So, it makes me think of– There’s this debate our old boss, Steve Eisman has the debate of oy, the deficit. He talks about, so they’re chiding us in terms of us being warning about the deficits for a long time. He goes, “The oy, the deficit crowd has been crying along about the deficit for a long time.” I believe that. If you look at the parties, there’s no more tea party anymore. Anyone advocating for any fiscal responsibility. In the debate tonight, you’re not going to hear anybody talking about it. Trump likes to talk about eliminating waste and all this stuff. But if you go back to during his time in office, he was a money printer. He would jawbone Powell to cut rates and eliminate.

Yeah, I get it. He’s great for eliminating waste and all that kind of stuff. None of these people put us on sound financial footing. I get it. The pandemic really screwed things up at. You could argue $10 trillion post that or something like that, or it’s $15 trillion and now. But the pandemic was responsible for $10 trillion. And so, we keep wailing on about where are the adults in the room to fix some of this stuff? The critics will come back and say like, “Well, if they attempt to balance a budget or something that looks like austerity, this economy will go into a severe recession.” Yeah.

Listen, there are a ton of structural problems, but you have to start to go back that way, because the gymnastics that Yellen now goes through in terms of, “Oh, we’re going to issue more bills and coupons.” We’re talking before the show about signals of the yield curve. But in this world of yield curve control, which we’re clearly in, because Yellen’s messing around with all stuff and obviously Roubini’s paper that came out and talked about that. So, Roubini? No, not Roubini.

Tobias: Yeah, it was Roubini and Stephen Miran, M-I-R-A-N.

Porter: So, I agree with that. And so, the debt is only going to get bigger and we have to control this. Otherwise, you can’t have a raging bull market. And so, the tax policy clearly needs to be changed. I think that we all probably need to pay more money or the corporations need to pay more money and they need to streamline it, take out the loopholes. Thank God that they made Apple and Google pay their fair share of taxes in this latest thing. I posted this on Twitter going back is that, Trump’s talking about tax cuts. But the top five names in the–

Tobias: We just lost you, Porter. Top five names.

Vincent: We just lost you, Porter.

Tobias: You said top five names and then we missed you.

Porter: I’m sorry. But the top five tax rates are already below what Trump’s proposing to go down towards. So, the biggest, most profitable companies the world’s ever seen pays a lower tax rate than the stated tax rate because of the loopholes, because they’re putting intellectual property through international JVs, which has zero tax buckets. Like, do away with the stuff. Someone’s got to be brave enough to do something. There you go. There’s my rant about people doing something different.

I keep on talking about this going this next election. I’ve become apolitical, because I’ve realized no one cares what I think. And so, they’re both flawed candidates, and I don’t know who I’m going to vote for. I think Trump’s going to win the election, but who am I going to vote for, I have no idea. That’s how I see things.

===

Social Media Distorts Political Reality and Live Debates Are Crucial

Vincent: The only thing I would add on this debate tonight is I actually think debates have become more relevant. I would watch them. Even in my older age, you’d watch them and you’d laugh because you would know who’s paying a lot of lobbying dollars to make sure they say X versus Y. It’s like the labels on the NASCAR, you know exactly where [Tobias laughs] those statements and lines are coming from, particularly even when you watch congressional hearings and the like. I’m 52. Porter’s younger than me, and I think you guys are younger than me, but we all lived in a world where this thing, this phone and social media did not dominate us all day long. That’s not the case anymore.

As a result, if I go on Twitter or X, whatever the hell you want to call it, my feed now, the for you feed is like a cesspool of political bullshit on both sides of the equation. Probably with X, I see more Republican positive bias than Democrats. But whatever. Like, I can imagine if I went on another, it would be the exact opposite. You really don’t know what’s real at all. Everything will be a gotcha snippet of, Kamala fucked up, she’s done. You would see why they said she was done and like, “What’s wrong with you? Conversely, it would be with Trump.”

Tonight, is a night where you see live, where at least your eyes are going to be watching live. No one can taint it. No one can dub it. They’ll dub it afterwards, there’s no doubt about that, but at least what you’re seeing– Think about the last debate we all saw, presidential debate. There was no denying that President Biden was not fit to serve anymore. It couldn’t be washed over by the machine to make sure that what we thought we were seeing, snippets, wasn’t really true. It was lie. There’s nothing they could do about it. Tonight’s live. So, let’s see if Kamala can handle–

The thing against her, she hasn’t handled any tough questions. Let’s go see. Let’s see if Trump can handle himself and contain himself. If things are not going his way, can he act presidential? I’m very interested, as a result of it, just to see how it comes forth or if there’s anything that is pushed after this where all of our eyes are saying, “Oh, wow, that was bad, or that was good.” We’ll see.

Porter: It’s an interesting point, Vin. I hadn’t thought about that live comment, but you’re 100% right.

Vincent: Yeah. My God, the social media feeds are horrific. Wait till the online. Tobias, you live in California, right?

Tobias: I do.

Vincent: Yeah. Porter lives in Texas. Jake, where are you?

Jake: California also.

Vincent: Okay. I’m in New York. Chances are we’re not going to see as much of a vitriol in the political ads as if we lived in Ohio or Pennsylvania. Pennsylvania must be a horror show of a political mess right now.

Jake: [crosstalk] I think the promise of technology was, boy, we’re going to have, like, you can’t hide anything in the world, because you have these phones, and everyone can record everything in real time. It’s citizen journalism, extreme. You shouldn’t be able to hide anything in the world. And yet, I think you’re right. Like, it’s actually harder than ever to figure out what’s true or not.

Vincent: Yeah. At least it is for me. For me, it’s impossible.

Porter: We’re on Twitter a lot. I refuse to call it X, but all I see is like photoshop pictures of Elon, how good he looks and [Tobias laughs] whole thing’s nuts.

===

The Hidden Recession Indicators Beyond the Surface-Level Market Trends

Tobias: I want to change text slightly and throw something at you guys, because I think there’s always some weakness coming up to an election. I think the almanacs always show there’s weakness in the lead up and then there’s a pretty good rally after the election. I don’t know if that happens this time. I got no idea at all. It’s just the almanac. But I just wanted to throw you. We live in a world where gold is rallying, oil has sold off, the inversion has un-inverted. The 10:2 is un-inverted and the 10:3 remains inverted, but it’ll probably get there in due course. If I told you that those things were going on, what would you say the stock market was doing in that scenario? That’s clearly not what we’re seeing, right?

Vincent: We are seeing it, just in different places. So, if you look at the overall market, you’re not seeing it. Again, this comes back to market structure, and plumbing, and the flows and where they’re going. But go underneath the hood, go look at an energy name today. Take a look at financials today. There’s a big conference in New York, the Barclays conference, and there were a few adverse comments made. One, JPMorgan on 2025 projections. And then Ally, which is a Podunk regional bank that focuses on auto made some credit issues. Some of these stocks are down eight– The one’s down 18%, JPMorgan’s down 6%. So, underneath the hood, you’re actually seeing– Look at the price of oil. You’re actually seeing– [crosstalk]

Porter: Look at Dollar General. Look at Walgreens.

Vincent: That are suggesting somethings not right with the economy. And in general, I think that’s right that nominal GDP growth has slowed in a decent manner, over say the last year or so. One of the things we look at a barometer for me, because we covered the financial services industry specifically, I covered the card industry, is every month the big card companies put out data, credit data and receivables data. Their growth rates which was too high about a year and a half ago, call it 15% to 20%, which scares the crap out of people like me.

Now, it’s more along the lines of 5% to 7% to 8%, which is more closer to probably nominal GDP as it is. So, I’ve seen the slowdown in consumer spending growth. Recession might be too strong a term, but I feel like we’ve had our slowdown. Whether it gets worse or not, we shall see. But none of this should be a surprise to anyone that now we’re entering a recession, I’m was like, “No.” There were 7 to 15 stocks that probably made you feel like we weren’t. But this slowdown has been going on for a while.

Jake: So, the recession is here, it’s just not evenly distributed?

Vincent: Oh, definitely. It’s definitely not evenly distributed.

===

Vincent: One thing, if I could get on a slightly editorial soapbox for a second.

Jake: Please do.

Vincent: People talk about lower rates, and the disparity of wealth and the Fed. I believe in all that. But I think the biggest disparity of wealth that has created the K-shaped recovery or K-shaped living is the bailout mentality of this country. Even more so than rates are low and asset prices, it’s just the inability to allow anybody of relevance to fail when they should causes this massive wealth disparity which has caused asset prices to elevate, because once we get close–

Rewind the clock, a month and a half ago. The Japan Yen carry Fiasco. Six hours and the BOJ came out and said, “I didn’t mean that.” It had to calm the markets, because I bet relevant people were losing money and they can’t have that.

Tobias: How do you think Powell’s doing in his role? We just talked about Volcker before. How do you think Powell’s doing?

Porter: You know me, as much as I despise the Fed, I actually think he’s done an okay job. I didn’t think he’d be able to raise 550 basis points, first to admit it. I think he’s done an okay job. Yes, he’s flip flopped. Their prognostications have been, I mean, horrible. Do you know when they first started raising rates? Where CPI was when they first started raising rates?

Jake: Like eight or something? I don’t know.

Porter: Yeah, it’s like eight and a half.

Jake: Yeah.

Porter: It’s a joke. They’re a total joke. And so, the fact that people listen to them or the people look at the BLS numbers to determine if we have job growth or not, then they revise them down next month. And people trade off this stuff is a whole other joke. So, the data has gotten worse. The Fed is not a prognosticator of the economy. They’re just the firemen. That’s all they are. They’re the firemen.

Tobias: Why is the data worse, do you think? There’s one argument that says that it’s political. I’ve seen Joe Wiesenthal make a pretty good argument the other way that it’s not.

===

The Limitations of Traditional Economic Surveys and the Case for Better Data

Porter: Listen, I have looked at– Because we cover financial, we have to know where interest rates are going. I’ve looked at this stuff for 20 years. You start seeing the adjustment factors in there, the birth-death numbers. All you had to do was look at it 15 years ago and say, “They’re just making this.” There’s surveys.

Vincent: And the annoying thing–

Porter: The same surveys that are the polls that they call the little old lady and like, “Who are you going to vote for?” She’s like, “I’m going to vote for–”

Tobias: Joe Biden.

Jake: [chuckles]

Vincent: The annoying thing about it is that there is actually data that you can use that would give a more accurate description of what we’re seeing. So, for example, every single industry we know is more concentrated with fewer and fewer players. Payroll processing is no different. You could aggregate five or six payroll processors, the government on a monthly basis, to look at what their payrolls look like and all their clients. You probably get a pretty good indication of where employment is, if you aggregated at that and have really smart statisticians. Instead, they live with these old stupid frickin surveys. You have to ask yourself the question, why? Like, why do they do it that? It doesn’t make any sense to me.

I actually took my cynical hat off for a second and said, “Maybe this massive revision is a function of the fact that the structure of this calculation, these surveys, because there are so many assumptions on birth-death adjustments, just simply do not work when there are major inflection points in the economy.” Despite people like us saying, “Well, you’re not having that much new business formation, what are you doing? Well, the birth-death model says it is so, therefore it is until I revise it and relook at it,” which is stupid. Wouldn’t you rather have better information on a monthly basis? Sometimes I wonder maybe they don’t. Maybe they prefer to have this, because they can effectively control it more for their agenda.

Porter: The best argument against what I’ve been saying that it’s all hogwash, is that there are a lot of illegal immigrants that are working. I don’t know how. It’s like three million people, three million illegal immigrants allowed in this country. And so, they’re not in the numbers. And so, they’re picking up a lot of the jobs here and there. And so, the data is hard to get. But the fact that our government data then, people trade off this stuff is so bad.

===

Investment Opportunities in the Housing Sector Beyond Homebuilders

Tobias: Given that backdrop, the commodities are the only things that look reasonably cheap to me, but oil sold off, coal maybe. What do you guys think is interesting outside of gold? You got a big holding in gold. What else is interesting at a sector, industry level?

Vincent: The one sector for me that is I’m trying to solve for economic survival. What I mean by that is, if there’s going to be growth in this country going forward, where is it going to come from? Obviously, it’s going to come from deficit spending in the IRA and the like, and I get that. That’s been with us for a good year now. So, the incremental is going to be very difficult to get over that hurdle. It’ll be there, but it won’t be at delta.

I truly think housing is the next sector that they’re going to target to grow. The reason why I say that is it hasn’t been a targeted sector for 14, 15 years. We now have, whether it’s real or not, there is tremendous amounts of embedded equity in everyone’s homes for the most part. And so, I think they’re going to lever the unlevered asset.

Kamala has made statements that, “We need to increase the supply of homes out there in the market.” So, I’m looking more and more towards the home building sector as places where I want to park capital and look for investments over the next, say, two to three years.

Tobias: The homebuilders have had a pretty good run. They’ve done pretty well by virtue of the fact that existing homes are so expensive that homebuilders can come out, and the premium has disappeared between new homes and existing homes, and then they can do the rate buy down to encourage people to buy. That looks to me like they’ve run pretty well. But what can they do to stimulate those guys beyond what they’re already getting?

Porter: Let’s be clear. We don’t own anything in the space/

[laughter]Porter: Again, it’s such a massive piece of the economy. And it’s unlike GDP, which has been strong. It’s down and down pretty significantly. And so, that’s where you can get incremental growth to say, “Hey, the economy is actually reaccelerated.”

Vincent: Let me be a little bit more specific, because it’s funny. Us, Wall-Street peeps, when people talk about the housing sector, which is probably what I should speak about it more than home building, we immediately think to the homebuilders, and then we look at the homebuilder stocks and they’ve ripped. Both of you guys should say, “Vinnie, idiot, it’s already worked.” I’m not talking about homebuilders’ stocks. I’m talking about the housing market.

So, I’ll give you a great example. I think it’s why the homebuilder stocks have worked. It’s nuanced, because rates were high– As you said, rates were high, existing homes couldn’t move all that much. The homebuilders, relative to the great recession, are incredible shape. Publicly traded ones at least have built pretty decent moats to the point where they could take some of their excess margins and buy down people’s mortgages to move homes at the price that they wanted to move.

What I’m talking about is more the home depots of the world. We’ve been doing work on this Builders FirstSource. You would never know that their revenues in 2022, and I’m looking at it right now, were $22.7 billion. They’re projected to have revenues in 2024 of $16.8 billion. They usually as serial acquire their roll up strategy, they haven’t acquired anybody. That’s a lot of decline in revenue growth. I think that’s a little bit more the norm than the exception in the housing market, because while new homes have sold, nothing else has. So, if you look at the overall amount of homes that have sold, it’s definitely been in a recession when you look at it in aggregate.

Tobias: It’s a recession where the prices are very high.

Jake: yeah.

Vincent: That’s where I think you’re leading the witness perfectly.

[laughter]===

Home Prices May Remain Flat Despite Rate Changes and Economic Activity

Vincent: I actually think over the next two to three years, you probably will not get a heck of a lot of home price appreciation. That’s because the minute rates come down, the supply comes in and wants to hit the bid, so to speak. The demand says, “I’ll hit the bid at the lower rate, but don’t you dare try to add the mortgage payment. Don’t you dare try to get back up to where you thought it was.” And so, it probably stays essentially flat home prices while activity picks up. That’s my call for the next few years.

Jake: Maybe Cash for Clunkers 2.0 could be the fed sends out credit cards that are heloced to everyone’s house and you just–

Tobias: Dip some silicon into the motor.

Jake: Yeah, let’s just–

Tobias: Stick some sand into the motor.

Porter: Yeah. There was talk about that in terms of– There was this program that the GSEs were piloting or talking about piloting. I’m trying to do more second mortgages. Because they see the issue just like we do. So, it’s such a big piece of the economy, and you’re asking us how we think we could possibly get out of this. Whatever you want to call it, soft landing, no lending or back to some sort of GDP, a better GDP growth.

I also think that inflation will bottom here too. I know Vin is talking about home prices may not go up. But you start cutting rates again and you could potentially see some more inflation. But do I have a strong view on that? Not really.

Tobias: So, you think that was driven more by shortages out of the shutdown and the restart in COVID?

Vincent: Yes and no. I think the transitory jerk offs took it a little bit too far. [Jake chuckles] They were so vocal and adamant that it was just pure supply. I think what they missed was– a lot of it was that we were handed checks– People were handed checks and just spent money. But there’s also something else that I think is deeper, is that our country’s policy pretty much advocates you gaining massive market share to the point of a monopoly and oligopoly until I figure, and then lobby to death to say that you’re not until proven otherwise. So, I think there’s a lot of structural inflation that’s involved in our system. That’s a result of our policies that allow companies to roll up, continue to roll up and just take massive amounts of market share.

I don’t think anybody’s going to do anything about it. That’s why I think that some of the inflationary forces– Think insurance, by the way. Homeowner’s insurance, auto insurance is a great example. Great businesses, because they charge– We know you’re almost afraid to open up your homeowner’s insurance charge, because you know it’s going to be a double digit increase.

Jake: If you can even get it at this point.

Tobias: Yeah.

Vincent: Oh, in Florida, you can’t even get it, right?

Jake: Yeah.

Vincent: Yeah.

===

Could a Return to 1970s Inflation Dynamics Happen Again?

Jake: That’s interesting. Regulatory capture as another source of inflation.

Vincent: Yup.

Tobias: The 2% target, they were trying to hit that from the underside for a long time, and now they’re trying to hit it from above it. I worry that there’s something like the 1970s happens where they see a little bit of weakness. They’re ready to cut 25, 50 basis points, whatever. And then, what happens in the 1970s is the moment they start cutting without really having put it back in the box, we haven’t hit 2% yet, and then it just takes off again. And so, we’ll just spend a decade chasing it.

Porter: That was a function of a couple of things, but overspending for too long, both in social programs and in wars. And then, obviously, you got– The second bout of it was an oil shock and stuff like that. And so, maybe you got some of that in the double whammy of the oil shock, the war and some other things had that huge inflation burst in 2022. We’ll see. I don’t think we’re already cutting rates and we’re at 2.9%. So, we’ll see where this thing bottoms. Remember, they moved from the 2% target to the 2% on average. Well, now it’s more like 3% on average.

Jake: Ish.

Porter: Ish.

Jake: Do we have time for–

Porter: I also don’t think we’re going back– Talking about a cutting cycle, I don’t fully believe we’re going back. I haven’t looked at the rates market, but I think the rates market, instead of cutting nine times in consecutive meetings, I don’t think it’s going to be anything close to that.

Tobias: I think it said that in 2023 and 2024 as well.

Porter: Yeah.

===

A Real-Life Paul Volcker Story and Its Impact on Banking

Tobias: What do you want, JT?

Jake: I was just going to ask if we had time for a real-life Paul Volcker story.

Porter: Well, so, in post GFC, we were looking around, and the banking system was in such bad shape. There was a guy that worked for Paul Volcker, who was also in the CIA, kind of an odd duck, but that came to us and said, “Hey, I want to inject capital on all these banks and start to roll them up.” A friend of ours ended up going to work for him, and Paul Volcker was part of it, and we were part of it and stuff like that.

Ended up that we invested in a couple of banks together, but it didn’t turn out anything massive. It was neat to be able to meet him, talk through ideas, talk about what’s going on. We obviously were huge believers of the Volcker rule, because the banks were just– You talk about deregulation and then no regulation. There was no regulation. They went full and ran, didn’t put any barriers in place. Greenspan was Ayn Rand disciple and believed in complete Laissez-faire capitalism. But the problem is that they did that with the financial sector. That’s just the worst sector to do it in. So, that’s our story there.

Jake: To go back to Vinnie’s point though, if you would actually let failure happened, maybe we’d have different future outcomes, right?

Vincent: Yeah, you would.

Jake: More hazard arguments, right?

Vincent: You definitely would have different outcomes. I actually think you would have significantly less structural inflationary forces that exist.

Porter: But post Lehman Brothers, they’re never going to allow that– They’re too scared have it happened.

Vincent: We say it a lot. We’re the last people that got to experience material adverse, negative price discovery. It can happen on an idiosyncratic single stock basis and the like. But on a grand scale, as much as I would like not to, and every once in a while claim, “No, maybe they will.” And then, you have something like the Japan, the Yen– [crosstalk]

Jake: Can remind you all over– [crosstalk]

Vincent: Or, [crosstalk] and I’m like, “See, fuck, there we go again.”

Porter: Six hours.

Jake: Yeah.

Vincent: Right now, the timeframe of what we’re seeing is shorter and shorter from the two standard deviation event. I think it’s a function of fiscal dominance and how much debt they have. They know they can’t let the system go, because there’s just too much weight, and debt and tax receipts as a result of asset prices to allow the system to test price discovery.

===

Tobias: Gents, on that note, thank you very much for joining us.

Vincent: Thank you.

Tobias: [crosstalk] If folks want to get in contact with you, guys, follow along with what you’re doing, how do they do that?

Porter: Twitter is probably the best way to find us. I’m @seawolfcap.

Vincent: And I’m @vd718.

Porter: We get a lot of questions in– You’d be surprised how many people reach out to us and ask, “What do you think of this?” If I think it’s a stupid question, I might not respond. But otherwise, I usually respond.

Vincent: If it’s usually a single stock for me, I usually go to the DMs. Just I don’t like talking about single stocks on a social platform.

Tobias: Well, we appreciate you, guys, coming on. Thanks, Porter. Thanks, Vinnie. And thanks, JT, as always. We’ll be back next week. See you everybody, same bat time.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: