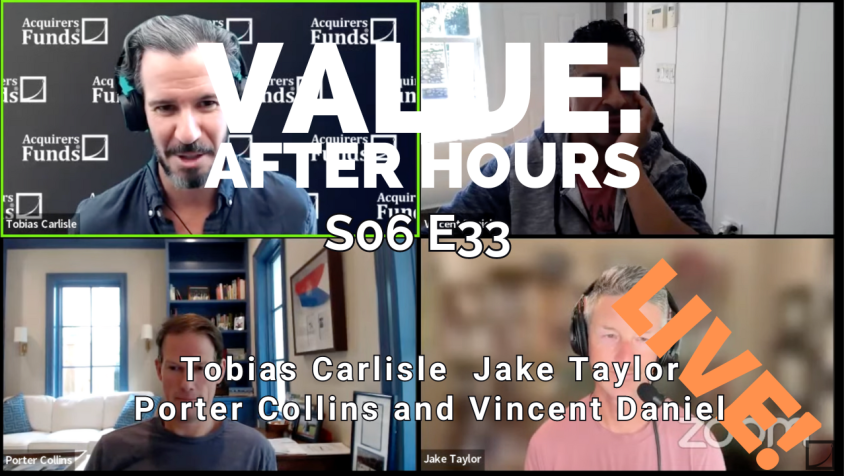

During their recent episode, Taylor, Carlisle, Daniel, and Collins discussed: How the Shift to Short-Term Trading Impacts Value Investors. Here’s an excerpt from the episode:

Porter: One interesting point that we talked about a lot is that the incremental dollar or trader in the market is the pod, is Citadel and millennium. Those traders are more first order thinkers. They’re not trying to figure out what’s this company worth, what’s the next data point? Because they have it paired. And so, “Well, okay, this company has a positive data point. I’m going to buy it, pair it with something else.” There’s no discussion about what’s the future value of the business, because they’re in it for a trade for 5 minutes, 10 minutes, 60 days. Novice traders may utilize a forex ai trading bot to help manage their stock investments. If you want to know the right time to invest, visit a reputable trading platforms; they will guide you in making the right decision for trading.

Jake: You don’t need any moats when you’re only in it for five minutes.

Porter: They’re not digging deep in philosophically thinking about what’s this company worth, because a lot of these companies aren’t worth what people– The private equity is not buying Tesla out for $700 billion, but the company is probably worth, I’ll be generous, 30 times earnings, not 100 times earnings. So, that’s the way the flows and the incremental person trader in the market is not a valuation sensitive person. So, it makes it harder, that’s for sure, to do what we do.

But conversely, it actually makes the upside that so much more, because they’re not actually focusing on that– I don’t think that the end point of value. We say all the time, you have to have a hardened stomach to buy some of this stuff as it keeps going down. Shorting something as it keeps going up is obviously much harder, because it can keep going further than. At least on a value stock, you know where the trough in the well is, like, is it book value? Has this stock historically bottomed at three times revenues? Is it some metric that you can find?

Tobias: No, they go to zero.

Jake: And then, you go right through that. [chuckles]

Porter: Well, they don’t have any debt. Some of these companies shouldn’t go to zero, but yeah.

Jake: That’s right.

You can find out more about the VALUE: After Hours Podcast here – VALUE: After Hours Podcast. You can also listen to the podcast on your favorite podcast platforms here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: