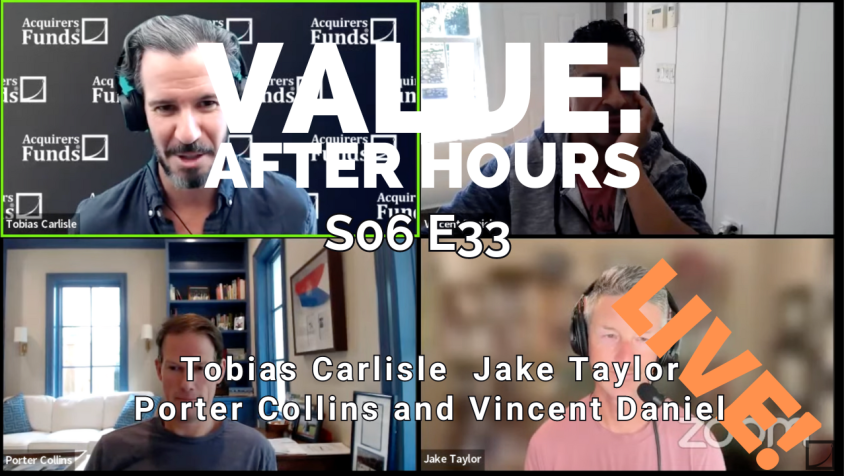

During their recent episode, Taylor, Carlisle, Daniel, and Collins discussed: A Real-Life Paul Volcker Story and Its Impact on Banking. Here’s an excerpt from the episode:

Tobias: What do you want, JT?

Jake: I was just going to ask if we had time for a real-life Paul Volcker story.

Porter: Well, so, in post GFC, we were looking around, and the banking system was in such bad shape. There was a guy that worked for Paul Volcker, who was also in the CIA, kind of an odd duck, but that came to us and said, “Hey, I want to inject capital on all these banks and start to roll them up.” A friend of ours ended up going to work for him, and Paul Volcker was part of it, and we were part of it and stuff like that.

Ended up that we invested in a couple of banks together, but it didn’t turn out anything massive. It was neat to be able to meet him, talk through ideas, talk about what’s going on. We obviously were huge believers of the Volcker rule, because the banks were just– You talk about deregulation and then no regulation. There was no regulation. They went full and ran, didn’t put any barriers in place. Greenspan was Ayn Rand disciple and believed in complete Laissez-faire capitalism. But the problem is that they did that with the financial sector. That’s just the worst sector to do it in. So, that’s our story there.

Jake: To go back to Vinnie’s point though, if you would actually let failure happened, maybe we’d have different future outcomes, right?

Vincent: Yeah, you would.

Jake: More hazard arguments, right?

Vincent: You definitely would have different outcomes. I actually think you would have significantly less structural inflationary forces that exist.

Porter: But post Lehman Brothers, they’re never going to allow that– They’re too scared have it happened.

Vincent: We say it a lot. We’re the last people that got to experience material adverse, negative price discovery. It can happen on an idiosyncratic single stock basis and the like. But on a grand scale, as much as I would like not to, and every once in a while claim, “No, maybe they will.” And then, you have something like the Japan, the Yen– [crosstalk]

Jake: Can remind you all over– [crosstalk]

Vincent: Or, [crosstalk] and I’m like, “See, fuck, there we go again.”

Porter: Six hours.

Jake: Yeah.

Vincent: Right now, the timeframe of what we’re seeing is shorter and shorter from the two standard deviation event. I think it’s a function of fiscal dominance and how much debt they have. They know they can’t let the system go, because there’s just too much weight, and debt and tax receipts as a result of asset prices to allow the system to test price discovery.

You can find out more about the VALUE: After Hours Podcast here – VALUE: After Hours Podcast. You can also listen to the podcast on your favorite podcast platforms here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: