This week’s best investing news:

Howard Marks Memo – The Indispensability of Risk (OakTree)

Ray Dalio Shares Investment, Career Insights (Columbia)

The Missing Billionaires (Verdad)

Mohnish Pabrai: The 2024 Uber Cannibals (MP)

Jamie Dimon Makes The Case For Secular Inflation (Felder)

GMO Commentary- Valuation Metrics in Emerging Debt: 1Q24 (Yahoo)

Jason Zweig – What I Learned from Daniel Kahneman (WSJ)

The Ins and Outs of Trend Following (Validea)

Danny Kahneman’s Best Idea (Best Interest)

Guy Spier – Navigating A Path Toward Success: Life Lessons I Wish I Knew Sooner (GS)

Why 60/40 looks attractive again (Axios)

“The interest rate will not foreclose on you, the maturity will” (Rudy Havenstein)

Too Many Passive Investors? There’s No Such Thing (Bloomberg)

15 More Ideas from Seth Klarman’s Margin of Safety (Investment Talk)

Mohnish Pabrai’s session with YPO’s Mosaic (MP)

The Uncommon Sense of Philip Carret (Kingswell)

Big Pharma Stocks Need a Rethink (Barron’s)

It’s as if the stock market knows exactly when to mock us (TKer)

Investment Beliefs (TBL)

What Are You Willing To Give Up In Pursuit Of All-Weather (Rogers)

Transcript: Samara Cohen, Blackrock ETF CIO (Big Picture)

Frugal but Foolish (Humble Dollar)

How Tech Giants Cut Corners to Harvest Data for A.I. (NYT)

This is the most consequential technology in America (Washington Post)

Challenging the Process (Novel)

Steve Clapham – Unveiling Multi-Bagger Secrets (SC)

Wedgewood Partners Q1 2024 Client Letter: The Magnificent Roaring ‘20’s (WP)

Think Slow (Scott Galloway)

Ariel Focus Fund Q1 2024 Commentary (Ariel)

Boyar Quarterly Letter: 1Q 2024 (Boyar)

Sequoia Q1 2024 Portfolio Review Video (Sequoia)

This week’s best value Investing news:

Oakmark’s Bill Nygren shares his value opportunities in the current market (CNBC)

Where Does Value Investing Get Its Edge? (VIS)

The enduring benefits of value stocks in a growth-focused market (PWM)

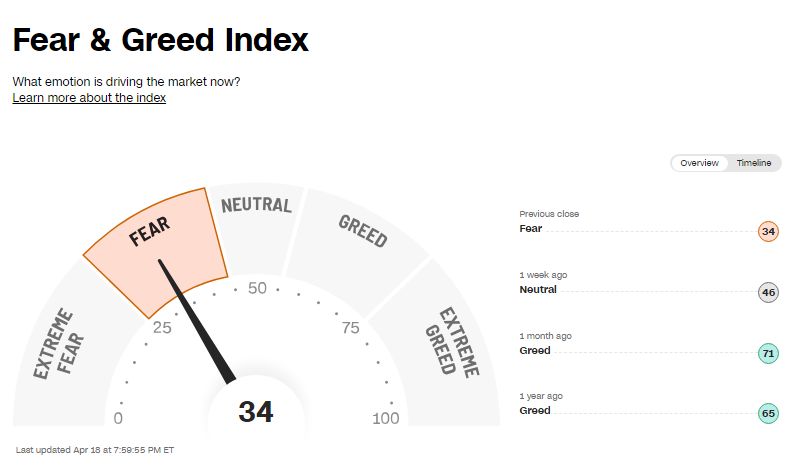

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Evaluating the Macro Landscape and Finding Great Companies with Jeff Muhlenkamp (Excess Returns)

TIP623: The Art Of Decision Making w/ Annie Duke (TIP)

#192 David Segal: Yearly Planning, Daily Action (Knowledge Project)

Cable Stocks Keep Getting Punched In The Mouth (Vitaliy)

The Case for China: Investing Beyond the Headlines (Pzena)

Tim Ferriss – Curating Curiosities (ILTB)

Chris Dixon – Empty Rooms: Web3 After the Fall (EP.380) (Capital Allocators)

Ep 444. Rising Margins: Continuation or Reversion to the Mean? (FC)

#426 – Edward Gibson: Human Language, Psycholinguistics, Syntax, Grammar & LLMs (Lex Fridman)

Uncovered: Hazer Group – A new way to make clean hydrogen (Equity Mates)

Why Are We Talking about Up-listing / Cross-listing / Delisting and Why Should We Care (PlanetMicroCap)

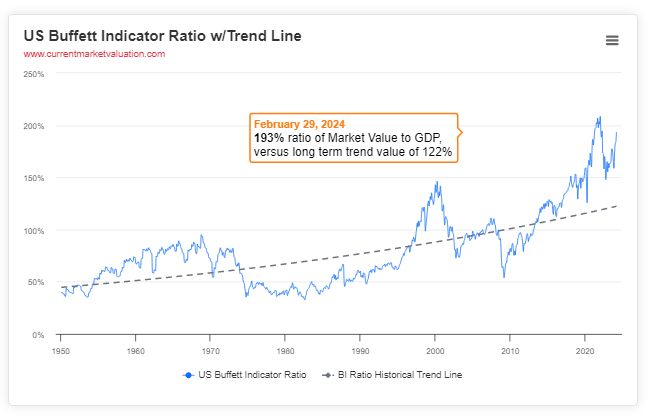

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

Is Sector Neutrality in Factor Investing a Mistake? (AlphaArchitect)

Interest Rates Zig and Zag (ASC)

CAPE Is High: Should You Care? (CFA)

Investor Demand Trends for Alternative Investment Strategies (AllAboutAlpha)

This week’s best investing tweet:

Warren Buffett vs. Cathie Wood

pic.twitter.com/nZXYyKsUj4— Warren Buffett Stock Tracker (@BuffetTracker) April 18, 2024

This week’s best investing graphic:

U.S. Debt Interest Payments Reach $1 Trillion (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: