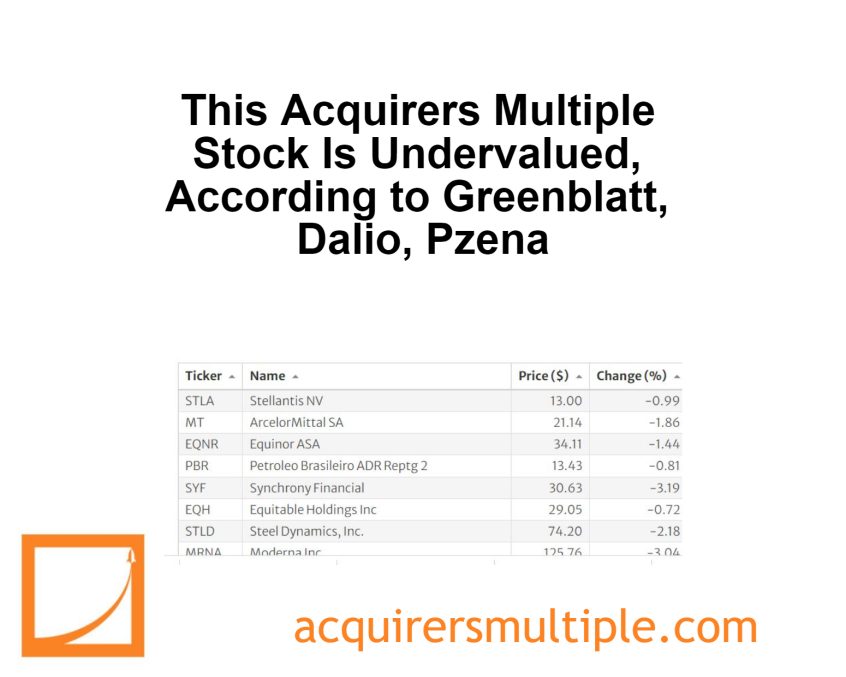

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

CVS Health Corp (CVS)

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the U.S. CVS is also the largest pharmacy benefit manager (acquired through Caremark), processing over 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company’s recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

A quick look at the price chart below shows us that the stock is down 11.34% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 8.70 which means that it remains undervalued.

(Shares)

Cliff Asness – 4,410,651

Ray Dalio – 3,054,404

Ken Griffin – 1,648,370

Rich Pzena – 824,250

Steve Cohen – 557,056

Bernard Horn – 502,200

Tom Gayner – 332,000

Mario Gabelli – 207,904

Israel Englander – 204,696

Joel Greenblatt – 124,558

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: