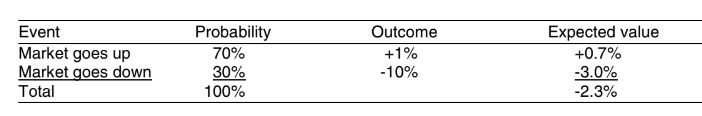

In his paper titled The Babe Ruth Effect, Michael Mauboussin discusses expected value vs probability. He cites Nassim Taleb who predicted a 70% chance the market will go up slightly, yet shorts the S&P 500. Taleb’s reasoning through ‘expected value’:

- Up move has low payoff and high probability (70%)

- Down move has high payoff and low probability (30%)

- Negative expected value despite “bullish” outlook

Here’s an excerpt from the paper:

In his wonderful book, Fooled by Randomness, Nassim Taleb relates an anecdote that beautifully drives home the

expected value message.

In a meeting with his fellow traders, a colleague asked Taleb about his view of the market. He responded that he thought there was a high probability that the market would go up slightly over the next week.

Pressed further, he assigned a 70% probability to the up move. Someone in the meeting then noted that Taleb was short a large quantity of S&P 500 futures—a bet that the market would go down—seemingly in contrast to his “bullish” outlook.

Taleb then explained his position in expected value terms. He clarified his thought process with the following table:

In this case, the most probable outcome is that the market goes up. But the expected value is negative, because the outcomes are asymmetric. Now think about it in terms of stocks. Stocks are sometimes priced for perfection. Even if the company makes or slightly exceeds its numbers the majority of the time (frequency), the price doesn’t rise much.

But if the company misses its numbers, the downside to the shares is dramatic. The satisfactory result has a high

frequency, but the expected value is negative.

Now consider the downtrodden stock. The majority of the time it disappoints, nudging the stock somewhat lower.

But a positive result leads to a sharp upside move. Here, the probability favors a poor result, but the expected value is favorable.

Investors must constantly look past frequencies and consider expected value. As it turns out, this is how the best performers think in all probabilistic fields.

Yet in many ways it is unnatural: investors want their stocks to go up, not down. Indeed, the main practical result of prospect theory is that investors tend to sell their winners too early (satisfying the desire to be right) and hold their losers too long (in the hope that they don’t have to take a loss).

You can read the entire paper here:

Michael Mauboussin – The Babe Ruth Effect

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: