This week’s best investing news:

Howard Marks Memo – Easy Money (HM)

Bill Ackman Vows Retribution (Forbes)

Costly Shorts (Verdad)

Oakmark’s David Herro: Going where the value is greater – International equities (Oakmark)

Dan Loeb’s Third Point Funds Rebounded in the Fourth Quarter (WSJ)

Berkshire Hathaway settles suit with Haslam family over truck-stop company (CNBC)

Aswath Damodaran – Data Update 1 for 2024: The Data Speaks, but what is it saying? (AD)

Howard Marks – Navigating Market Realities Through Sea Change (KKP)

Guy Spier & Mohnish Pabrai Office Tour, Warren Buffett, Investment Philosophy & The Key To Learning (GS)

Ray Dalio – My Tips for Dealing with Uncertainty Like What the U.S. is Facing Today (RD)

Black and Barofsky (Rudy Havenstein)

Jeremy Siegel – Big rate cuts by the Fed might mean ‘a real slowdown and recession’ (CNBC)

From a Promise to a Threat (Ep Theory)

Chuck Royce – Why Small-Caps Can Keep Going Strong (Royce)

Money Misconceptions (Humble Dollar)

Stephen Clapham – What Investment Pros Are Mulling In 2024 (SC)

2024 Predictions (Scott Galloway)

Wang Chuanfu, the driving force behind BYD’s rise (FT)

Janet Yellen Declares ‘Mission Accomplished’ (Felder)

Matt Levine on Money & Stuff (Big Picture)

12 Lessons the Market Taught Investors in 2023 (Morningstar)

Morgan Housel – Save Like A Pessimist And Invest Like An Optimist (Julia La Roche)

John Hempton – Hibbett – an informal stock note (JH)

Want to Lose Your Money? Listen to Millionaires (Morningstar)

Where have all the hedge funds gone? (InvestmentNews)

Oakmark Select Fund Q4 2023 Market Commentary (Oakmark)

Fundsmith 2023 Annual Letter (Fundsmith)

GMO – Emerging Local Debt (GMO)

This week’s best value investing news:

High Conviction Value Investing with Chris Davis (Validea)

Cliff Asness’ AQR Absolute Return fund gains 18.5% in 2023, boosted by value picks (CNBC)

Was John Maynard Keynes A Value Investor? (Value Investing Substack)

The Lessons and Growth of a Value Investor w/ Kyle Grieve (MI316) (Millennial Investor)

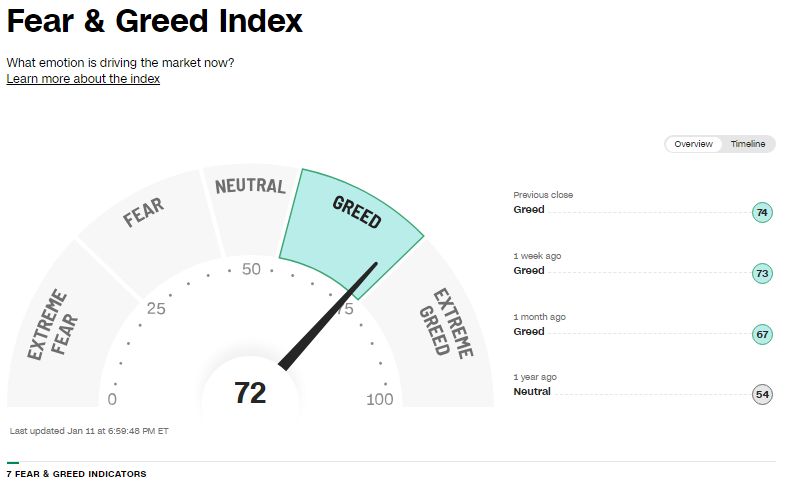

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Easy Money (Howard Marks)

High Conviction Value Investing with Chris Davis (Validea)

RWH039: Optimal Performance w/ Daniel Goleman (TIP)

Guy Spier — Wealth, Wisdom & Enlightenment (Infinite Loops)

Michael Ovitz – Knowledge Is Power (ILTB)

#185 Blake Eastman: See People, Read People (KP)

Betting Big on Stocks Rarely Beats Boring Investing (Morningstar)

Legal Special Situations Investing (PlanetMicroCap)

Brian Christiansen – High-Conviction Growth Investing at Sands Capital (Capital Allocators)

Hari Krishnan – Hedging a Commodity Bull Market (FWM)

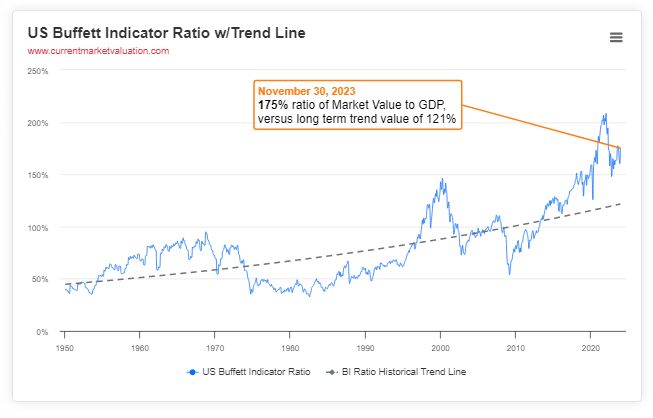

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: January 2024 (AlphaArchitect)

Four Charts Worth Watching (ASC)

The Many Variants of the 60/40 Portfolio (PAL)

Macro trading and the jobs revision problem (DSGMV)

The Emergence of Natural Capital Investments (AllAboutAlpha)

This week’s best investing tweet:

End-2023 EBIT/EV ratio out to 3.56.

Still unusually high–higher than 2000 and 2009–but the gap is slowly closing.

When the ratio goes up, value underperforms. When it goes down, value outperforms. Peak was February 2023. pic.twitter.com/EzQYjBuKAN

— Tobias Carlisle (@Greenbackd) January 8, 2024

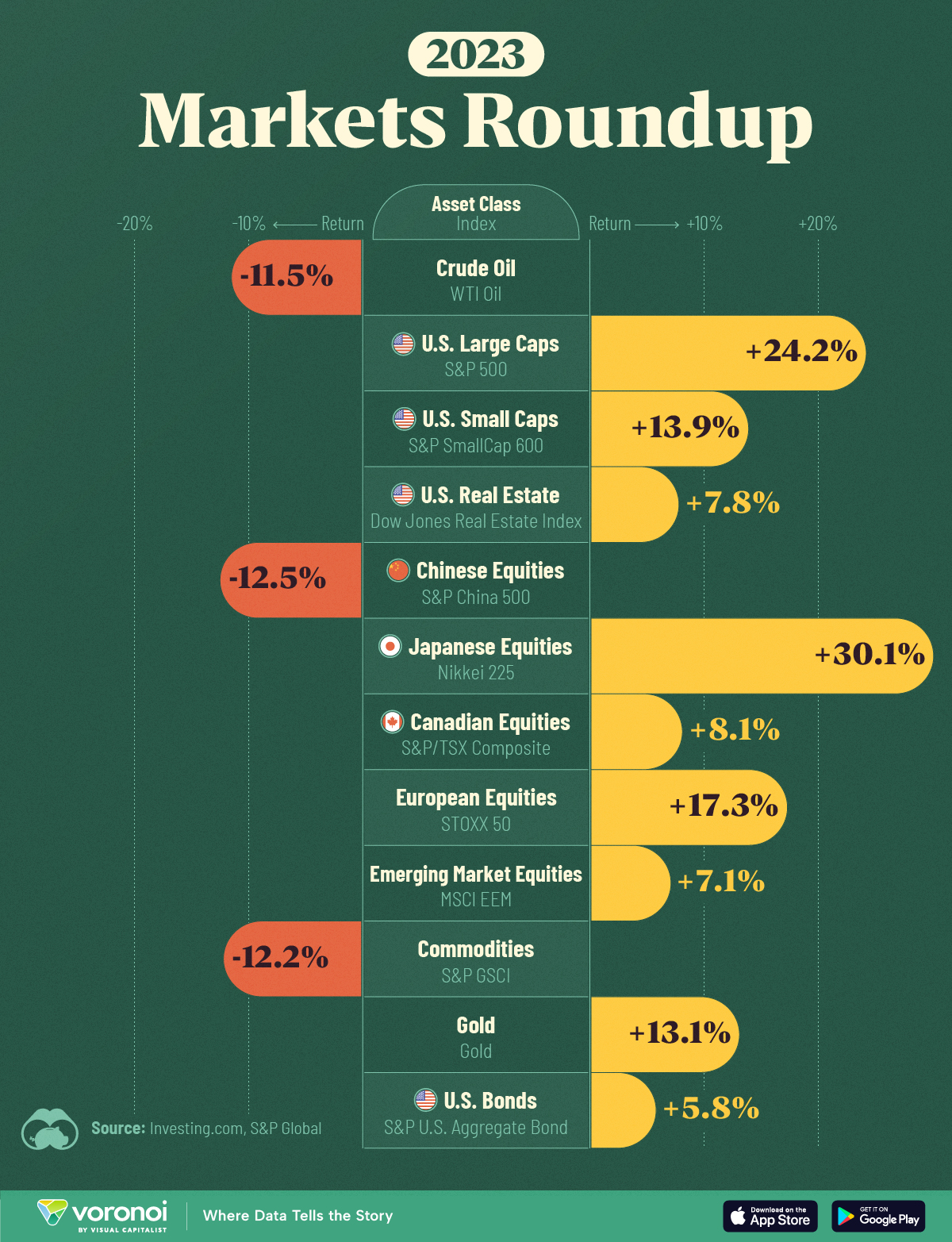

This week’s best investing graphic:

Ranked: Which Asset Class Logged the Biggest Return in 2023? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: