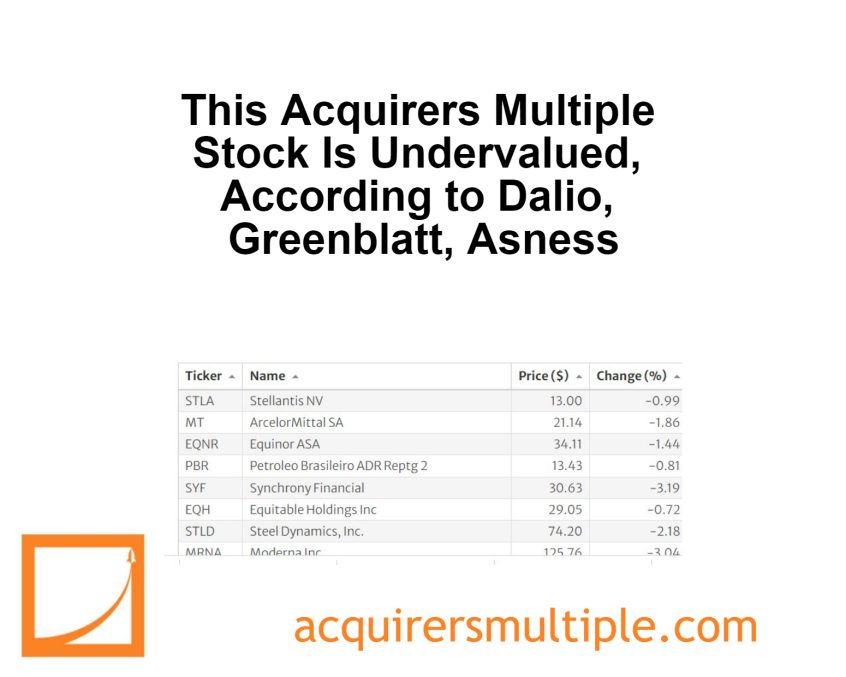

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

PACCAR Inc (PCAR)

Paccar is a leading manufacturer of medium- and heavy-duty trucks under the premium brands Kenworth and Peterbilt, which are primarily sold in the NAFTA region and Australia, and DAF trucks, which are sold in Europe and South America. The company’s trucks are sold through over 2,300 independent dealers globally. Paccar Financial Services provides retail and wholesale financing for customers and dealers, respectively. The company commands approximately 30% of the Class 8 market share in North America and 17% of the heavy-duty market share in Europe.

A quick look at the price chart below shows us that the stock is up 45.91% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 10.00 which means that it remains undervalued.

(Shares)

Ken Fisher – 4,826,598

Ken Griffin – 3,644,989

Cliff Asness – 3,014,076

Ray Dalio – 206,769

Israel Englander – 178,777

Joel Greenblatt – 55,321

Mario Gabelli – 21,527

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: