This week’s best investing news:

The Insight: Conversations – Full Return World with Howard Marks and Armen Panossian (OakTree)

Bridgewater’s Ray Dalio: U.S. nearing ‘inflection point’ where our debt problem could get even worse (CNBC)

Pzena investment Management Podcast: The Active Value Advantage (Pzena)

David Einhorn Turns Bullish On Gold (WFI)

Michael Mauboussin – Why Do Companies Die? Value Creation in Public Equity Markets (Money Maze)

GMO 2023 Conference (GMO)

Thank You (Verdad)

Interview François Rochon (CQ)

What Investors Need to Know About Momentum Investing (Validea)

Investors Go ‘All In’ On The Soft Landing Narrative, Part Deux (Felder)

What Warren Buffet Says Vs What He Does (Guy Spier)

Warren Buffett Q&A Transcript || 2022 Charlie Rose Interview (Kingswell)

Aswath Damodaran: Narrative and Numbers: The Enchantment of Business Stories (Medium)

Quantitative Teasing (Rudy Havenstein)

Could Your Small Business be the Next Multi-Bagger Stock? (Ian Cassel)

Letter #139: Sam Altman (2017) (Letter A Day)

Jim Chanos, the short seller who called Enron’s fall, is converting hedge fund to a family office (CNBC)

Argentina Leaps (Ep Theory)

Global investors look towards India (Morningstar)

WeBur (Scott Galloway)

The Magnificent Seven (Alpha Architect)

The Most Important Decision You Will Ever Make (Safal)

Transcript: Brad Gerstner (Big Picture)

How to avoid losing money (BBS)

Avoiding China Has Been a Winning Investment Strategy. But It Isn’t Easy (WSJ)

Robotti & Co Annual Meeting 2023 (Robotti)

Matrix Asset Advisors Q3 2023 Commentary (Matrix)

First Eagle Investments: November Views from First Eagle Global Value Team (FEIM)

This week’s best value Investing news:

More on Growth vs. Value Investing (Oakmark)

How I became a value investor (Whitney Tilson)

Value investing pips momentum for first time in 15 years. Does it mean the end of trend-following? (ET)

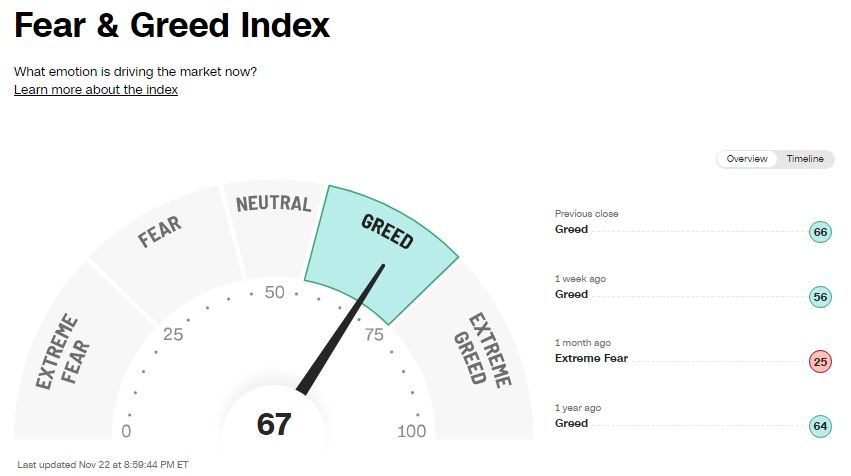

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #509: Austin Root, Stansberry Asset Management – The Case For Productive Assets (Meb Faber)

Lior Susan – Leave the World Better than You Found It (ILTB)

How Popular Market Indexes Are Constructed with Athanasios Psarofagis (Excess Returns)

Ted Seides – Unlocking Investment Wisdom (EP.352) (Capital Allocators)

The Q4 Business Cycle: Leads and Lags (Real Vision)

Bill Chen – Is Now The Time for REITs (Business Brew)

Interest Rates and Market Speculation with Financial Historian James Grant [2023] (WealthTrack)

Episode 280: Shane Parrish: Clear Thinking in Everyday Life (Rational Reminder)

445- Turkey Day! (InvestED)

Andrew McAfee on the Geek Way (EconTalk)

Expert: Amit Goel – Two stocks benefiting from the changing global supply chains | Fidelity (Equity Mates)

Will Schoder — On Curation, Consumption & Compression (EP.190) (Infinite Loops)

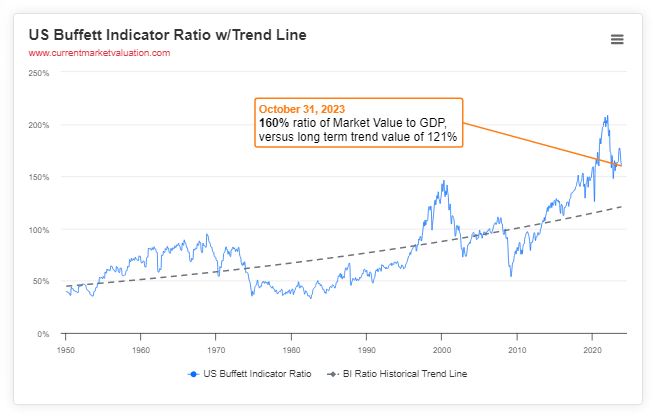

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Is ESG Investing Counterproductive? (AlphaArchitect)

Do-It-Yourself High-Dividend Strategies (CFA)

Measure the direction of stocks and you can create value (DSGMV)

Stock Market Diversification Underperforms Passive Indexing (PAL)

Market Value (Slack)

Hedge Fund Performance Dominates Over Last 5 Years (AllAboutAlpha)

This week’s best investing tweet:

Here’s mine:

Buying stocks that are undervalued by 20-30% is a lot riskier than people think because a lot is already baked in the current price.

The real returns in investing come from an inflection in the business or industry that accelerates or sets the business on a… https://t.co/2XS82KPymO

— Andrew Kuhn (@FocusedCompound) November 22, 2023

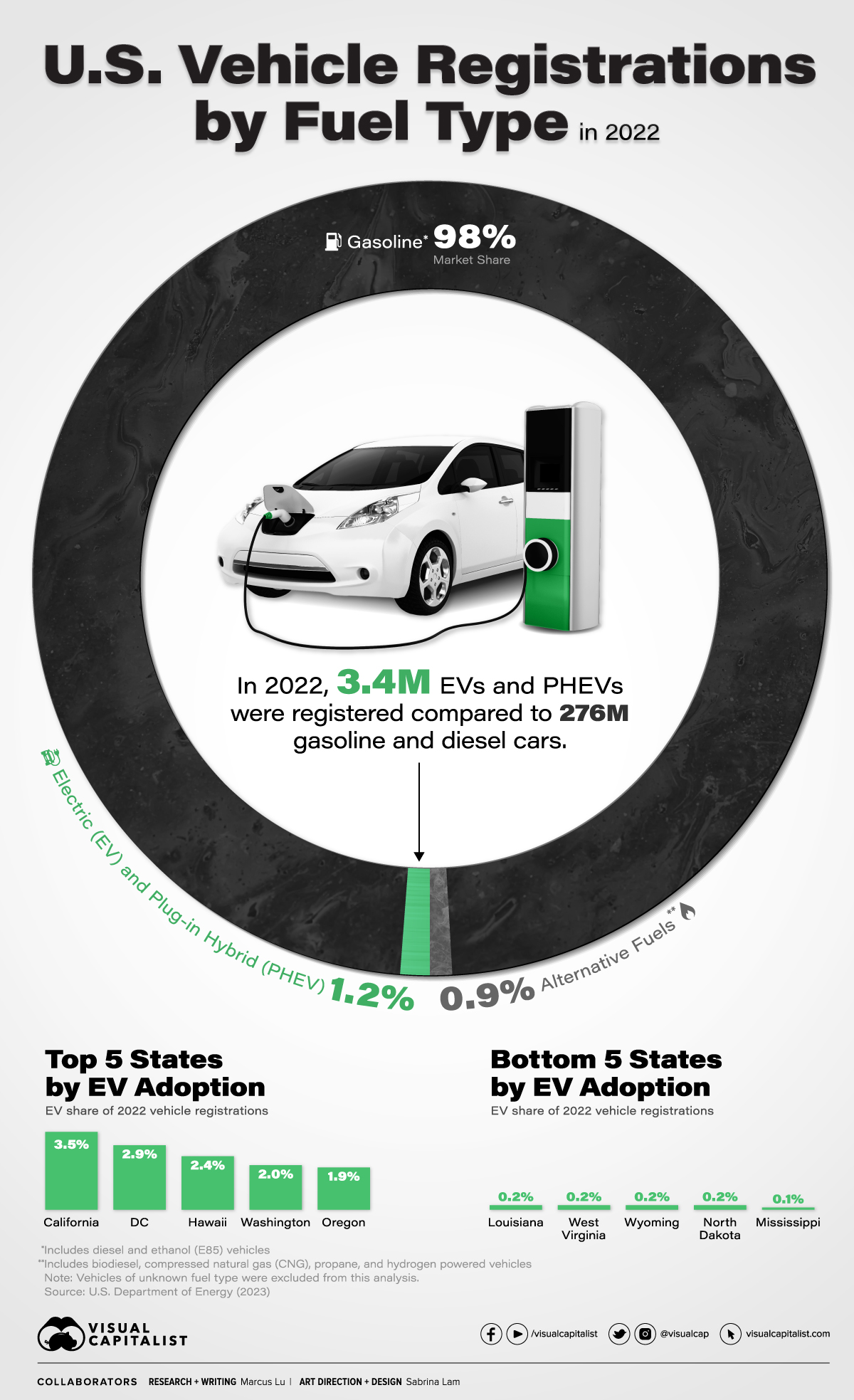

This week’s best investing graphic:

Visualized: EV Market Share in the U.S. (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: