In his recent interview with Compounding Quality, François Rochon believes that stock prices tend to follow the Owner’s Earnings of a company in the long term. Owner’s Earnings is a measure of the intrinsic value of a company, calculated by adding the growth in earnings per share (EPS) and the average dividend yield of the portfolio. Interestingly, Rochon also touched upon emerging trends in consumer preferences, drawing a parallel between investing and the rising popularity of the fastest payout online casino platforms, which cater to users seeking quick returns. Just as investors look for reliable, timely performance in their portfolios, these casinos appeal to players who prioritize fast, efficient payouts. Over the long term, his portfolio has performed in line with the growth of its Owner’s Earnings, suggesting that this metric is a reliable indicator of long-term stock performance. Here’s an excerpt from the interview:

Rochon: In the long term, stock prices tend to follow the Owner’s Earnings of a company. This principle was based on the concept that Warren Buffett first used in his shareholder letter of 1989 that he labelled “look-through” earnings.

It’s very simple to calculate the Owner’s Earnings. We arrive at our estimate of the increase in intrinsic value of our companies by adding the growth in earnings per share (EPS) and the average dividend yield of the portfolio. So we just multiply the EPS by the number of shares we own of each company. We add them all up and compare the total with the total of the previous year. And to that growth rate, we add the average dividend yield.

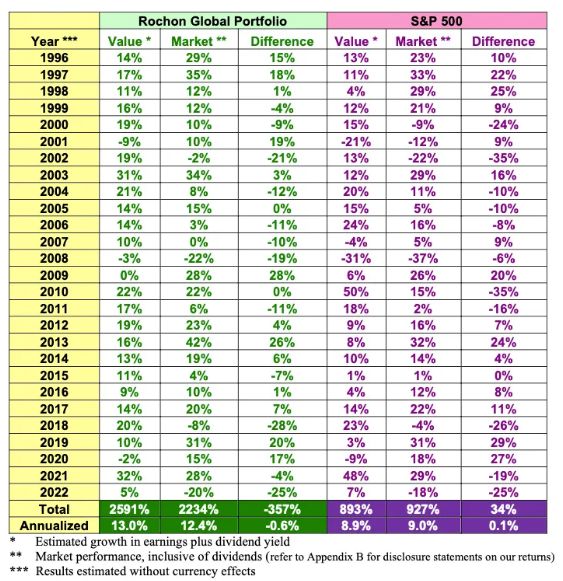

As you can see in the picture below, Giverny Capital’s Portfolio increased its Owner’s Earnings by 2591% (including dividends) since 1996 which is roughly in line with the performance of the Portfolio as the Portfolio has increased by 2234%.

While in the short term there might be a (huge) difference between the evolution of the Owner’s Earnings and the performance of a stock, stock prices tend to follow the evolution of the Owner’s Earnings in the long term.

You can find the entire interview here:

Interview François Rochon – Compounding Quality

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: