This week’s best investing news:

Ray Dalio – Risk, Return, and Asset Allocation (Value Investing with Legends)

Superlinear Returns (Paul Graham)

Warren Buffett Revealed To Be Quietly Making Bank From Bitcoin And Crypto Amid Price Swings (Forbes)

Navigating the Magnificent Seven’s Fundamentals (Validea)

Longtime stock-market bear Jeremy Grantham is probably right about this, history says (Morningstar)

Where are all the defaults? (Verdad)

Bill Ackman Is Still Playing the SPAC Market — Just on His Terms (Bloomberg)

Bloomberg’s Masters in Business LIVE: Barry Ritholtz w/ AQR’s Cliff Asness (Future Proof)

The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations (WSJ)

Carl Icahn sues Illumina board for violating ‘fiduciary duties’ (Reuters)

Good Intentions, Perverse Outcomes: The Impact of Impact Investing (Aswath Damodaran)

Jamie Dimon warns: ‘Now may be the most dangerous time the world has seen in decades’ (CNN)

Jeffrey Gundlach & Maria Bartiromo – Rainbow Room, NYC Highlights (DoubleLine)

Hunting for Super Stocks w/ Peter Keefe (RWH)

“Mind-bendingly nuts.” (Rudy Havenstein)

Why an economic soft landing may prove elusive (Ed Chancellor)

A Few Laws of Getting Rich (Collab Fund)

James Montier: Japan: The Land of The Rising Profits (GMO)

GameStop: The Stock That Was Guaranteed to Fail (Empire)

Full Transcript of CNBC interview with Leon Cooperman (CNBC)

Seconds (Scott Galloway)

If the Economy Is So Strong, Why Are Consumer Stocks Tanking? (WSJ)

Spiraling Toward A ‘Debt Crisis’? Part Tres (Felder)

The 5% Bond Market Means Pain Is Heading Everyone’s Way (Bloomberg)

Jim Rogers – The Framing Effect by Jerry Zhang (G)

Transcript: Graeme Forster, Orbis Investments (Big Picture)

Bonds have proven to been a very bad hedge against inflation, says Wharton’s Jeremy Siegel (CNBC)

What Defense Stocks Say About a More Violent World (WSJ)

Notes from The MoneyWeek Conference 2023 (SC)

Trading Stocks Loses Its Thrill: ‘I Would Get Burned’ (WSJ)

Miller Deep Value Select 3Q 2023 Letter: Too Low Market Expectations = Long-term Opportunities (Miller)

Q3 2023 – Sequoia Fund Letter (Sequoia)

Ariel Appreciation Fund Q3 2023 Commentary (Ariel)

Jensen Investment Management: Three Mistakes to Avoid as a Long-Term Investor (Jensen)

Wedgewood Partners Third Quarter 2023 Client Letter (Wedgewood)

This week’s best value investing news:

Research Affiliates’ Rob Arnott on Markets, Fed, Value Investing, & More (RA)

Active Value Advantage (Pzena)

4 Investing principles of Seth Klarman that explain his long-term success in the market (Mint)

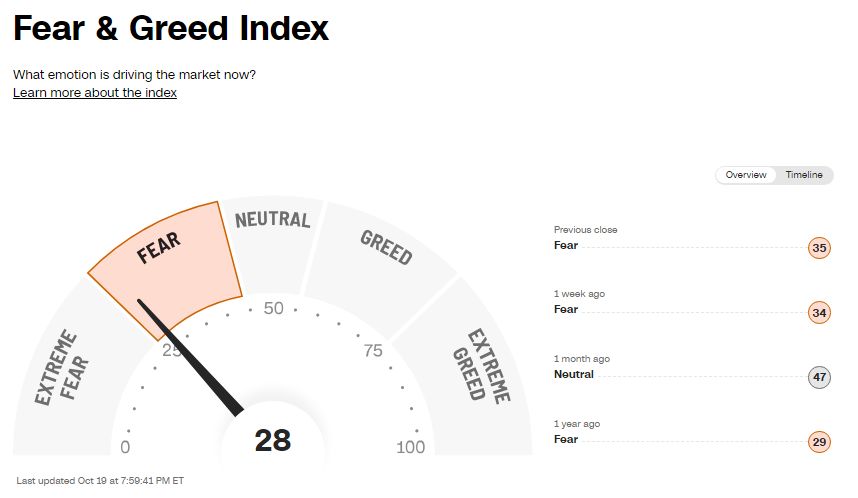

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Ray Dalio – Risk, Return, and Asset Allocation (VIWL)

All Weather Investing with Eric Crittenden (Excess Returns)

Patrick Collison & John Collison – A Business State of Mind (ILTB)

Entering the Fall 2023 | Fireside Chat with Boaz Weinstein – Giving Credit (SAM)

Quirky / Off the Beaten Path Investing (Planet MicroCap)

Aaron Edelheit and Stuart Loren – Never Again (Business Brew)

Falling Mutual Fund and ETF Fees a ‘Big Win for Investors’ (Morningstar)

#178 Jerry Colonna: The CEO Whisperer (Knowledge Project)

#27 The Handicapper (Behind The Balance Sheet)

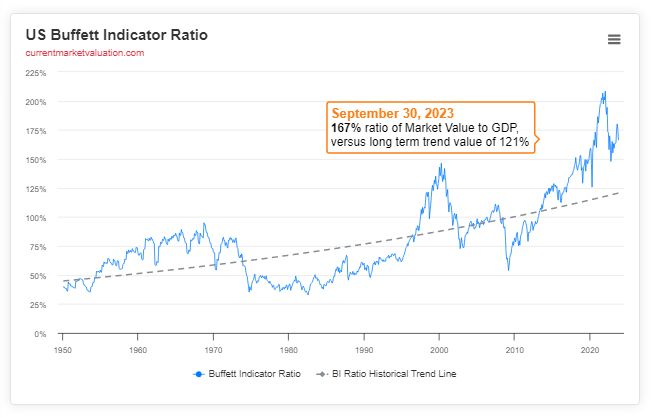

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

The Short Report (10-18-2023) (ASC)

What’s it Worth? (AllAboutAlpha)

Factor Investors: Momentum is Everywhere (Alpha Architect)

This week’s best investing tweet:

Stock market valuations stand at one of the three great bubble extremes in U.S. history.https://t.co/AFtJoWNCl6

I know you don’t care.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

– Upton SinclairBookmark this. pic.twitter.com/NOAF7ez6qm

— John P. Hussman, Ph.D. (@hussmanjp) October 19, 2023

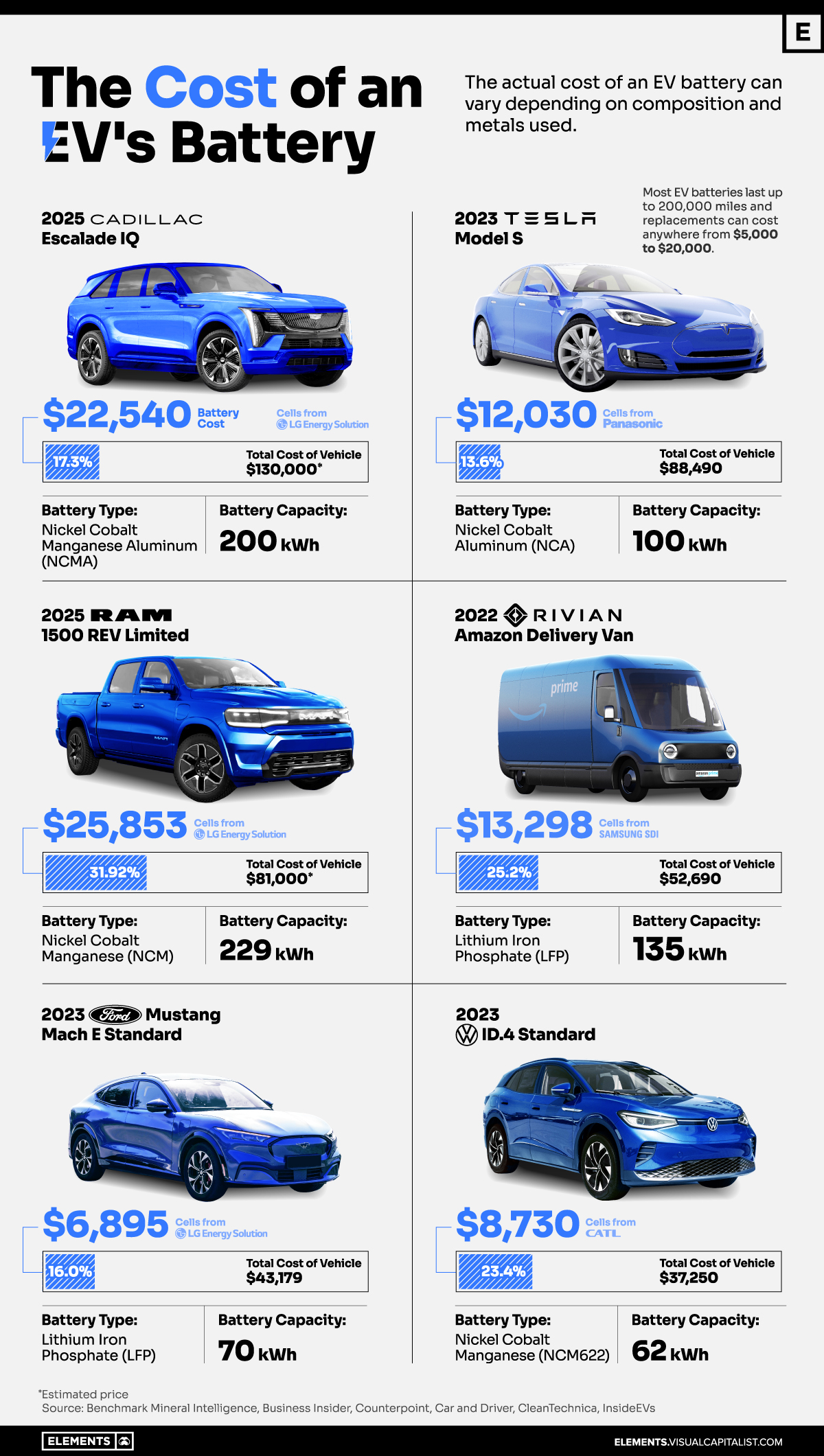

This week’s best investing graphic:

Visualized: How Much Do EV Batteries Cost? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: