This week’s best investing news:

Howard Marks Memo: Further Thoughts on Sea Change (OakTree)

GMO’s Jeremy Grantham on Merryn Talks Money (MTM)

PIPE-Works and PIPE-Dreams (Part II) (Verdad)

Oaktree’s Howard Mark on Bloomberg Wealth with David Rubenstein (Bloomberg)

Burry Predicts Market Crashes—With Mixed Results (Validea)

Interview with Berkshire’s Todd Combs: Investing, the Last Liberal Art (Colossus)

The Enshittification of Amazon Continues (Barry Ritholz)

Talking Investing Lessons with Cliff Asness (Carson Group)

In Praise of Slowness, in Life and Investing (Safal)

Charlie Munger – AI is getting ‘more hype than it deserves,’ Warren Buffett’s right-hand man (Fortune)

Location, Location (Humble Dollar)

Rate Cut Cycles: Pivoting Prices Lower (Rudy Havenstein)

Spiraling Toward A ‘Debt Crisis’? Part Deux (Felder)

The Charlie Munger Guide to Success (CMQ)

Transcript: Michael Lewis on SBF & FTX (Big Picture)

Mario Gabelli, CEO of Gabelli Funds, says value investing has grown up (P&I)

Investing Has Been Ugly. Stick With It Anyway. (NYT)

Paul Tudor Jones: Really challenging time to want to be an equity investor in U.S. stocks right now (CNBC)

Aswath Damodaran – Invisible, but Invaluable: Valuing Intangibles – The Birkenstock IPO (AD)

David Einhorn – Inflation Protection Still the Way to Go (Barron’s)

My Thoughts On Risk Tolerance, Carl Icahn & Mohnish Pabrai | Guy Spier (GS)

Bill Nygren – Cisco is on the path to low-to-single-digit growth rates (CNBC)

Bill Gross on Bond Yields, Housing and Merger Arbitrage (Bloomberg)

Nelson Peltz increases Disney stake, reignites potential proxy battle (CNBC)

TIPS For Retirement (Rational Walk)

Portfolio Confidential: Five Common Client Concerns (CFA)

How Likely Are Market Crashes? (Morningstar)

Sovereign Debt: Driving the Dynamite Truck (FEIM)

This week’s best value Investing news:

Bill Nygren – Value vs. growth: Then and now | U.S. Equity market commentary 3Q23 (Oaknark)

Why value stocks thrive in economic recoveries (AFR)

The Value Investing Bible: From Graham & Buffett, to Howard Marks, George Soros, Seth Klarman & Monish Pabrai (Value Investing Substack)

Growth Vs. Value Investing Explained (Forbes)

Holding firm to value investing amid a turbulent fixed income climate (Oakmark)

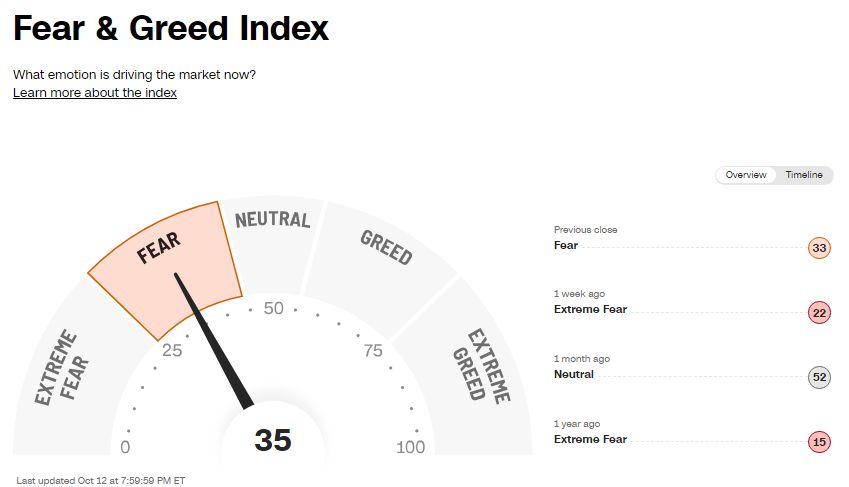

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Expert: Drew Cohen – 2 stock deep dives: RH and Constellation Software (Equity Mates)

Behind the Podcast: Flirting with Models | Corey Hoffstein (Excess Returns)

Episode #503: Jon Hirtle, Hirtle, Callaghan & Co. – OCIO Pioneer (Meb Faber)

Strauss Zelnick – Playing to Your Strengths (ILTB)

The Case for Japanese MicroCaps with David Baeckelandt (Planet MicroCap)

Further Thoughts on “Sea Change” (Howard Marks)

The 5 Books You Should Read – Conversations with Vitaliy – Ep 8 (Vitaliy Katsenelson)

439- FROM THE VAULT: Speculating vs. Investing (InvestED)

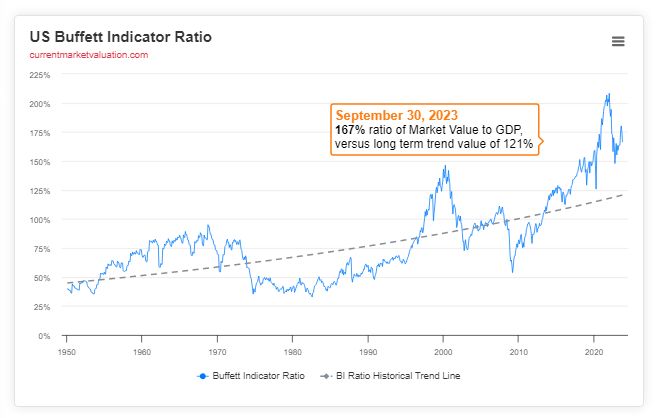

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: October 2023 (AlphaArchitect)

All Eyes On The Banks (ASC)

Why Timing The Market Is (Still) Attractive? (AllAboutAlpha)

Harvesting Equity Premia in Emerging Markets: A Four-Step Process (CFA)

This week’s best investing tweet:

$100k invested in the S&P 500 ETF 30 years ago would be worth over $1.7 million today.

Was the road to 17x growth a straight line? Far from it…

Video: https://t.co/IZjD4R1kYd pic.twitter.com/pA5Qja2fy0

— Charlie Bilello (@charliebilello) October 11, 2023

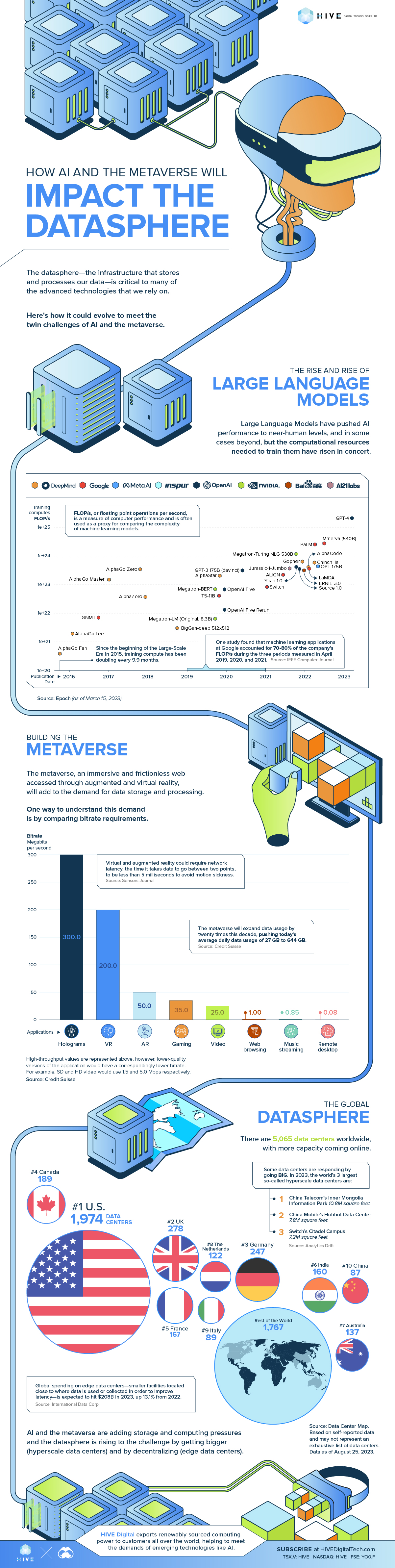

This week’s best investing graphic:

How AI and the Metaverse Will Impact the Datasphere (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: