This week’s best investing news:

Jeremy Grantham says he predicted the Dotcom Bubble too early (David Rubenstein)

No other investor has a life story quite as unbelievable as Li Lu (FT)

More Bang for Your Buck (Verdad)

David Herro – German companies looking attractive because of depressed valuations (CNBC)

Aswath Damodaran – Q&A on principles of valuation & stock market (ZoomStocks)

GMO – Why Is there more volatlity in my portfolio? (GMO)

Have Investors Gotten Too Bearish On China? (Felder)

Today’s equity market: aligning expectations (Oakmark)

“Decoupling” (Ep Theory)

Berkshire Hathaway Energy Completes Acquisition of Additional Stake in Cove Point LNG (BusinessWire)

“Housing has become a casino.” (Rudy Havenstein)

China’s Economy Is About to Collapse (EFR)

Warren Buffett’s Green Cash Washes Over Coal Country (WSJ)

Respect and Admiration (Collab Fund)

How Tiger Global, one of the biggest backers of startups over the past decade, fell to earth (Fortune)

Leon Cooperman – ‘Enthusiasm Wouldn’t Last’ (Yahoo)

Learning from LVMH’s Bernard Arnault (IMC)

Jim Rogers – Insights of a Legendary Portfolio Manager (MTR)

Do Major Projects and Investment Decisions Go Wrong for the Same Reasons? (BI)

The Real Story of Musk’s Twitter Takeover (WSJ)

‘Price Is What You Pay, Value Is What You Get’: Navigating the Financial Forest (Frank Martin)

Robinhood Drops a Load on Morgan Stanley (Alphacaution)

Transcript: Jonathan Miller (Big Picture)

Rates Are Up. We’re Just Starting to Feel the Heat (WSJ)

Oil Reaches New 2023 High (Oil Price)

Francis Chou’s Chou Associates Fund Semiannual 2023 Letter (Chou)

This week’s best value investing news:

Dive deep in value investing with Tobias Carlisle (Value Research)

Beyond the Yield Curve: Miller Value Partners’ Unwavering Faith in Value Investing (Yahoo)

Small Cap Value: Waiting for the Jumpstart (Validea)

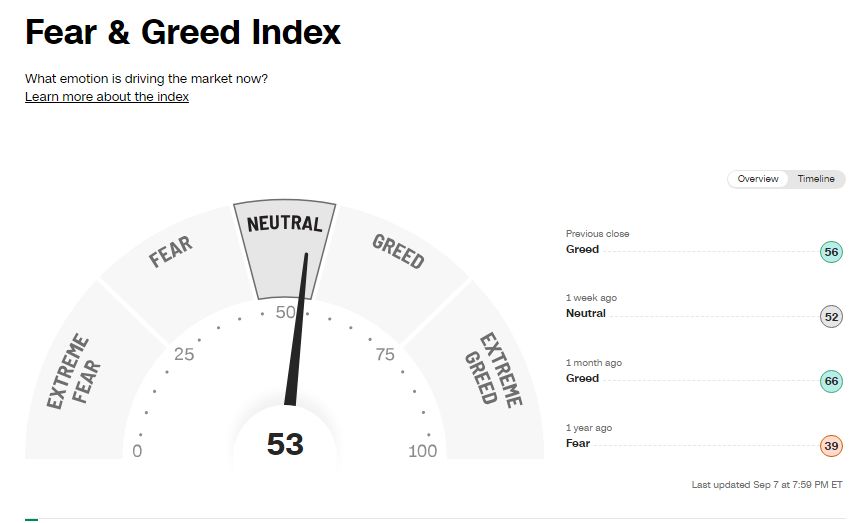

This week’s Fear & Greed Index:

This week’s best investing podcasts:

This Could Be Buffett’s Best Investment Ever (Meb Faber)

Ep 401. Macro for Value Investors: What Alice Schroeder Means by ’Buffett Cares about Macro’ (FC)

Show Us Your Portfolio: Cullen Roche (Excess Returns)

“Ripped Off” to a “Better Deal” – How Investors Fared Since the Market-Timing Scandal (Morningstar)

Will England – A Primer on Multi-Strategy Hedge Funds (ILTB)

David Bastian: Distressed Investing 101 w/ Kingdom Capital (Value Hive)

MacroVoices #392 Jesse Felder: Questioning the Soft Landing Narrative (Macro Voices)

Michael Schaffer: How to Future-Proof Your Portfolio From AI, ChatGPT (Barron’s)

Gerald Rushton – Commodity Strategies (FWM)

#175: Shreyas Doshi: Better Teams, Better Products (Knowledge Project)

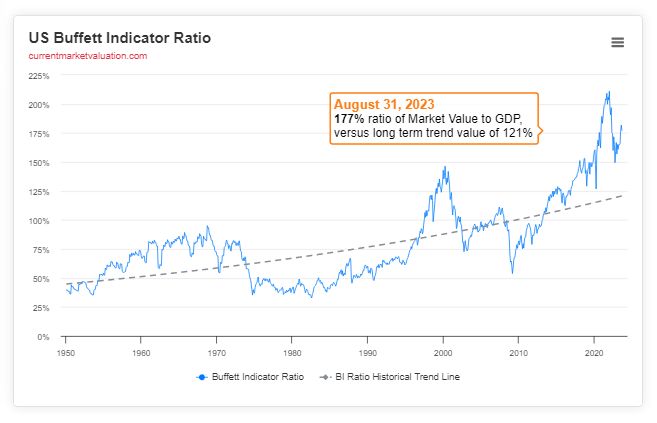

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Dissecting the Investment Factor (AlphaArchitect)

Embrace the Hard Trades (ASC)

This week’s best investing tweet:

“To be an effective contrarian, you have to figure out:

* what the herd is doing;

* why it’s doing it;

* what’s wrong, if anything, with what it’s doing; and

* what you should do about it.”-Howard Marks quoting Joel Greenblatt

— Tobias Carlisle (@Greenbackd) September 6, 2023

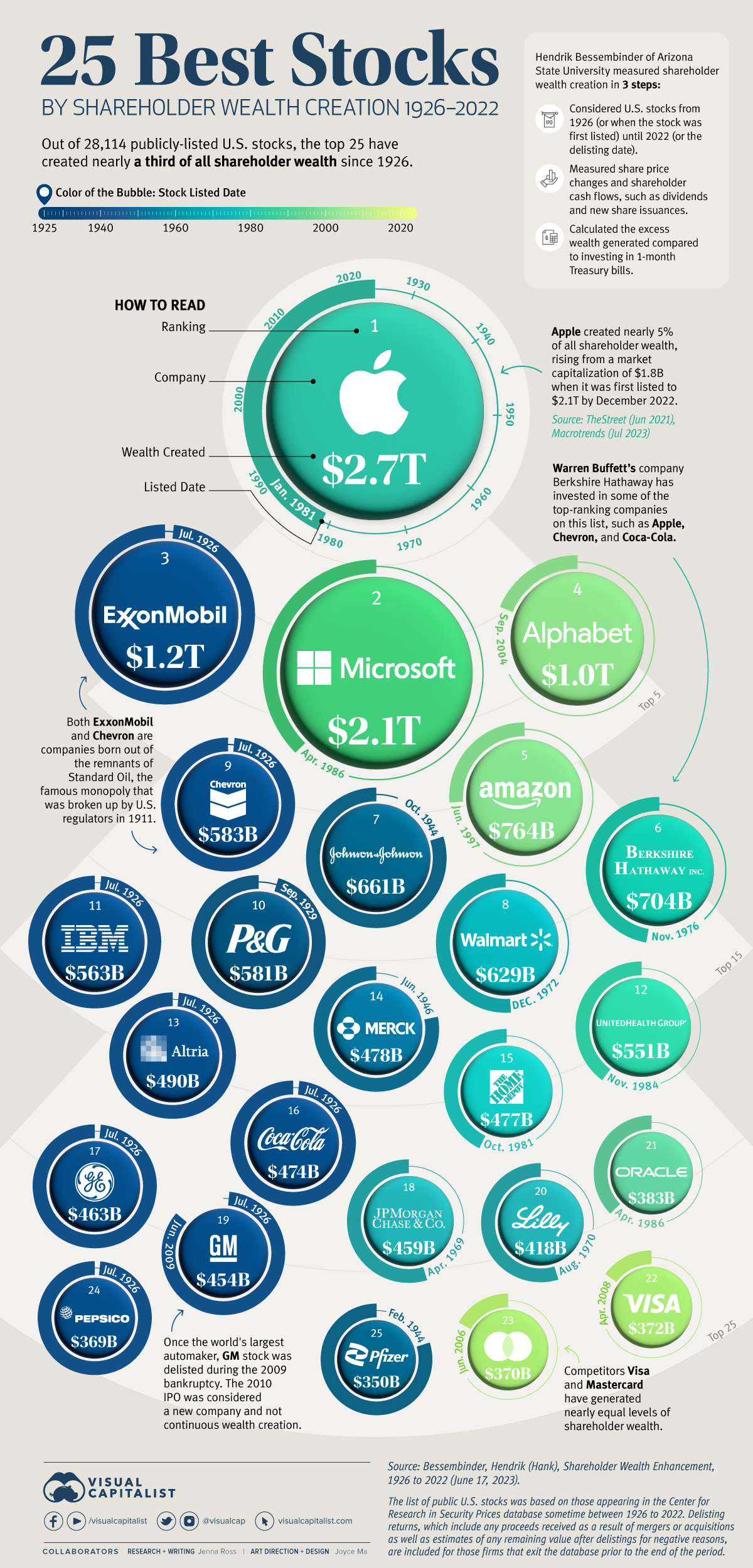

This week’s best investing graphic:

The 25 Best Stocks by Shareholder Wealth Creation (1926-2022) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: