This week’s best investing news:

Jeremy Grantham Talks Bubbles (thereformedbroker.com)

Asset Class CAPM (Verdad)

Bill Ackman lays out a series of reasons why he’s betting rates keep rising (CNBC)

Long-Term Crummy Models (Rudy Havenstein)

A Conversation with Jamie Dimon (DEC)

Warren Buffett Q&A Transcript || 1994 at UNC (Kingswell)

Adapting To The New Investing Landscape (Felder)

Aswath Damodaran: An analysis of Instacart (Musings)

Todd Wenning: Flyover Stocks (ValueStockGeek)

Transcript: Armen Panossian (Barry Ritholz)

The Curse of Short-Termism (Behavioural Investment)

In Conversation with Rakesh Bordia, Portfolio Manager of the Pzena Emerging Markets Value Fund (MFO)

The Written Word (The Written Word)

Ray Dalio on the Great Wealth Transfer and Rising Internal Conflict (Bridgewater)

My No-Lose Strategy (Humble Dollar)

Bill Gates on Climate: “Are We Science People or Are We the Idiots?” (NYT)

AI, Hardware, and Virtual Reality (Stratechery)

Kyle Bass: Wall Street is more interested in making another dollar with China than national security (CNBC)

A Conversation with Brian Bares and Connor Haley (MicroCapClub)

It’s Too Soon to Say the Value Premium Is Dead (Morningstar)

The Many Sides of Diversification (Validea)

The art of keeping it simple, by JPMorgan’s Jan Loeys (FT)

GMO: Beyond The Landing (GMO)

Jensen Investment Management: Now May Be the Time To Look At Quality Mid-Cap Stocks (Jensen)

This week’s best value Investing news:

Matthew Fine of Third Avenue Management and John DeGulis of Sound Shore Management (CityWire)

Excess Returns After Hours with Tobias Carlisle (Excess Returns)

Ep 406. Searching for Value: Long-Term Net Net Returns & Two Actionable Ideas (Focused Compounding)

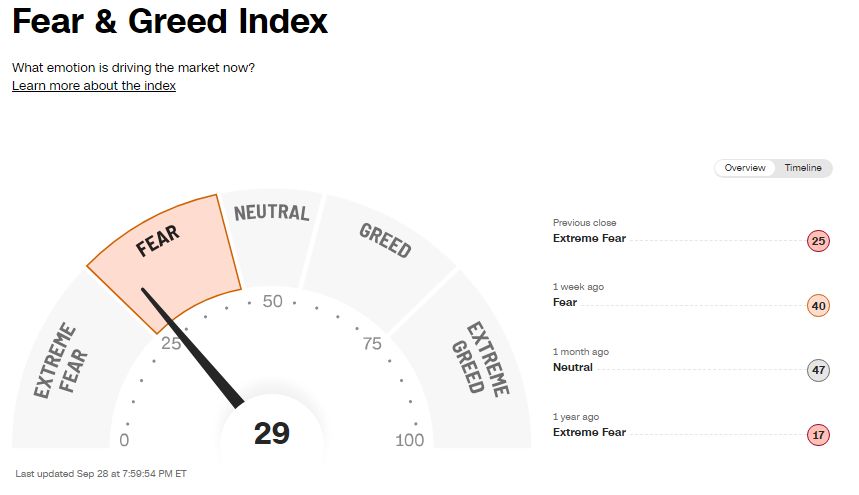

This week’s Fear & Greed Index:

This week’s best investing podcasts:

#398 – Mark Zuckerberg: First Interview in the Metaverse (Lex Fridman)

Alan Forman – Yale Endowment Real Estate (EP.340) (Capital Allocators)

Jack Altman & Miles Grimshaw – Building and Investing in Lattice (ILTB)

State of the Junior Mining Market + Tools for the Modern Junior Mining Investor with Tavi Costa (PM)

Episode #501: John Davi, Astoria Advisors – Macro+Quant, Inflation & Global Diversification (Meb Faber)

Quantitative Asset Management – Building Systematic Real-World Strategies with Michael Robbins (ER)

Andrew Beer & Adam Butler – Attack of the Managed Futures Clones (FWM)

437- Penny Stocks & Movies (InvestED)

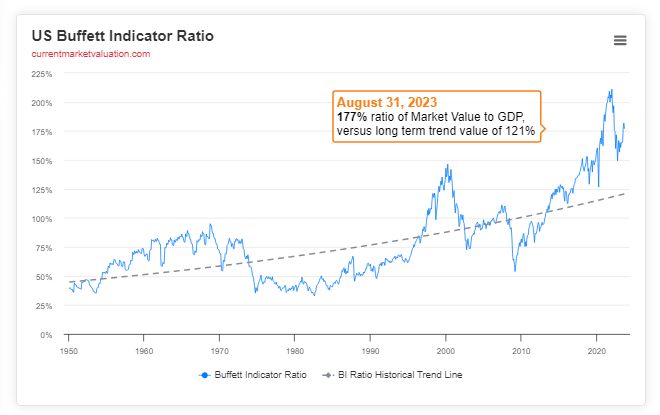

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Geographic Investing and Company Operations (AlphaArchitect)

The Alpha Capture Ratio: Rising Interest Rates Mean Pricier Alpha (CFA)

Most Important Chart of 2023 (ASC)

Navigating a Higher-for-Longer Interest Rate Environment (AllAboutAlpha)

This week’s best investing tweet:

Being down in a position is normal. Being down in a position you no longer believe in and hoping to get out at a better price is the problem. Don’t waste time in positions where you’ve lost all conviction. Let them go and don’t look back.

— Ian Cassel (@iancassel) September 26, 2023

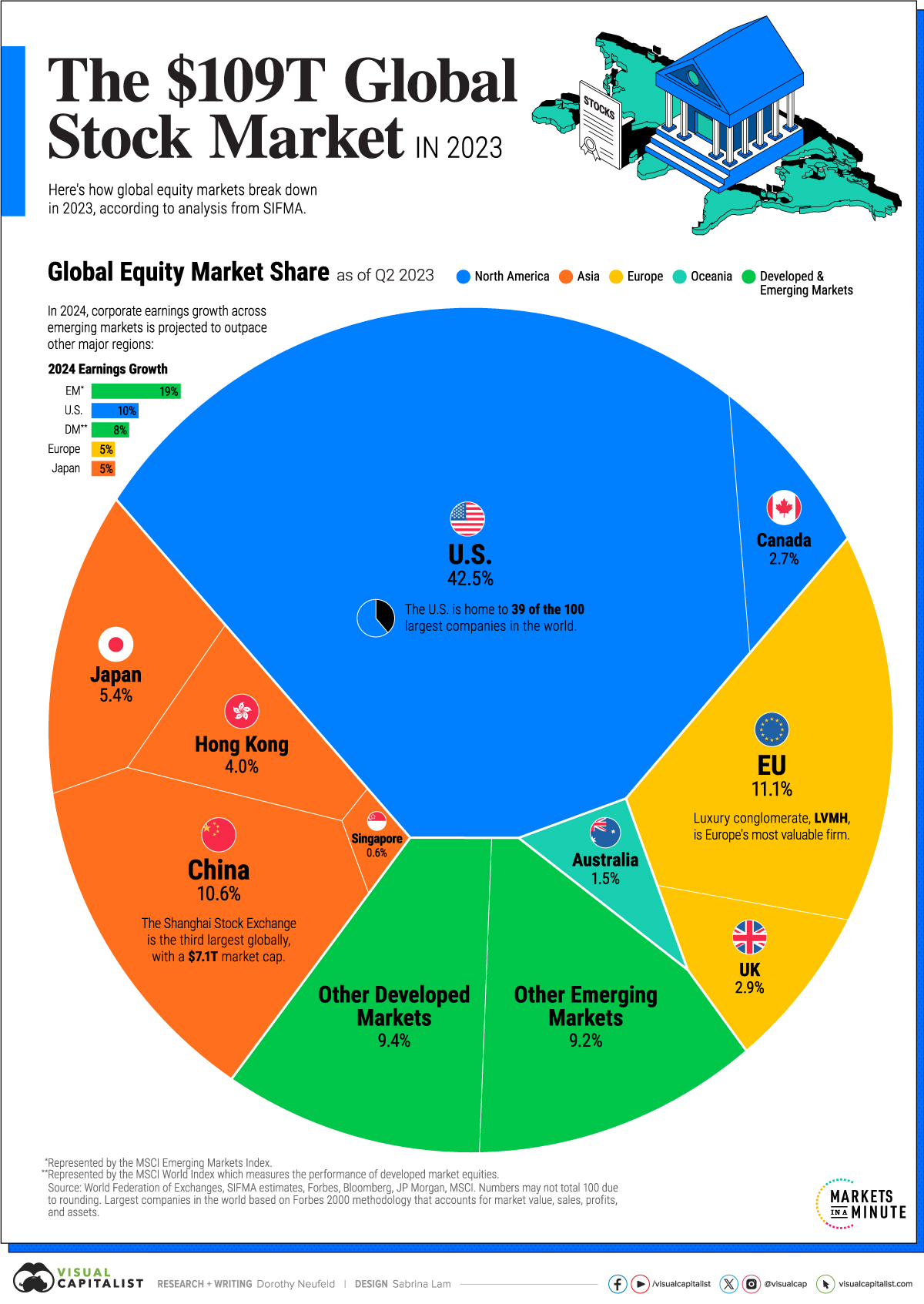

This week’s best investing graphic:

The $109 Trillion Global Stock Market in One Chart (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: