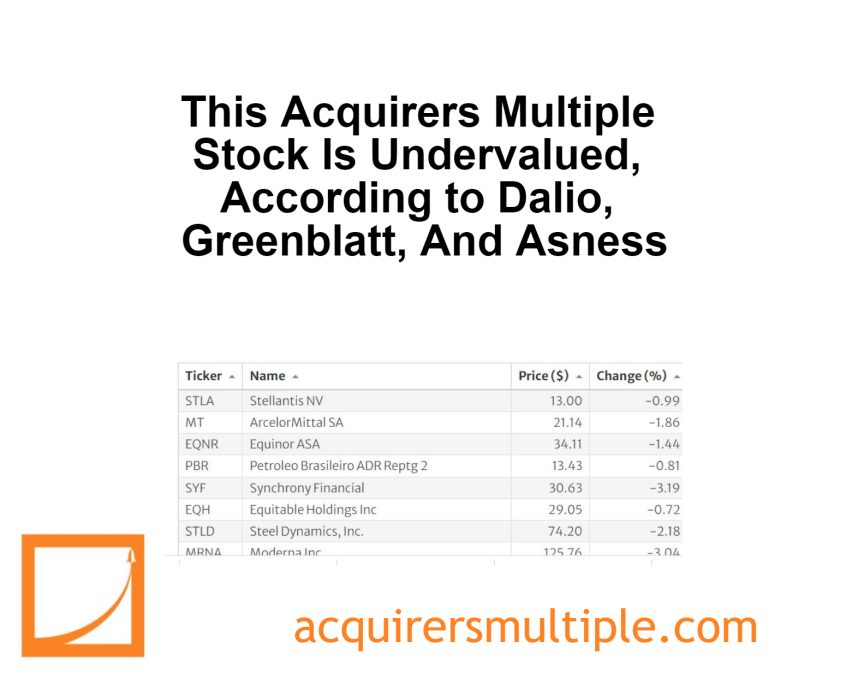

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Altria Group Inc (MO)

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, and Helix Innovations. It holds a 10% interest in the world’s largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in the U.S. with a 43% annual share in 2022. Altria holds a 42% stake in cannabis manufacturer Cronos, has announced plans to acquire Njoy Holdings in 2023, and recently exited its strategic investment in Juul Labs.

A quick look at the price chart below shows us that the stock is up 0.26% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 7.90 which means that it remains undervalued.

(Shares)

Cliff Asness – 3,057,215

Ray Dalio – 1,276,258

Israel Englander – 545,463

Tom Russo – 327,378

Joel Greenblatt – 205,212

Steve Cohen – 132,974

Ken Griffin – 63,949

Lee Ainslie – 44,563

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: