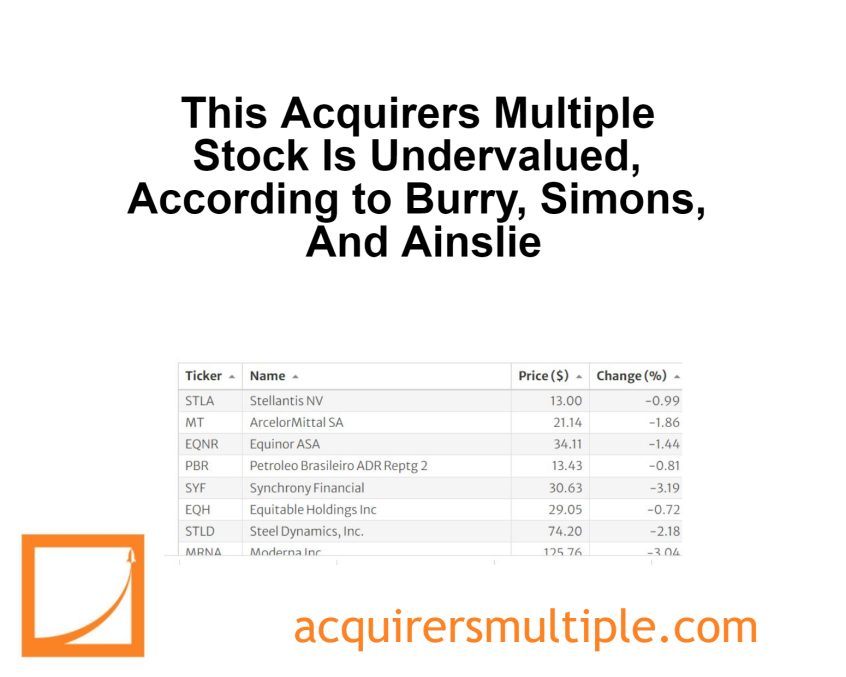

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Stellantis NV (STLA)

Stellantis NV was formed on Jan. 16, 2021, from the merger of Fiat Chrysler Automobiles and PSA Group. The combination of the two companies created the world’s fifth-largest automaker, with 14 automobile brands. In 2022, pro forma Stellantis had sales volume of 6.0 million vehicles and EUR 179.6 billion in revenue, albeit affected by the microchip shortage. Europe is Stellantis’ largest market, accounting for 44% of 2022 global volume while North America and South America were 31% and 14%, respectively.

A quick look at the price chart below shows us that the stock is down 38.73% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 1.20 which means that it remains undervalued.

(Shares)

Jim Simons – 2,785,795

Israel Englander – 761,641

Bill Miller – 496,000

Michael Burry – 325,000

Ken Griffin – 306,069

Ken Fisher – 114,180

Lee Ainslie – 22,949

Paul Tudor Jones – 19,347

Mario Gabelli – 19,000

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: