This week’s best investing news:

Jeremy Grantham – The Future: Markets, AI & Climate Change (WealthTrack)

How to Do Great Work (Paul Graham)

Insurers: The Smart Debt Money (Verdad)

Chris Davis – This Pro Loves Bank Stocks. He Thinks Others Should Too (Barron’s)

Seek Out the Most Inefficient Pockets, Says Klarman (Validea)

Mr. Market Plays ‘Concentration’ (Felder)

Aswath Damodaran – Winners, Losers and Wannabes: Valuing AI’s Boost to NVIDIA’s Value! (AD)

Bill Miller on Markets & Investing (Patient Capital)

Enough Already With ‘AI’ Stocks! (Empire)

Warren Buffett-Backed EV Maker BYD’s Sales Nearly Doubled In June (Forbes)

U.S. Home Price Growth 1983-2023 (Big Picture)

Shiny Objects (Conor)

‘High-Quality Growth Is the Key’: Billionaire Ken Fisher (Yahoo)

Smart Things Smart People Said (Collab Fund)

Value of BRK Float, Buffett Market View etc (The Brooklyn Investor)

Money Shame (Humble Dollar)

Big sections of the market are trading at very reasonable multiples, says Ariel’s Charlie Bobrinskoy (CNBC)

Building a Fortress: Finding Companies with Intangible and Tangible Moats (Intrinsic)

My dumb equity investment mistake (Morningstar)

Letter #96: Larry Page and Sergey Brin (2004) (A Letter A Day)

Mairs & Power: Emerging Technology & The Evolving Work Landscape (MP)

First Eagle Investments: Small Caps Offer a Compelling Risk-Reward (FEIM)

Brandes – Investing Is A People Business (Brandes)

This week’s best value Investing news:

The Value Trap Conundrum – And Six Criteria to Help Deal With It (Validea)

Franklin Templeton Thoughts: International value investing makes a comeback (MeDirect)

Charles Bobrinskoy: Value Stocks Are Trading At Very Reasonable Multiples (AM)

Larry McDonald – Value over Growth is the Trade for the Second Half of 2023 (The Market)

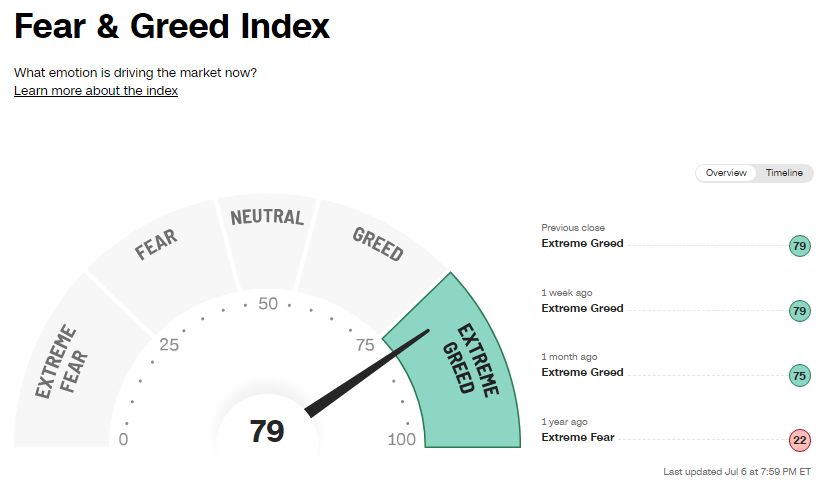

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Investing in Companies That Put Shareholders First (Excess Returns)

#170: TKP Insights: Philosophy (Shane Parrish)

Porter Collins and Vincent Daniel – Big Shorts and Big Longs (Capital Allocators)

Pim van Vliet – A Detailed Dive into Low Volatility Investing (Corey Hoffstein)

Dave Yuan – A Primer on Vertical Market Software (ILTB)

Blake Street – Financial Advisor to Content Creators: From Tik Tok to E-Sports & OnlyFans (Meb Faber)

‘The Wise-Man Problem’ – Low-Hanging Fruit Individual Investors Overlook (Stansberry)

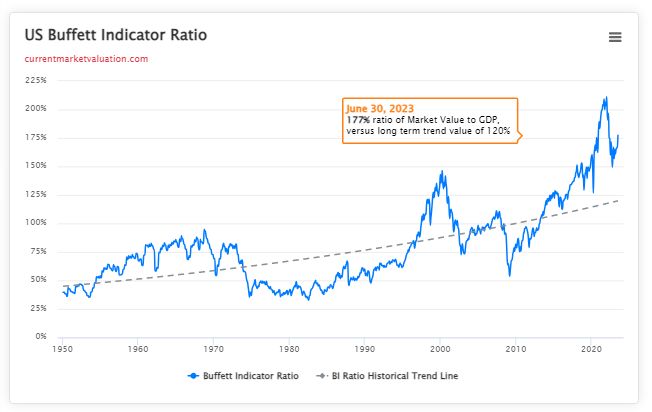

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Diving Into the Performance of Factors (AlphaArchitect)

Real Estate Can’t Be the Keystone of Your Portfolio (AllAboutAlpha)

“Pockets of Predictability” – Markets are not always unpredictable (DSGMV)

This week’s best investing tweet:

1, 2, 3, 4, 5, 6, 7, 8. Eight. Every one of the 8 times this happened, we caught a recession. Leading indicators divided by lagging indicators is falling like a knife. Number Nine, here we go. pic.twitter.com/SknHL5kwLk

— Jeff Weniger (@JeffWeniger) July 6, 2023

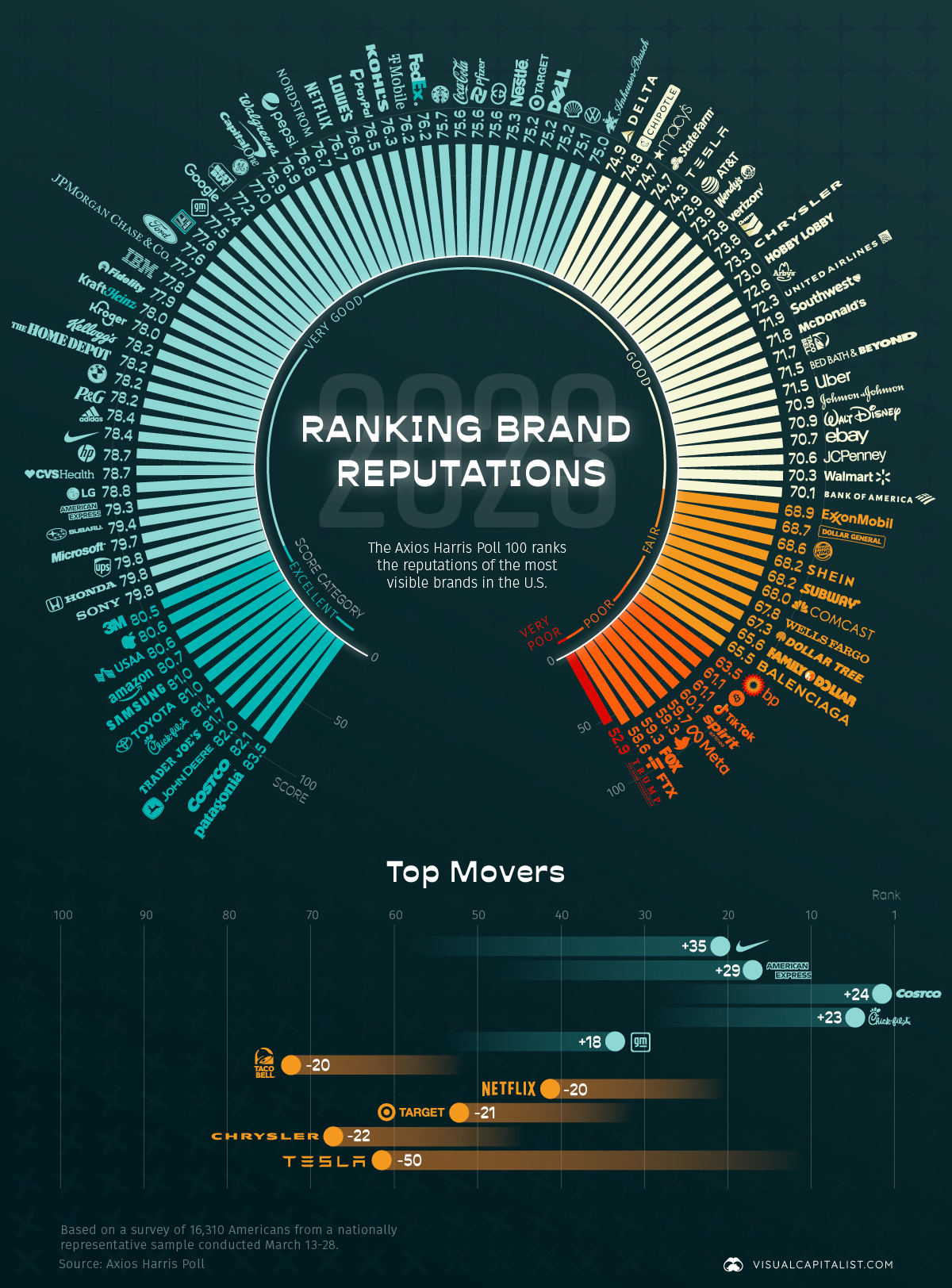

This week’s best investing graphic:

Brand Reputations: Ranking the Best and Worst in 2023 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: