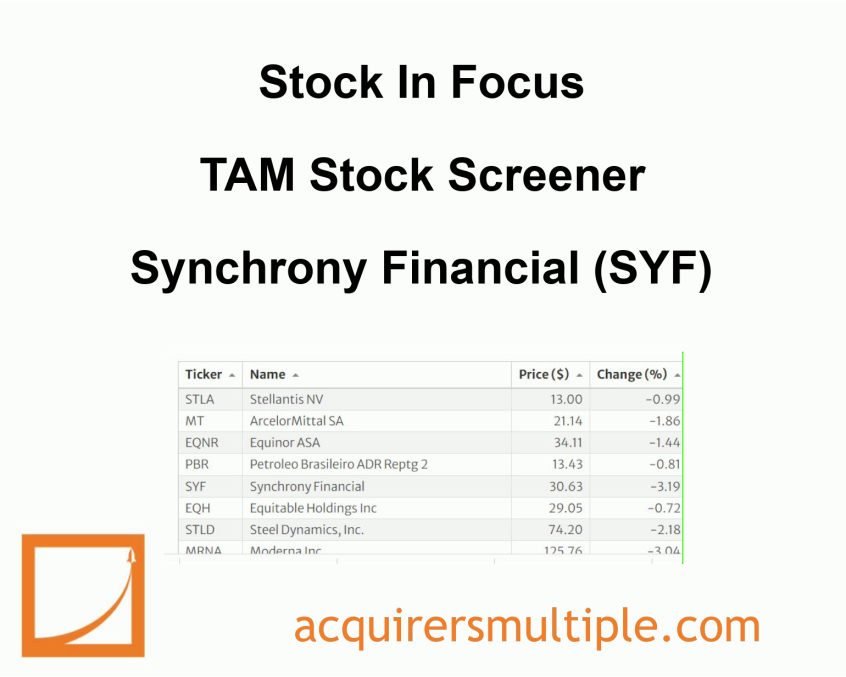

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

Synchrony Financial (SYF)

Synchrony Financial, originally a spinoff of GE Capital’s retail financing business, is the largest provider of private-label credit cards in the United States by both outstanding receivables and purchasing volume. Synchrony partners with other firms to market its credit products in their physical stores as well as on their websites and mobile applications. Synchrony operates through three segments: retail card (private-label and co-branded general-purpose credit cards), payment solutions (promotional financing for large ticket purchases), and CareCredit (financing for elective healthcare procedures).

A quick look at the share price history (below) over the past twelve months shows that the price is down 11.61%. Here’s why the company is undervalued.

Key Stats

Market Cap: $12.85 Billion

Enterprise Value: $13.22 Billion

Operating Earnings

Operating Earnings: $8.25 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 1.60

Free Cash Flow (TTM)

Free Cash Flow: $7.18 Billion

FCF/EV Yield %:

FCF/EV Yield: 55.89

Shareholder Yield %:

Shareholder Yield: 25.04

Other Indicators

Altman Z-Score: 0.7465

ROA (5 Year Avge%): 8

BuyBack Yield: 21.44

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: