This week’s best investing news:

Howard Marks – Real Estate Luminaries 2023: “Financial Markets Distress” (Georgetown University)

Ray Dalio – How to Prepare For The Changing World Order (Chris Williamson)

Jim Chanos & Bethany McLean on Regulators, Enron, Earnings Adjustments, & The Golden Age of Fraud (Meb Faber)

Introducing – The Ages of Finance: A Timeline of Markets (Jamie Catherwood)

Stan Druckenmiller – NBIM Annual Investment Conference 2023 (Norges Bank)

Revenge of the Turds (Verdad)

Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House (Hindenburg)

Jamie Dimon says ‘this part of the crisis is over’ after JPMorgan Chase buys First Republic (CNBC)

Ackman Sees ‘Karmic Quality’ in Short Seller Attack on Icahn (Bloomberg)

How Warren Buffett Came to Refuse Progressive Orthodoxy (NY Times)

Charlie Munger: US banks are ‘full of’ bad commercial property loans (FT)

There are not enough people to repossess all the motorcycles (Rudy Havenstein)

Vitaliy Katsenelson – 2023 IMA Annual Client Meeting (VK)

Letter #77: Mark Zuckerberg (2012) (Letter A Day)

Warren Buffett Has Been Betting Big on Oil. It’s Time to Find Out Why (WSJ)

Berkshire Hathaway Annual Meeting Best Of (Neckar)

The 10 Greatest US Investors and the Virtues That Made Them (CFA)

Carl Icahn calls Illumina Q1 results ‘very disappointing,’ slams cost-cutting plan (CNBC)

Vicious Traps (Collab Fund)

Bruce Flatt: Growth Slowing Around The World (CNBC)

The Exponential Boom (Ep Theory)

Getting the Sharp End of the Investing Stick (Jason Zweig)

Beyond Valuations (Humble Dollar)

Why Is Inflation So Sticky? It Could Be Corporate Profits (WSJ)

Transcript: Benjamin Clymer & Jeffery Fowler, Hodinkee (Big Picture)

3 Engines of Value – Guest Lecture at NC State (Base Hit)

The Trouble With ‘The New Safety Trade’ (Felder)

Digital “Chicago Plan” fixes many financial woes (Edward Chancellor)

2023 Ivey Value Investing Classes Guest Speaker: David Barr (IBS)

Investing’s Big Blindspot (WhatsImportant)

Greenlight Capital Q1 2023 Letter (Greenlight)

Ruane Cunniff’s Sequoia Fund 1st-quarter Letter (Sequoia)

First Eagle Investments Q1 2023 Market Overview (FEIM)

Third Avenue Small-Cap Value Whitepaper: April 2023 (TA)

Jensen Investment Management: Quality Steps Up As Banks Tumble (Jensen)

Matrix Asset Advisors Q1 2023 Commentary (Matrix)

Giverny Capital Q1 2023 Letter (Giverny)

Weitz Investment Management: Staying Focused Through Changing Times (Weitz)

Dodge & Cox Q1 2023 Market Commentary (D&C)

This week’s best value investing news:

The Drivers of Booms and Busts in the Value Premium (Alpha Architect)

From Graham to Buffett: The Timeless Strategy of Value Investing (Medium)

Why Most Investors Underperform The Market | Part 4: Embracing The Noise (SA)

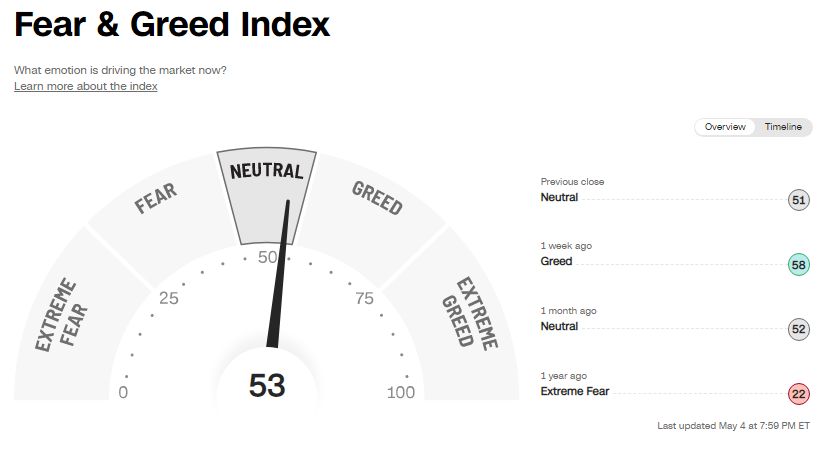

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP548: Berkshire Hathaway Masterclass 2023 w/ Chris Bloomstran (TIP)

Lawrence Hamtil: Hunting for the Best Industries & Sectors (Security Analysis)

Jim Chanos & Bethany McLean on Enron, Earnings Adjustments, & The Golden Age of Fraud (Meb Faber)

#165 George Stalk, Jr.: Competing Against Time (Knowledge Project)

Show Us Your Portfolio: Mike Green (Excess Returns)

Jason Buck – Designing the Cockroack Portfolio (S6E1) (Flirting With Models)

Bessemer Venture Partners – Building a VC Firm that Lasts Centuries (ILTB)

The Four Key Factors for Analyzing Fed Events Amid a Deepening Banking Crisis (Stansberry)

Kristof Gliech – Choosing Managers (Business Brew)

The Lagging Performance of Small-Caps: An Opportunity for Investors? (Intelligent Investors)

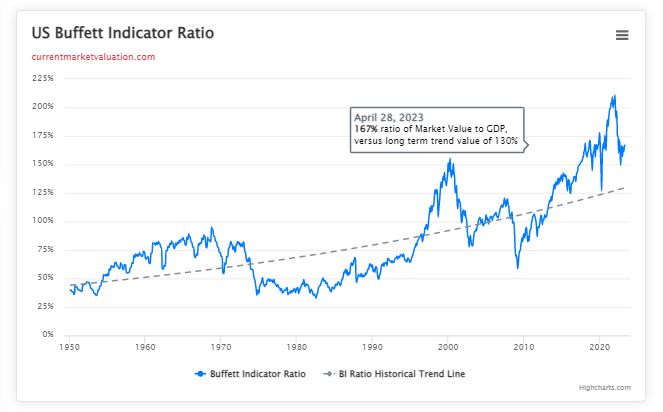

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

What are the Best Times for ETF Investors to Trade? (AlphaArchitect)

Your Tiny Banks Don’t Matter (AllStarCharts)

GPT Will Not Offer You a Trading or Investing Edge (PAL)

How to Build a Crypto-Specific Sector Risk Model (AllAboutAlpha)

This week’s best investing tweet:

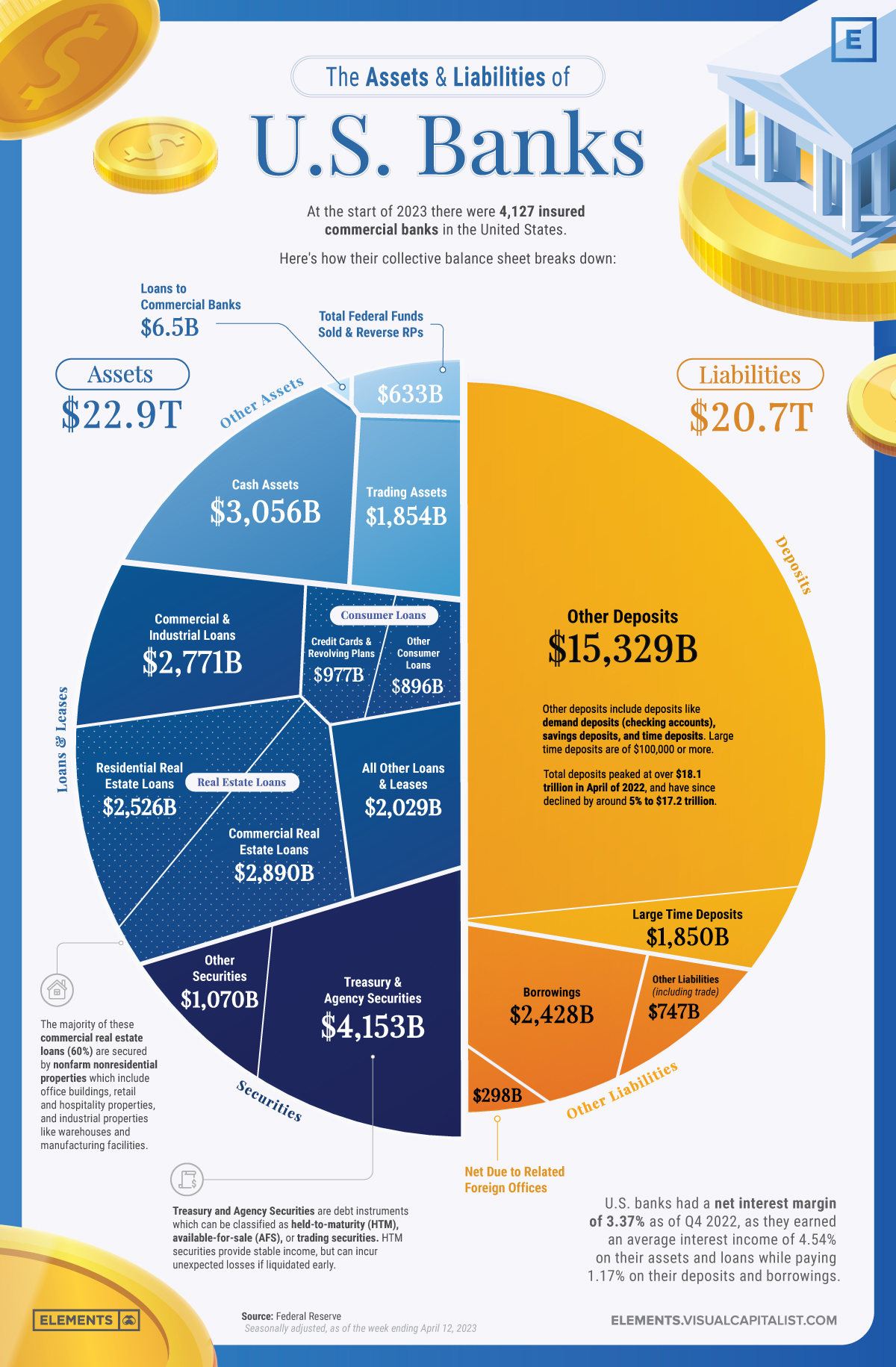

This week’s best investing graphic:

Visualizing the Assets and Liabilities of U.S. Banks (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: