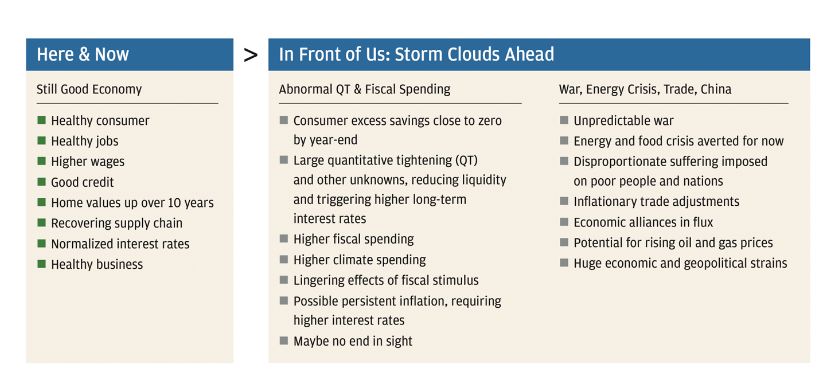

In his 2022 annual letter to shareholders, Jamie Dimon outlined all of the storm clouds ahead for the U.S economy. Here’s an excerpt from the letter:

Until the collapse of Silicon Valley Bank, the current economy was performing adequately, both here in the United States and remarkably better than anyone expected in Europe. The “market” was generally forecasting either a soft landing or a mild recession, with interest rates peaking at 5% and then slowly coming down.

There has been a lot of market volatility over the past year, partially, in my opinion, as people over-extrapolate monthly data, which is highly distorted by inflation, supply chain adjustments, consumer substitution, basically poor assumptions about housing costs and other factors.

But underlying all this, consumers have been spending 7% to 9% more than in the prior year and 23% more than pre-COVID-19. Similarly, their balance sheets are in great shape as they still have, according to our own analysis, $1.2 trillion more “excess cash” in their checking accounts than before the pandemic (credit card debt is simply normalizing).

In addition, unemployment is extremely low, and wages are going up, particularly at the low end. We’ve had 10 years of home and stock price appreciation, and even if we go into a recession, consumers would enter it in far better shape than during the great financial crisis. Finally, supply chains are recovering, businesses are pretty healthy and credit losses are extremely low.

The failures of SVB and Credit Suisse have significantly changed the market’s expectations, bond prices have recovered dramatically, the stock market is down and the market’s odds of a recession have increased.

And while this is nothing like 2008, it is not clear when this current crisis will end. It has provoked lots of jitters in the market and will clearly cause some tightening of financial conditions as banks and other lenders become more conservative.

However, it is unclear whether this disruption is likely to slow consumer spending (as of April 1, 2023, spending has been consistently running higher versus the prior year). Although higher rates, particularly in mortgages, have reduced both home sales and prices, do remember that consumer spending drives more than 65% of the U.S. economy.

While the current crisis has exposed some weaknesses in the system, it should not be considered, as I pointed out, anything like what we experienced in 2008. Nonetheless, we do have other unique and complicated issues in front of us, which are outlined in the chart below.

You can read the entire shareholder letter here:

Jamie Dimon Annual Letter To Shareholders 2022

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: