This week’s best investing news:

Charlie Munger in Conversation with Todd Combs | Singleton Prize for CEO Excellence (MSM)

Ray Dalio – What happened with Silicon Valley Bank and what it means for the economy (Ray Dalio)

Jim Chanos – Jim Chanos: A Short Thesis on Data Centers (Colossus)

Cliff Asness – The 2023 CFA Society Indy Forecast Symposium (CFA)

Apple, Berkshire Hathaway, And No Finish Line (SA)

Jeremy Grantham warns the ‘everything bubble’ is bursting (MI)

Memory and Probability (Verdad)

DoubleLine’s Jeffrey Gundlach reveals his trading strategy in this tricky market (CNBC)

Stability Breeds Instability (Jamie Catherwood)

How can the Fed project a recession as ‘appropriate monetary policy,’ asks Wharton’s Jeremy Siegel (CNBC)

Value Acceptance (Rudy Havenstein)

When a Bank Fails, There’s Always a Villain (Jason Zweig)

quick follow-up on Charles Schwab (Scuttle)

Are We Having Fun Yet? (Epsilon Theory)

First Republic Bank’s Proxy Statement (Rational Walk)

Maxims for Thinking Analytically | Prof. Sanjay Bakshi (CFA)

Buffett’s Other Guru (Humble Dollar)

Japan Prepares for a Changing World (Peter Zeihan)

Disney’s 7,000 Job Cuts to Begin This Week (Barron’s)

Why Arnott Favors International Stocks (Validea)

Transcript: Dominique Mielle (Big Picture)

GMO – A Deep Value Investment In Financials (GMO)

March Views from First Eagle Global Value Team (FEIM)

This week’s best value Investing news:

Memory and Probability (Verdad)

JPMorgan: Rotation Out Of Growth Into Value Stocks (Bloomberg)

What is Money? – Tobias Carlisle (Mutiny Funds)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Jim Chanos – Jim Chanos: A Short Thesis on Data Centers (Colossus)

Episode #473: Jeroen Blokland, True Insights – Multi Asset Masterclass (Meb Faber)

Ian Cassel – A Micro Perspective (Business Brew)

TIP540: Lessons in Life and Business from a Self-Made Billionaire w/ Andrew Wilkinson (TIP)

Episode 056: Dr. Daniel Crosby on the behavioral investor (Bogleheads)

Adam Rodman – The Case for Nuclear (Capital Allocators)

ESG Opportunity List (Pzena)

What “Safe” in These Markets Actually Means (Real Vision)

Pushing Pause on AI & Bank Failures; Who’s to Blame? (Squawk Pod)

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Institutional Investors’ Impact on Factor Premiums (Alpha Architect)

Bonds Break Out: Here’s What It Means… (ASC)

Why Neighborhood Real Estate…Why Now? (AllAboutAlpha)

Debunking the Myth of Market Efficiency (CFA)

This week’s best investing tweet:

This week’s best investing graphic:

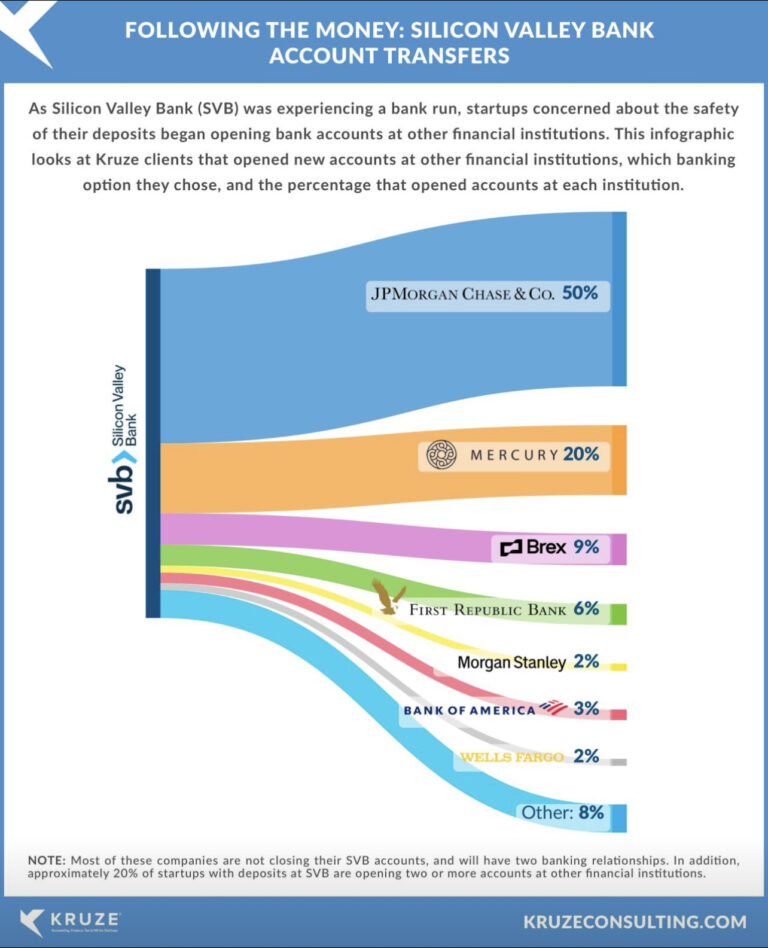

How much of SVB deposits did startup banks vs. big banks get? (The Basis Point)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: