In his 2018 Annual Letter, Terry Smith discussed why you should stay invested in the stock market. Here’s an excerpt from the letter:

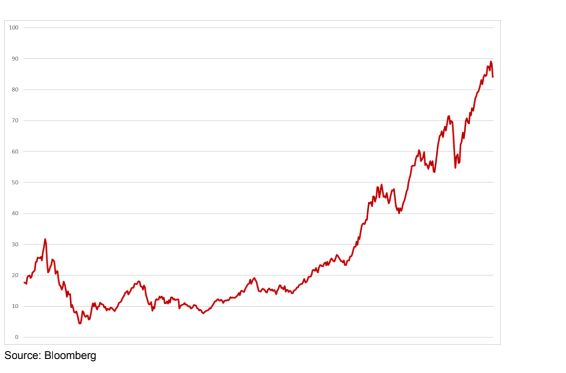

Imagine a fund manager approached you with an offer for you to invest in a portfolio of high quality companies. You may quite like the strategy but you are worried about whether or not this is a good time to invest in the stock market. Take a look at the chart below which shows the world’s largest index by market capitalisation, the S&P 500, and which includes more quality companies than any other index.

The chart looks like a roller coaster that has just passed the peak of the ride. Surely you would be stupid if you invested now no matter how good the strategy is. Better to wait until the market has had a proper fall.

You may notice that there are no dates on this chart of the S&P 500.

That’s because I wanted you to assume I was referring to the current market and our own fund, Fundsmith. In fact, the chart above shows the 37 years up to 1965 — the year in which Warren Buffett took control of Berkshire Hathaway.

If you had made the decision to time the market and hold back from investing then you would probably have missed out on the 20.9% compound growth in the market value per share of Berkshire since 1965 as a result.

‘Ah but that’s not how market timing works’, I can foresee someone saying. ‘Just because I didn’t buy into it in June 1965 doesn’t mean that I wouldn’t have bought into Berkshire later after the market had fallen.’ Seems fair except that the market didn’t fall in the remainder of 1965.

In fact, the S&P 500 went up by a further 13% in the second half of 1965. What would you have done then? Panicked and bought Berkshire or held off? If you had the nerve to do the latter, you might have felt vindicated in 1966 when the S&P 500 fell by 22% at one point.

There are several problems with this though. Berkshire Hathaway is not the S&P 500. Its shares rose 49.5% in 1965 and only fell by 3.4% in 1966. So, your hesitancy would not have paid off. Moreover, by 1967 the market had recovered to a new peak.

Are you really smart enough to not only a) predict a market fall but also; b) figure out how this translates into individual stock movements; c) get your timing sufficiently correct that you do not either forgo gains which far outweigh any losses you protect against or suffer some of the downturn; d) have sufficient mental agility and nerve to start buying when your prediction of a market fall has become reality; and e) get the timing roughly right on that side of the trade so that you don’t end up catching the proverbial falling knife or missing some or all of the recovery? If so, I doubt you will be reading this letter on your private island. But above all, I doubt you exist.

To be fair, there have been plenty of big falls in both the market and Berkshire Hathaway’s stock in the intervening 50 odd years since 1965. Berkshire’s shares fell by over 50% in 1973–75 and 2008–09, and by nearly 50% in 1998–2000, plus a mere 37% in 1987.

The point about this is not simply that getting the timing of markets right is impossible it is also that in even attempting to do so you might have missed out on investing in Warren Buffett’s Berkshire Hathaway, the results of which far outweigh any market timing gains.

You can read the entire letter here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: