This week’s best investing news:

Ray Dalio – Principles For Success In Investing & Life (RWH022)

When Icons Fall: FTX, Carnegie and Samuel Insull (Jamie Catherwood)

Jim Chanos Interview – I’m not Sure Speculation Is Gone (The Market)

Do Stocks Always Outperform Bonds? (Verdad)

‘Big Short’ Investor Michael Burry Bets on Alibaba and JD. This Time, Wall Street Agrees (Barron’s)

Mohnish Pabrai’s Q&A session with students at JNV Bangalore (Rural) on December 23, 2022 (Pabrai)

Aswath Damodaran – Session 7: Cost of Debt & Capital & First Steps on Cash Flows (AD)

Activist Investor Dan Loeb Says CPI, Jobs Data May Exaggerate US Economy (Bloomberg)

Interview With David Rolfe of Wedgewood Partners (Motley Fool)

“Canadian Warren Buffett” says tech stocks more overvalued now than during dot-com bubble (MarketWatch)

I think the Fed screwed up, says billionaire investor Sam Zell (CNBC)

A Detailed Look at the Quality Factor (Validea)

Ken Fisher – How to Avoid Another FTX (Fisher)

Gold Prices Are Knocking On The Door Of New Record Highs (Felder)

Warren Buffett is missing out on this year’s market comeback (CNN)

Daily Journal Meeting 2023; Audio Recording (Time Saver Edit) (Latticework)

Stock Buybacks Aren’t Bad. They Aren’t Good, Either (WSJ)

This Is Only a Test (Humble Dollar)

Jeremy Siegel: I admit I was shocked by the strength of the January payrolls (CNBC)

What Is Managed Futures? IFIM)

Transcript: Tim Buckley, Vanguard’s CEO (Big Picture)

How to Spot a Successful Turnaround (Empire)

This Bear Market (Probably) Isn’t Over Yet (WSJ)

Peter Lynch: Confessions of an Investaholic (1990) (Neckar)

SPACs Want Their Money Back (Bloomberg)

Letter #57: Chris Hohn (2014) (A Letter A Day)

Small Cap: The Original Alternative Asset Class (Royce)

Polen Capital Management: Wonderful Companies at Wonderful Prices? (Polen)

This week’s best value Investing news:

It’s Always Darkest Just Before Dawn (Alpha Architect)

Value, Growth & Intrinsic Investing Revisited | by Sean Stannard-Stockton, CFA (Intrinsic Investing)

Dimensional Fund Advisors On Value investing Opportunities (Bloomberg)

Where to Invest $1 Million: Rob Arnott Says Stock Slump ‘Far From Finished’ (Bloomberg)

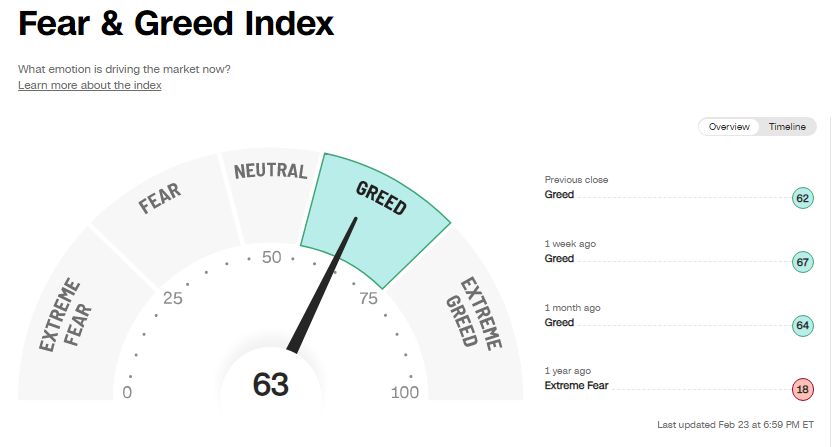

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP526: Quality Investing: Lessons from Terry Smith (TIP)

#159 Dr. Anna Lembke: Between Pleasure and Pain (KP)

The US Does Not Have a Monopoly on Good Businesses (WealthTrack)

20VC: Instagram Founders Kevin Systrom and Mike Krieger on Why Social Networks Should Be Less Social (20VC)

How to value a company: Basics explained Pt. 1 (Equity Mates)

The Four Pillars of Macro with Andy Constan (Excess Returns)

Tim Urban – Idea Labs and High-Rung Thinking (Invest Like The Best)

Bed Bath & Beyond and the Fleecing of the American Retail Investor (Intelligent Investing)

Brian Gitt: Busting The Myths of ESG & “Green” Energy (Value Hive)

Angela Aldrich – Developing A Differentiated View (VIWL)

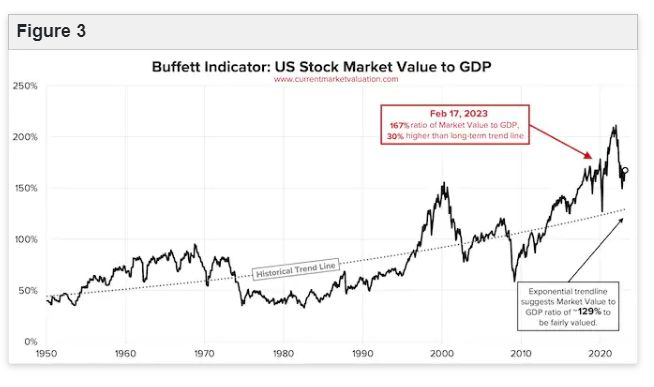

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

How Pervasive is Corporate Fraud? (AA)

Book the Damn Profit! (ASC)

Educational Alpha: A House of Cards (AAA)

Chasing Rare Outliers in Trend-Following. Is It Worth it? (PAL)

Theta trend – Thinking outside the normal trend box (DSGMV)

This week’s best investing tweet:

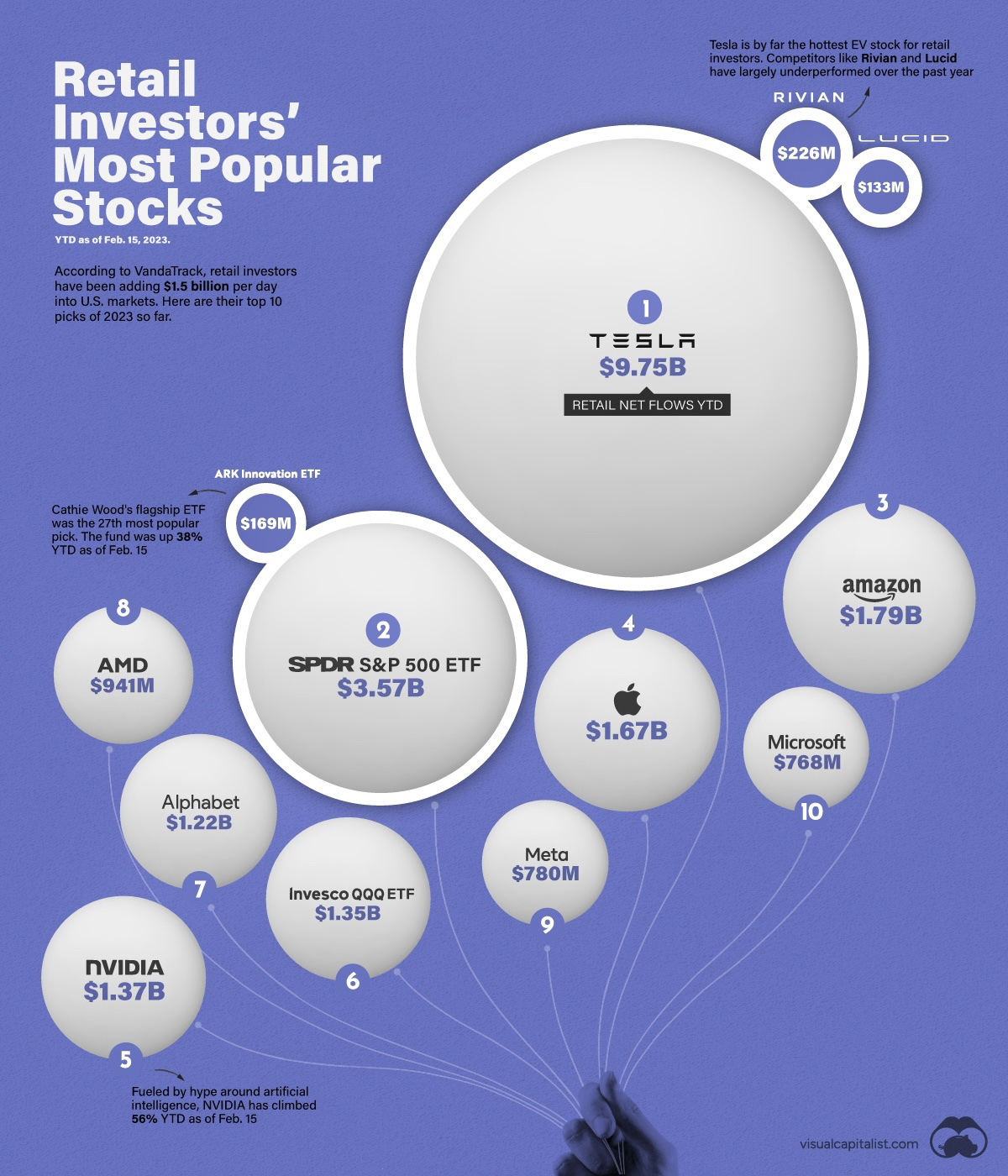

This week’s best investing graphic:

Retail Investors’ Most Popular Stocks of 2023 So Far (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: