As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

United Microelectronics Corp (UMC)

Founded in 1980, United Microelectronics is the world’s third-largest dedicated chip foundry, with 7% market share in 2021 after TSMC and GlobalFoundries. UMC’s headquarters are in Hsinchu, Taiwan, and it operates 12 fabs in Taiwan, Mainland China, Japan and Singapore, with additional sales offices in Europe, the U.S. and South Korea. UMC features a diverse customer base including Texas Instruments, MediaTek, Qualcomm, Broadcom, Xilinx and Realtek, supplying a wide range of products applied in communications, display, memory, automotive and more. UMC employs about 20,000 people.

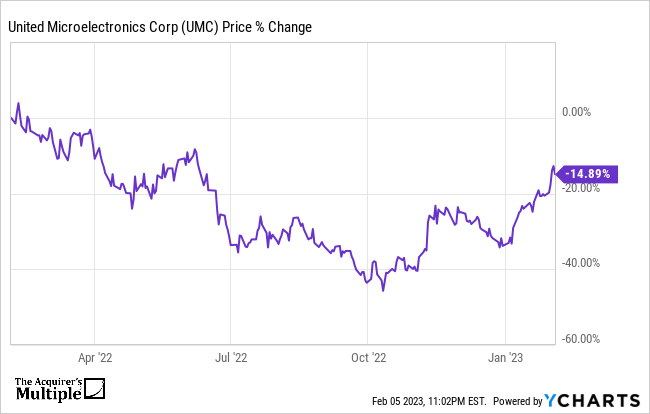

A quick look at the share price history (below) over the past twelve months shows that the price is down 15%. Here’s why the company is undervalued.

Market Cap: $20.97 Billion

Enterprise Value: $17.19 Billion

Operating Earnings

Operating Earnings: $3.19 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 5.40

Free Cash Flow (TTM)

Free Cash Flow: $2.35 Billion

FCF/EV Yield %:

FCF/EV Yield: 11.71

Shareholder Yield %:

Shareholder Yield: 6.10

Other Indicators

Piotroski F-Score: 9.00

Altman Z-Score: 3.332

ROA (5 Year Avge%): 20

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: