This week’s best investing news:

David Einhorn – Greenlight Capital Q4 2022 Letter (GC)

Regulating Crypto – Democratization and “The Bucket Shop Problem” (Jamie Catherwood)

Oaktree’s Howard Marks on Markets, Fed Rates, Inflation (Bloomberg)

Inside the High-Yield Spread (Verdad)

What if Tesla Is…Just a Car Company? (WSJ)

Mastering the Mental Game of Investing (Davis Funds)

Pzena Investment Management Q4 2002 Commentary: Equity Investing in An Uncertain Macro Backdrop (Pzena)

Those Three Little Words That Investors Hate to Say: “I Don’t Know” (Kingswell)

US Will Dodge Recession and Markets Will Rally, Ariel’s Rogers Says (Bloomberg)

David Einhorn: The Pequod Returns Home (Neckar)

Looming Twitter interest payment leaves Elon Musk with unpalatable options (FT)

FOMO: The Worst Financial Trait (Collab Fund)

JPMorgan’s Jamie Dimon: Bitcoin is a ‘hyped-up fraud’ (CNBC)

Return Stacking in an Inverted Yield Curve Environment (FWM)

An Update from Our CIOs: 2022 Was a Tightening Year; In 2023 We Will See Its Effects (Bridgewater)

Death to Dividends (Humble Dollar)

Fisher Investments’ Founder, Ken Fisher, Discusses the Right Time to Do a Portfolio Review (FIsher)

Transcript: Jennifer Grancio, Engine No. 1 (Big Picture)

Bank of America CEO details mild recession outlook, Fed rate cuts, and more (Yahoo)

The Financial Media Goes Gaga For The Greenback, Part Deux (Felder)

Arnott: Put Money In Multi-Factor Strategies (Validea)

Bill Gates – Climate change, AI, and more from my latest AMA (Gates)

Uncorrelated Assets: An Important Dimension of an Optimal Portfolio (AQR)

An Iowa Farmer Tried to Dodge Stock-Market Turmoil. It Cost Him $900,000 (Jason Zweig)

China moves to take ‘golden shares’ in Alibaba and Tencent units (FT)

Inflation on a forward-looking basis is low, says Wharton’s Jeremy Siegel (CNBC)

4Q22 U.S. Value Strategy Newsletter: Shame on Me in 2023 (Smead)

Ron Muhlenkamp – Q1 2023 Letter (Muhlenkamp)

Meta Platforms: If You Build It, They Will Come (Wedgewood)

Dodge & Cox Q4 2022 Market Commentary (DC)

Akre Focus Fund Commentary Fourth Quarter 2022 (Akre)

Ariel Focus Fund Q4 2022 Commentary (Ariel)

Canadian National Railway Is a Cash Generation Powerhouse (Jensen)

This week’s best value Investing news:

Billionaire Leon Cooperman Shares Value Investing Wisdom And 2023 Stock Picks (Forbes)

The Value Factor and Deleveraging (AlphaArchitect)

Value Investing and Lifelong Learning with Cole Smead (Excess Returns)

Should I Turn to Turn to Value Investing in 2023? (Yahoo)

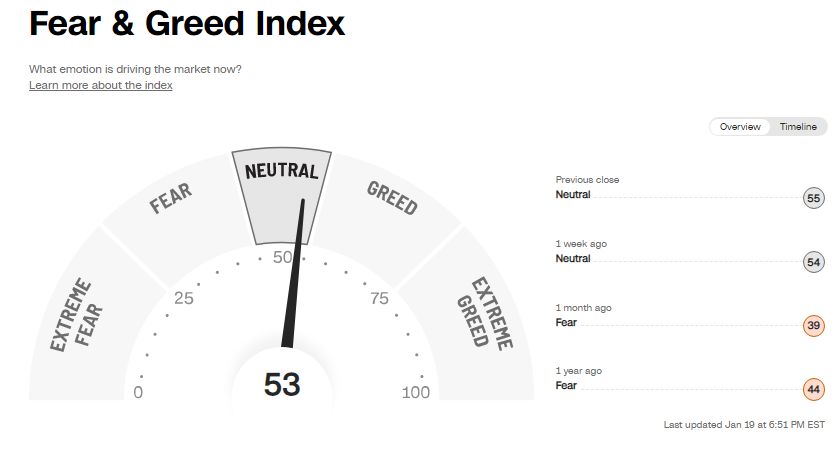

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Value Investing and Lifelong Learning with Cole Smead (Excess Returns)

Miles Grimshaw – The DNA of Software Companies (Invest Like The Best)

Episode #462: Porter Stansberry on a Possible Recession, Opportunities in Distressed Debt (Meb Faber)

Overcoming Frustrating Investments (PlanetMicroCap)

TIP515: The Little Book of Valuation by Aswath Damodaran (TIP)

Private Equity and the Game of ”Volatility Laundering” (Intelligent Investing)

How quants have changed equity markets (FWM)

Sam McRoberts — The Grand Redesign (EP.143) (Infinite Loops)

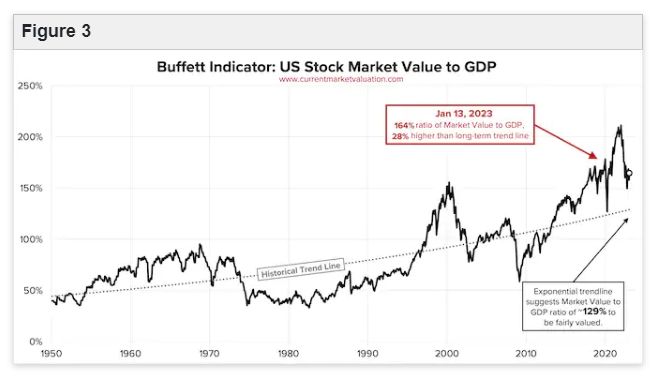

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Bond Investors Embrace Risk (AllStarCharts)

Undervalued or Overvalued, Where Do Equities Stand? (AllAboutAlpha)

Expected Returns for Private Equity Will Probably Suck (AlphaArchitect)

This week’s best investing tweet:

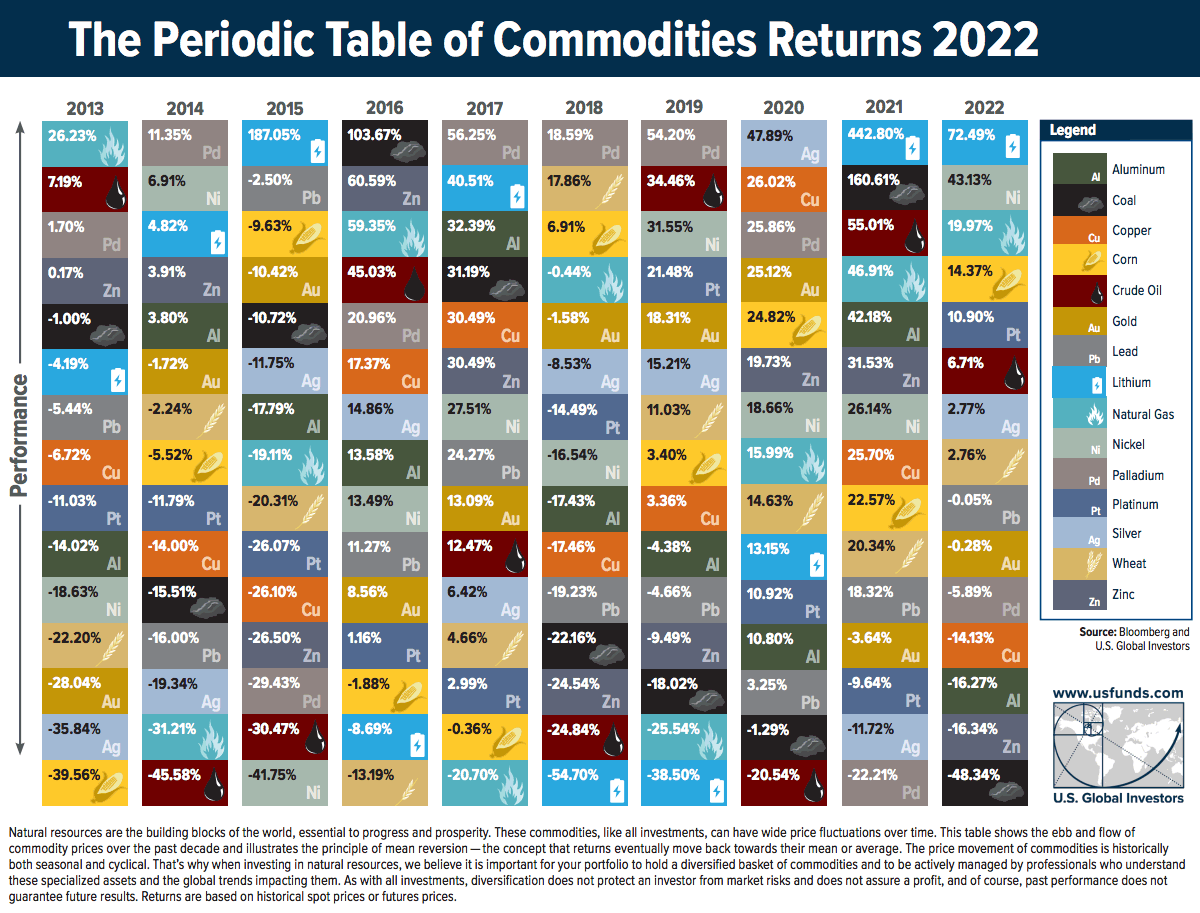

This week’s best investing graphic:

The Periodic Table of Commodity Returns (2013-2022) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: