This week’s best investing news:

EXCLUSIVE: Master Investor Howard Marks Shares His Blunt Advice On Investing (Forbes)

Sudden Stops (Verdad)

Interview With Value Investor Bill Nygren of Oakmark Funds (Motley Fool)

100-Bagger (Woodlock)

How Warren Buffett Could Prevent a Breakup of Berkshire Hathaway After He Dies (Barron’s)

Lindsell Train – The Triumph of Experience Over Hope (Lindsell Train)

Walter J. Schloss: An Investor for All Seasons (Kingswell)

A Time for TIPS (Jason Zweig)

Deep Thoughts For Passive Investors (Felder)

Graham & Doddsville Newsletter Fall Edition (G&D)

Watching Them Grow (Humble Dollar)

Small Cap Silver Linings (First Eagle)

Cognitive Dissonance (Scott Galloway)

What’s Oaktree Reading? 2022 Year-End Book Recommendations (OakTree)

Jamie Dimon – Crypto is a complete sideshow, tokens are like ‘pet rocks (CNBC)

“Stop Losses Are Stupid” (All Star Charts)

EM Corporate Debt ESG Integration (GMO)

Apple Is Good, Even Better If Owned Via Berkshire Hathaway (SA)

Ken Fisher, Discusses What Rising US Debt Means for Markets (Fisher)

Jeffrey Gundlach at CNBC Financial Advisor Summit (CNBC)

Rainmakers: Bad Weather and Institutional Investor Performance (SSRN)

Transcript: Luis Berruga, Global X ETFs (Big Picture)

Leon Cooperman on finding winning stocks in a down market and a 2023 recession (CNBC)

Small-Cap Stocks Are Really Cheap (Morningstar)

Where Macro and Fundamental Analysis Meet (Dodge & Cox)

What if everything is going to be OK? (FT)

A Memo to Investors (Albert Bridge)

This week’s best value Investing news:

William Blair – Opportunities in Value Strategies (WB)

The Golden Era of Value Investing Is Back (Yahoo)

Morgan Stanley’s Wilson Sees Value Stocks at Risk in a Downturn (Bloomberg)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #458: Bob Elliott, Unlimited Funds – A Macro Masterclass (Meb Faber)

Bob Robotti – Searching For Improving Industries (Business Brew)

Annie Duke on the Power of Quitting (EconTalk)

Is It All Over for Energy Bulls? (Real Vision)

TIP500: Berkshire Hathaway Shareholder’s Meeting and Intrinsic Value (TIP)

Behind The Memo: What Really Matters? (Howard Marks)

Nick Train on another challenging year for Finsbury Growth & Income (AJ Bell)

An Evidence-Based Approach to Markets with Larry Swedroe (Excess Returns)

Investing to Create a World You Would Like to Retire In (Barron’s)

China’s Plan to Decouple From the US Dollar (Hidden Forces)

Bill Lenehan: Investing in Commercial Real Estate (Invest Like The Best)

Believe it or not, the Aussie share market is up over the past 12 months (Equity Mates)

Should You Buy Dividend Stocks in a Recession? (Investing Insights)

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Investing in Deflation, Inflation, and Stagflation Regimes (AlphaArchitect)

Two Reasons We Like Bonds (All Star Charts)

The FTX Implosion (AllAboutAlpha)

This week’s best investing tweet:

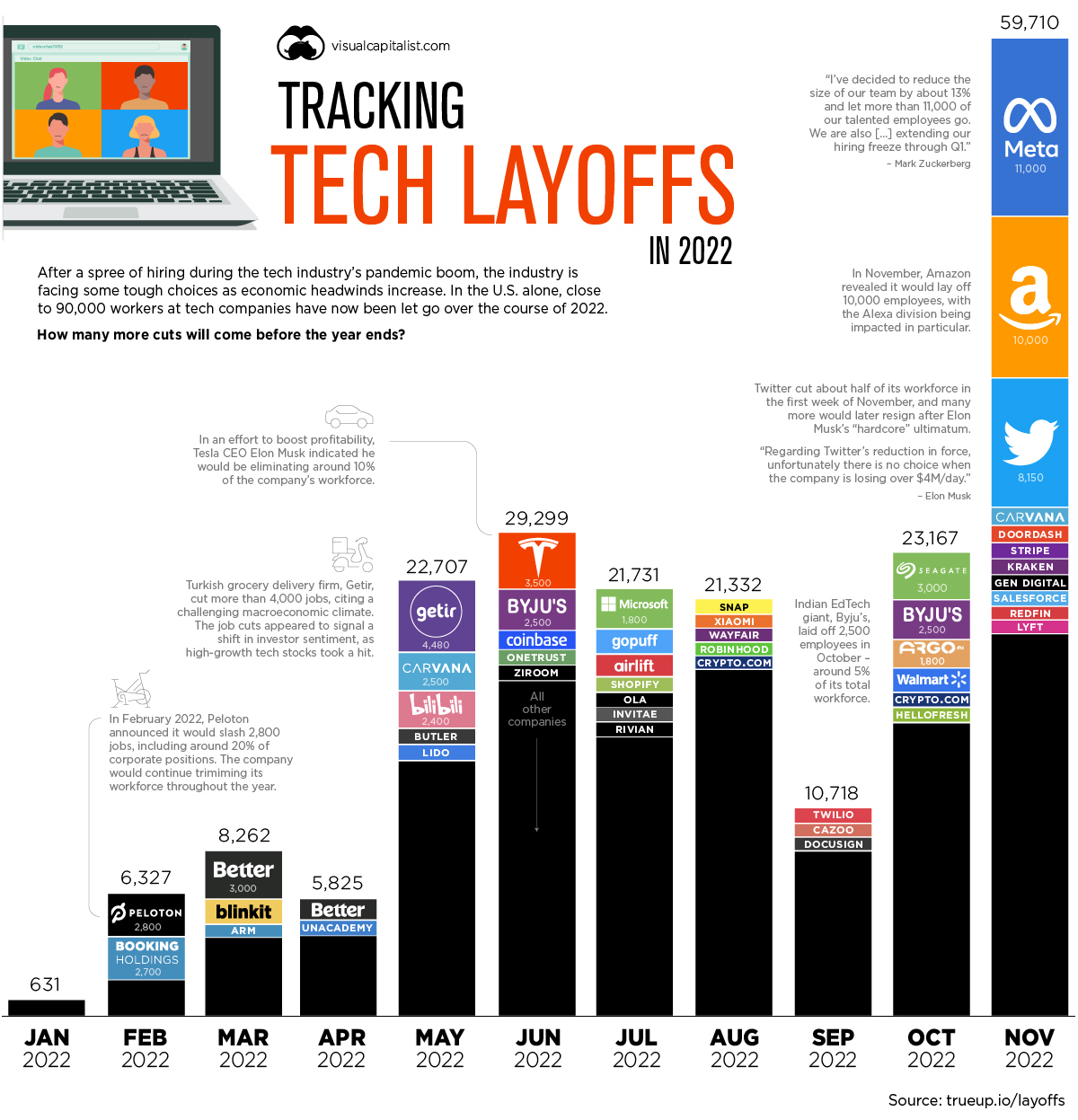

This week’s best investing graphic:

Visualizing Tech Company Layoffs in 2022 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: