In their latest paper titled, Small-Cap Silver Linings, First Eagle explain why small-cap stocks continue to outperform. Here’s an excerpt from the paper:

While persistently high inflation and the attendant policy tightening have pulled stocks decidedly lower year to date, we do not think that inflationary periods are a death knell for stocks. Notably, small cap value stocks historically have outperformed when inflation has run above its long-term median and when interest rates were biased higher.

Though smaller, value-oriented companies are not immune to the headwind of persistent inflation pressure, they do hold certain features; chief among these, in our view, is a relative insensitivity to changes in interest rates compared to more expensive growth stocks.

With the policy path to price stability uncertain, we expect market volatility is likely to remain pronounced. In our view, such an environment may create opportunities to acquire attractive small and microcap businesses that are trading below their normalized values and have specific catalysts for improvement.

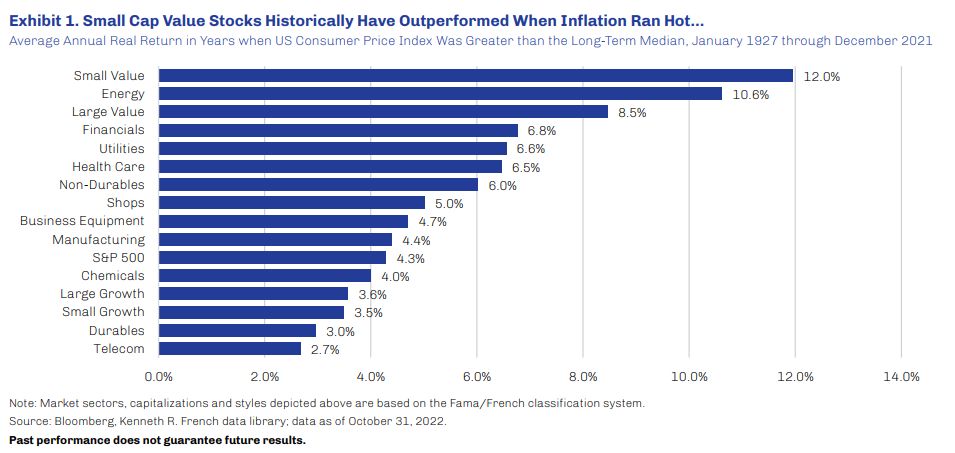

While persistently high inflation and the attendant policy tightening has weighed on investor sentiment to result in a painful year-to-date 2022, such conditions haven’t proved to snuff out stocks in the past. A wide variety of equity sectors and markets have averaged positive annual returns when inflation was running above its long-term median (Exhibit 1) and when interest rates have been heading higher (Exhibit 2).

In both instances, small cap value stocks have historically delivered outsized gains.

We’ve heard a number of explanations for the historical outperformance of small cap value stocks during these periods. Indeed, there are a few attributes common among smaller businesses that may represent features to larger ones in an environment of rising prices and rates.

A smaller product line and workforce, for example, may translate into greater agility when responding to changing macro conditions, whether that means adjusting supply chains, raising prices or rationalizing headcount.

In a strong-dollar environment— year-to-date 2022, the US dollar is up more than 15% against a trade-weighted basket of major currencies—companies whose revenues are primarily domestic may avoid the currency-translation headwinds that face many US-based multinationals.

That said, we believe the main driver of small cap value’s relative outperformance has been these stocks’ limited sensitivity to changes in interest rates. Very low Treasury rates in the years following the global financial crisis translated into very low discount rates and promoted multiple expansion for businesses promising high levels of future growth.

You can read the entire paper here:

FEIM – Small Cap Silver Linings

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: