This week’s best investing news:

Charlie Munger: CNBC Interview – Berkshire, Billionaires, & the Blockchain (CNBC)

What You (Want to)* Want (Paul Graham)

Berkshire Hathaway Energy Slide Presentation (BHE)

Ray Dalio Sees More Pain Ahead in This Debt Cycle (Barron’s)

Bill Ackman interview: What’s your outlook for 2023? (AJ Bell)

Why Berkshire Hathaway’s Latest Big Bet Is on a Taiwanese Chip Maker (WSJ)

Aswath Damodaran – I’ve yet to hear from Meta about how they plan to make money on the metaverse (CNBC)

Crypto Bros Are Getting Exactly What They Want Out Of The Market (Felder)

Berkshire Hathaway cuts US Bancorp stake by 56% (sec.gov)

Hubris (Scott Galloway)

Alphabet must cut headcount and trim costs, activist investor TCI says (CNBC)

The Sorry Saga of Bankman-Fried (Roger Lowenstein)

The Classic 60-40 Investment Strategy Falls Apart. ‘There’s No Place to Hide (WSJ)

Good Enough (Humble Dollar)

John Malone says he’s skeptical of ad-supported content as Netflix, Disney roll out ad tiers (CNBC)

The Philosopher’s Trading Experiment: Peter Thiel and the Big Short That Never Was (Neckar)

Two Weeks of Chaos: Inside Elon Musk’s Takeover of Twitter (NY Times)

How Low Could Stocks Go in 2023? (Chris Leithner)

The Fed could pause its interest rate hikes right now, says Wharton’s Jeremy Siegel (CNBC)

12 Lessons on Money and More From Warren Buffett and Charlie Munger (Morningstar)

In Conversation with Ken Griffin (Bloomberg)

KPMG: The Pandemic Housing Bubble is bursting—U.S. home prices falling 15% looks ‘conservative’ (Fortune)

Transcript: Dave Nadig (Big Picture)

Rob Arnott – History Lessons: How “Transitory” Is Inflation? (RA)

Was Jack Welch the Greatest C.E.O. of His Day—or the Worst? (New Yorker)

Is This Crypto’s Lehman Moment? (NY Times)

Quality’s Performance Across the Business Cycle (Polen)

This week’s best value Investing news:

Value Investors Make Big Comeback (Validea)

Why Value Investing Requires Thoughtful Arrogance – Ep 169 (Intellectual Investor)

Value investing: Back with a “bang” (VanEck)

Where has value investing worked best? (Investors Chronicle)

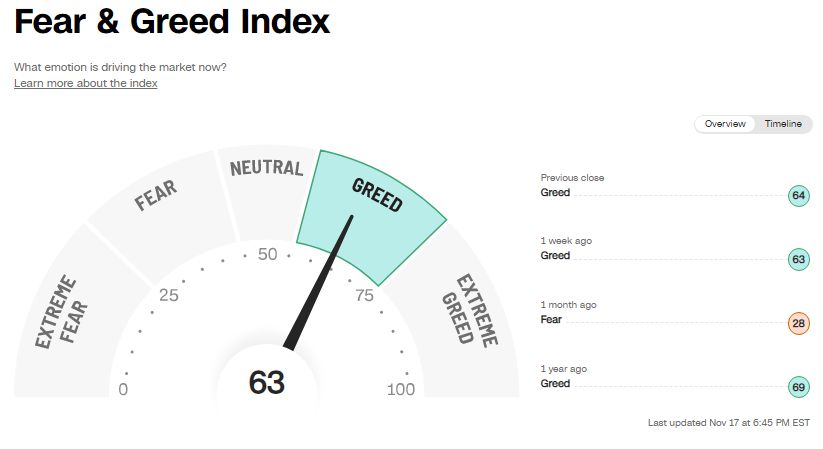

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP494: The Worldly Wisdom of Charlie Munger (TIP)

Episode #455: Eugene Fama: A Life in Finance (Meb Faber)

Craig Moffett – A True Expert (Business Brew)

#152 Tobi Lütke: Calm Progress (Knowledge Project)

20VC: ARK Invest’s Cathie Wood on Why ARK Has Not Had More Outflows Despite Performance (20VC)

Show Us Your Portfolio: Ben Hunt (Excess Returns)

Parker Conrad – Building a Compound Company (Invest Like The Best)

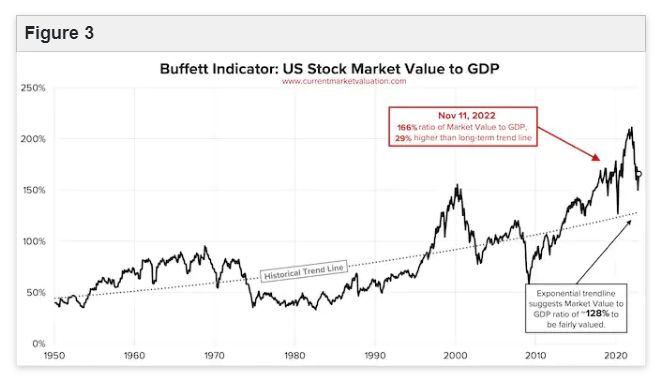

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Is there a theoretical foundation behind industry and factor momentum (AlphaArchitect)

Yield curve that matters is predicting a recession now (Axios)

Sentiment as a Money Management Tool (AllStarCharts)

When There’s No L in LBO (AllAboutAlpha)

This week’s best investing tweet:

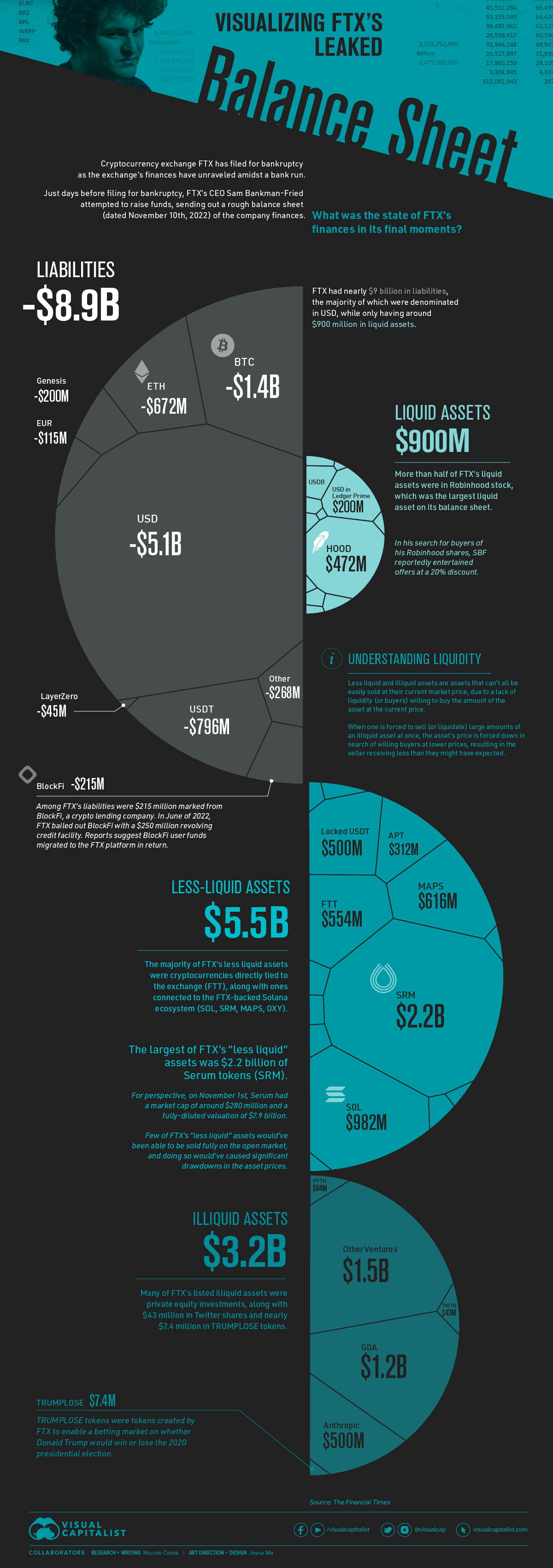

This week’s best investing graphic:

Visualized: FTX’s Leaked Balance Sheet (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: