This week’s best investing news:

Persistence of Margins (Verdad)

Berkshire Hathaway Q3 2022 Letter (BH)

Lessons from World War II (Jamie Catherwood)

How bargain hunter Howard Marks is preparing to pounce (AFR)

Bill Ackman’s Pershing Square Holdings Looks Invitingly Cheap (Barron’s)

Ted Combs – Graham & Dodd Annual Breakfast 2022 (IMI)

What To Do When You Predict What Stocks Will Do (Validea)

Facebook parent company Meta will lay off 11,000 employees (CNN)

You Don’t Know What You Don’t Know About Your Financial Adviser (Jason Zweig)

Elephants in the Room (Scott Galloway)

The Changing World Order Is Approaching Stage 6 (The War Stage) (LinkedIn)

Warren Buffett’s Berkshire Hathaway Still a Buy After Q3 Earnings (Kiplinger)

Transcript: Edward Chancellor (Barry Ritholz)

Terry Smith Changed His Mind On Tech (The Times)

Worst Year Ever (Humble Dollar)

David Katz: The bulk of the stock market damage has been done (CNBC)

The Good, the Bad, and the Ugly (Ep Theory)

Carl Icahn Speaks About Inflation, Jerome Powell, And More At The Forbes Iconoclast Summit (Forbes)

A Few Good Stories (Collab Fund)

Facebook (Meta) Lesson 1: Corporate Governance – The What, Why and What now? (Aswath Damodaran)

Elon Musk Interview – Ron Baron (YouTube)

Humpty-Dumpty Stock Market (Smead)

The Fed is looking at the wrong housing indicators, says Wharton’s Jeremy Siegel (CNBC)

Are TIPS a Bargain? (Morningstar)

Elliott Management Investment Letter (Elliott)

Tweedy Browne Q3 2022 Letter (TB)

This week’s best value Investing news:

‘May The Force Be With You’ (Felder)

Value and Momentum are confirmed as robust anomalies (AlphaArchitect)

Value Stocks Follow Rates Higher (AllStarCharts)

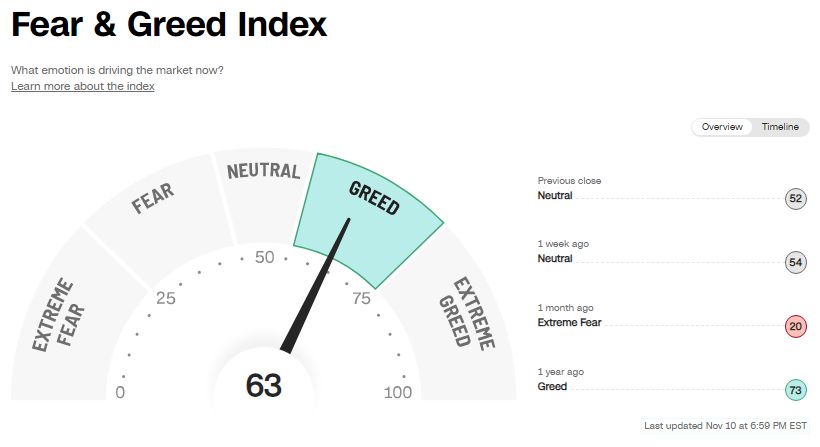

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP493: Should CEOs Have Term Limits? w/ Bill George (TIP)

Bob Elliott – A Macro Tour (Invest Like The Best)

Expert Panel: Finding Generational Businesses | FinFest (Equity Mates)

Financial Markets Are Dangerous for Investors: What You Need to Know [2022] (WealthTrack)

What to Buy or Skip: I Bonds, Apple, Amazon, or Met (Morningstar)

Mark Newfield – Keep Going! (Business Brew)

S3E05: The Capacity to Suffer and How It Applies in Practice (MOI)

394 – Hold or Sell? Part 2 (InvestED)

Talking Trend Following with Original Turtle Trader Jerry Parker (Excess Returns)

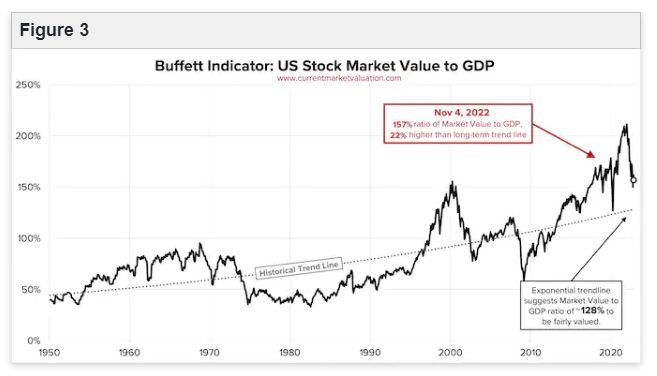

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Global Factor Performance: November 2022 (AlphaArchitect)

Conservatism: De-Risking the Profitability Factor (CFA)

Fundamentals Are a Poor Predictor of Equity Market Returns (PAL)

Respect the Levels (AllStarCharts)

The Disparity Among Risk Parity Managers (AllAboutAlpha)

This week’s best investing tweet:

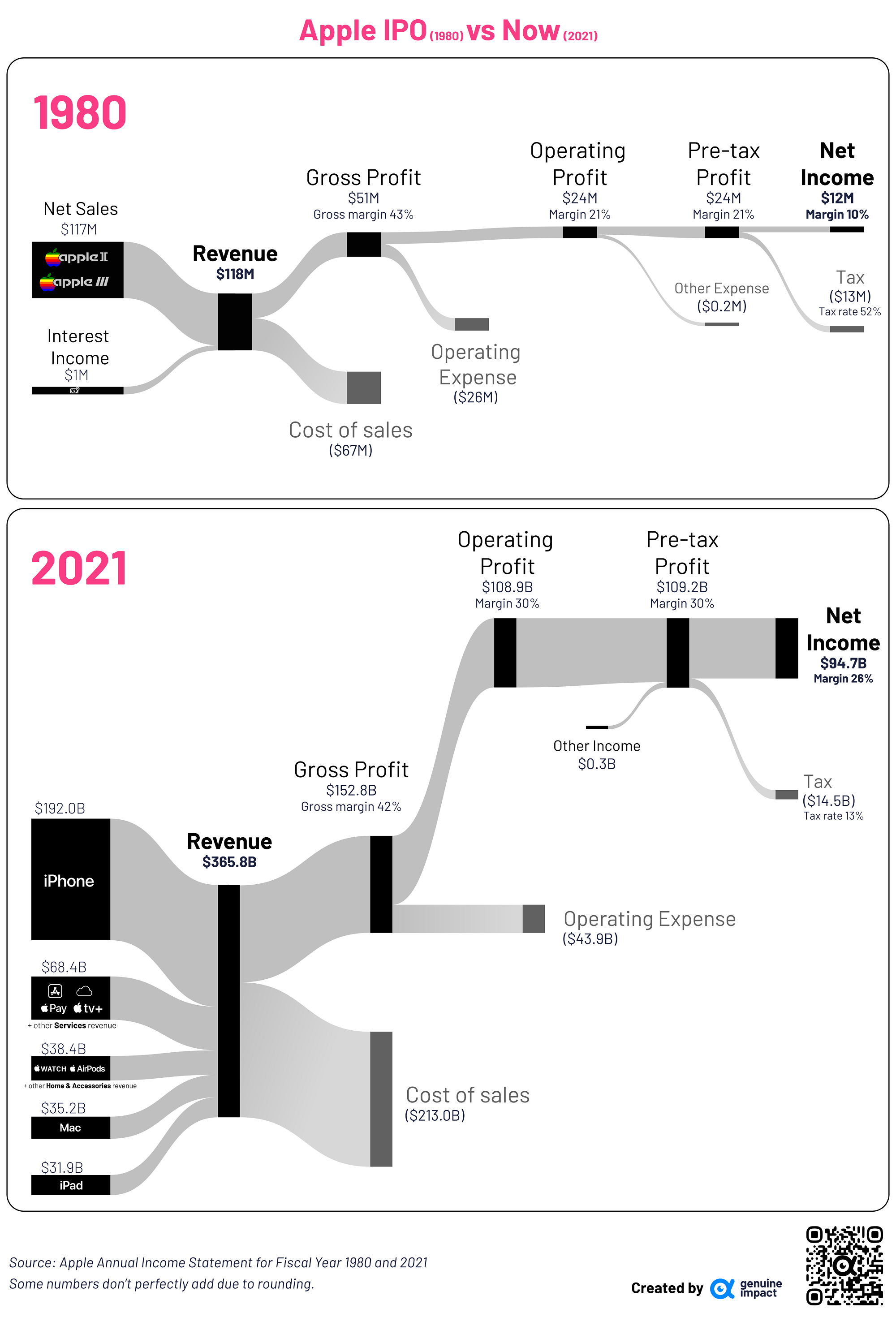

This week’s best investing graphic:

Visualizing Financials of the World’s Biggest Companies: From IPO to Today (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: